Cable Rally May Stall Ahead of UK Inflation Data

GBP PRICE, CHARTS AND ANALYSIS:

What Tye of Trader Are You? Take the DailyFX Quiz Now

Read More: Gold Weekly Forecast: Breakout Fails to Kick on as Technicals Flash Mixed Signals

Cable stalled on Friday last week as a slight US Dollar rebound kept the bulls at bay around the 1.3150 handle. This morning has thus far brought mixed price action with downside in the Asian session overshadowed by a renewed push to the 1.3100 handle following the London Open.

UK INFLATION DATA, US DOLLAR AND EARNINGS SEASON

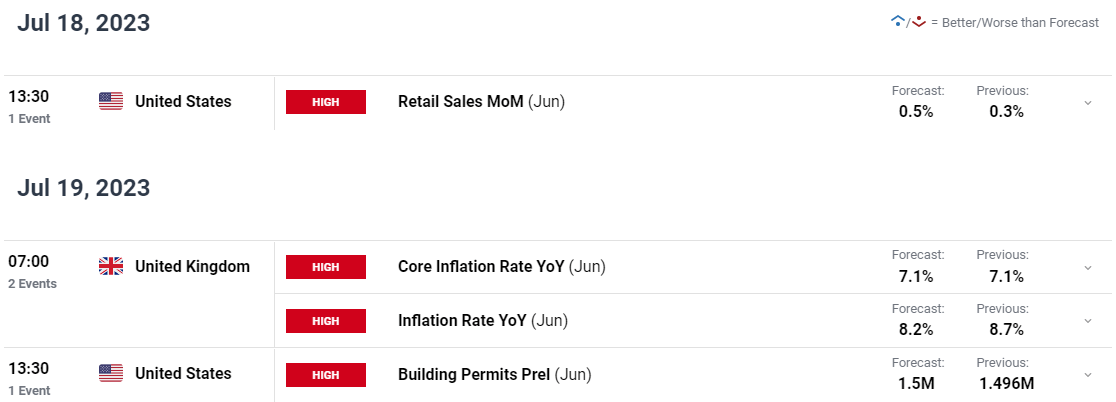

Any attempted recovery by the Dollar Index (DXY) remains elusive at this point with the index facing a fresh bout of selling pressure this morning. The US Federal Reserve have entered the ‘blackout period ahead of the July 26 meeting while there is little in terms of significant event risk on the docket this week. This could weigh on the USD ahead of the FOMC meeting as US earnings take center stage this week.

UK Inflation remains the big risk event for the week where cable is concerned and given the average earnings data both incl. and excl. bonuses had increased there is even more interest in the upcoming print. I for one had expected some form a drop in inflation largely due to energy prices which could be offset by the rise in wages. Should this come to pass UK inflation could remain sticky for now despite insistence by Governor Andrew Bailey and the Bank of England (BoE) that inflation is expected to fall significantly in Q3 and Q4 of 2023. Only time will tell whether Governor Bailey is correct or whether the BoE have a bigger problem for the rest of 2023 and looking ahead to 2024.

For all market-moving economic releases and events, see the DailyFX Calendar

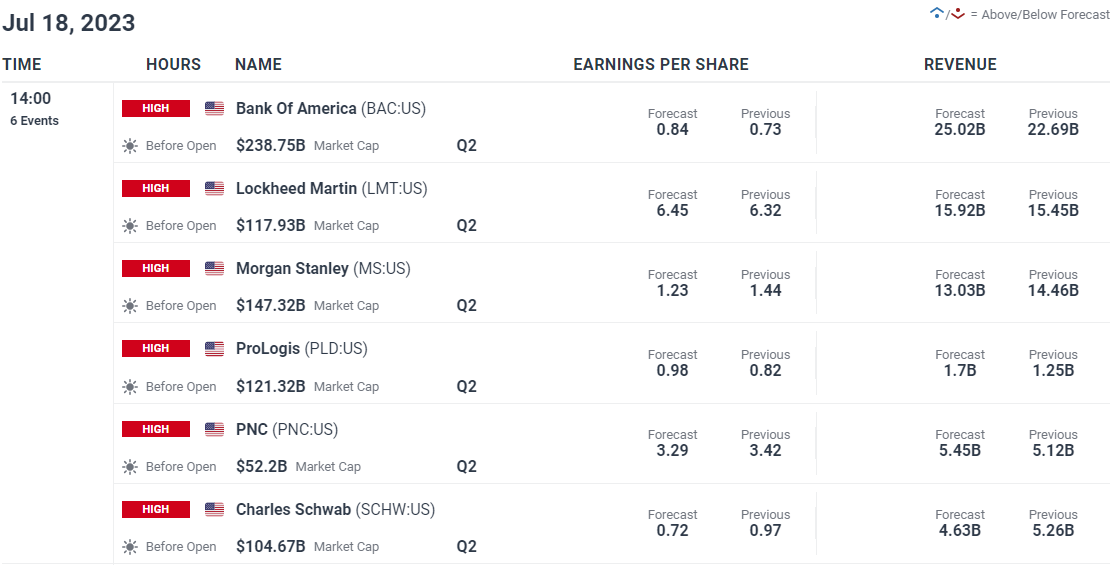

US Earnings season got under way on Friday led by Banking Stocks which came in largely above estimates keeping the overall market mood relatively upbeat ahead of the weekend. Earnings releases continues tomorrow with Bank of America and Morgan Stanley kicking things off with positive earnings this week likely to keep risk assets supported and keep recessionary fears at bay. Earnings could be a key driver of sentiment for the week ahead.

For all your earnings releases and events, visit the DailyFX Earnings Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

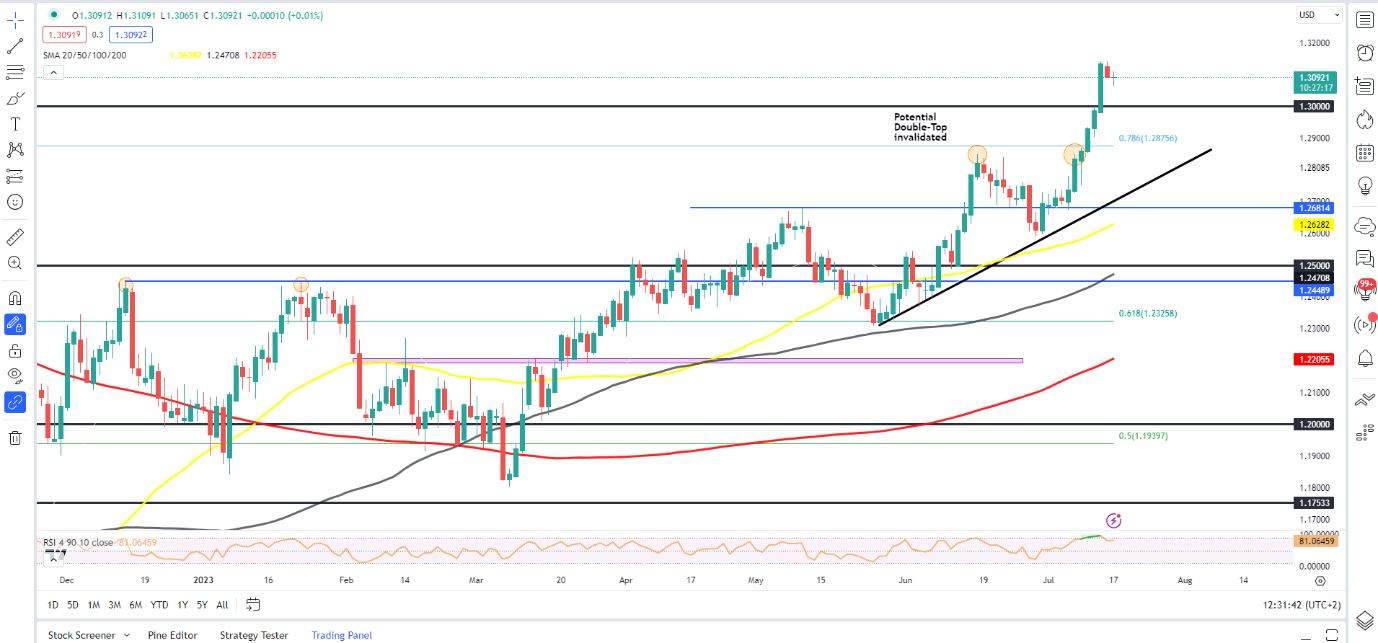

GBPUSD retreated on Friday from multi-month highs slipping below the 1.3100 handle. The Asian session saw a push lower toward the 1.3050 zone before a recovery back toward the 1.3100 level as the DXY continues to struggle. Today has seen mixed price action thus far and something that could continue for the rest of the day as market participants seek guidance on the pairs next move from US retail sales and UK inflation data.

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

Friday’s daily candle closed as a bearish inside bar hinting at further downside. Whether or not sellers are able to ush prices back below the 1.3000 psychological level ahead of the UK inflation data print remains uncertain as buying pressure certainly remains in play.

Key Levels to Keep an Eye On:

Support levels:

- 1.3000

- 1.2875

- 1.2800 (upper-trendline retest)

Resistance levels:

- 1.3150 (YTD High)

- 1.3250

- 1.3360

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently SHORT on GBPUSD, with 72% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that GBPUSD may enjoy a short pullback before continuing to head higher.

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Learn More About Technical Analysis Now

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.