Breaking News – US Dollar Slips After Inflation Data Miss Forecasts

US Dollar (DXY) Price, Chart, and Analysis

- The US dollar sheds half a point after the CPI release.

- Headline inflation rises by less than expected.

Recommended by Nick Cawley

Get Your Free USD Forecast

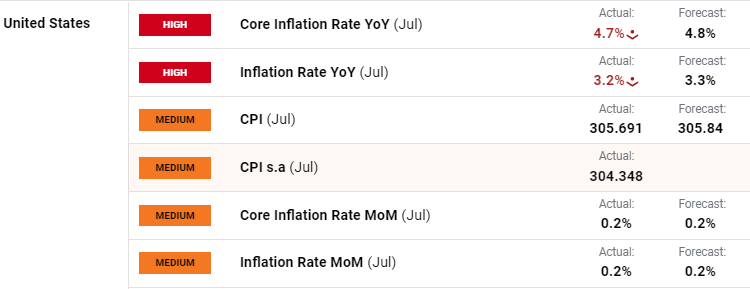

Core inflation fell and headline inflation rose by less than expected in July, according to the latest US Inflation Report. Core inflation fell to 4.7% y/y, the lowest level since October 2021, while headline inflation rose from 3% to 3.2% but missed market expectations of 3.3%.

For all market-moving data releases and economic events see the real-time DailyFX calendar

Bureau of Labor Statistics Release

The marginally better-than-expected report sent the US dollar lower by around 50 pips as further rate hike expectations eased a fraction. EUR/USD touched 1.1065 before retreating back to 1.1035 at the time of writing, while GBP/USD clipped 1.2820 before falling back to 1.2775. Interest-rate sensitive gold rose to $1,930/oz after opening Thursday at $1,914/oz. before slipping back to $1,925/oz.

The US dollar (DXY) currently trades at 102.02 after opening the session at 102.489.

Learn How to Trade the News by Downloading our Free Guide Below

Recommended by Nick Cawley

Trading Forex News: The Strategy

US Dollar (DXY) Daily Price Chart – August 10, 2023

Chart via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.