Bollinger Bands Arrow Breakout Forex Trading Strategy

Momentum trading is a popular type of trading strategy and for good reasons. This is because momentum trading is a very effective trading strategy. It either is an initial phase for a longer-term trend or in many cases it allows traders to earn consistent profits over a short period.

Momentum breakouts have the tendency to be a catalyst for a market trend. Many traders jump into a strong momentum breakout which could in turn cause more buying or selling in the same direction, which then leads to a trending market. Traders could also make quick profits using a momentum breakout strategy because price tends to push in the direction of the momentum breakout within a few candles from it. The momentum that was generated on the breakout would usually carry over to the next few candles giving traders good trading opportunities right after a breakout.

There are many ways to identify a momentum trade setup. Some traders use technical indicators to identify momentum. However, this could sometimes be counterproductive as indicators may show indications of strong momentum while price action is not exactly characterizing a momentum breakout. Some traders identify momentum based on a momentum candle or a strong full-bodied candle pushing in one direction. While this is very effective, it could also be very subjective. Traders could interpret different candles as such or not.

In this strategy, we will be combining the use of a popular technical indicator to objectively identify a momentum breakout while incorporating the concept of a strong momentum candle.

Bollinger Bands

The Bollinger Bands is a versatile technical indicator which traders can use for different types of trading strategies. It is applicable for identifying trend direction, volatility, momentum breakouts and overbought or oversold market conditions.

The Bollinger Bands is one of the more popular band types of indicators. It plots three lines. The middle line is a basic 20-period Simple Moving Average (SMA) line. The two outer lines are standard deviations shifted above and below the 20 SMA line.

Since the Bollinger Bands use a 20 SMA line, it can also be used to identify trend direction just like most moving average lines. Trends can be identified based on whether price action is generally staying on one half of the Bollinger Band. The trend is bullish if price action is generally in the upper half of the Bollinger Band, and bearish if price action is generally in the lower half of the Bollinger Band.

Since the outer lines are based on standard deviations, the expansion and contraction of the outer lines could also indicate volatility. An expanding Bollinger Band indicates a volatile market, while a contracting Bollinger Band indicates a contracting market.

The outer lines can also be used to identify overbought or oversold conditions. Price above the upper line could indicate an overbought market, while price below the lower line could indicate an oversold market. Both conditions are prime for a mean reversal.

However, the same outer lines can be used to identify momentum breakouts. The key is in how price action reacts as it crosses the outer lines. If price action is pushing against the outer lines, rejecting the price level outside of the line, the market may soon be on a mean reversal phase. On the other hand, if a strong momentum candle would break out of the Bollinger Band after a market contraction phase, the market may be on a momentum breakout phase.

Indicator Arrows

Indicator Arrows is an entry signal indicator which is based on a confluence of multiple underlying technical indicators.

This indicator have an underlying moving average line, MACD, Moving Average Oscillator (OsMA), Stochastic Oscillator, Relative Strength Index (RSI), Commodity Channel Index (CCI), Relative Vigor Index (RVI), Average Directional Movement Index (ADX), and Bollinger Bands, which it bases its trade signals from.

Since the indicator considers the trend indications coming from multiple technical indicators, it tends to produce high probability trade setups.

It simply plots an arrow pointing up whenever it detects a bullish trend reversal and an arrow pointing down whenever it detects a bearish trend reversal.

Trading Strategy

Bollinger Bands Arrow Breakout Forex Trading Strategy is a simple momentum breakout strategy which makes use of the Bollinger Bands as a basis for the breakout. At the same time, it isolates trade direction based on a confluence of direction pointed out by the Indicator Arrows.

First, possible trades are identified by a market condition which is contracting. This is based on the Bollinger Band contracting, indicating a low volatility.

Then, we wait for the Indicator Arrows to identify the direction of the possible momentum breakout based on the arrow it plots.

We then wait for the momentum breakout candle to occur coinciding with direction pointed out by the Indicator Arrows.

Indicators:

- Indicatorarrows

- Bollinger Bands

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

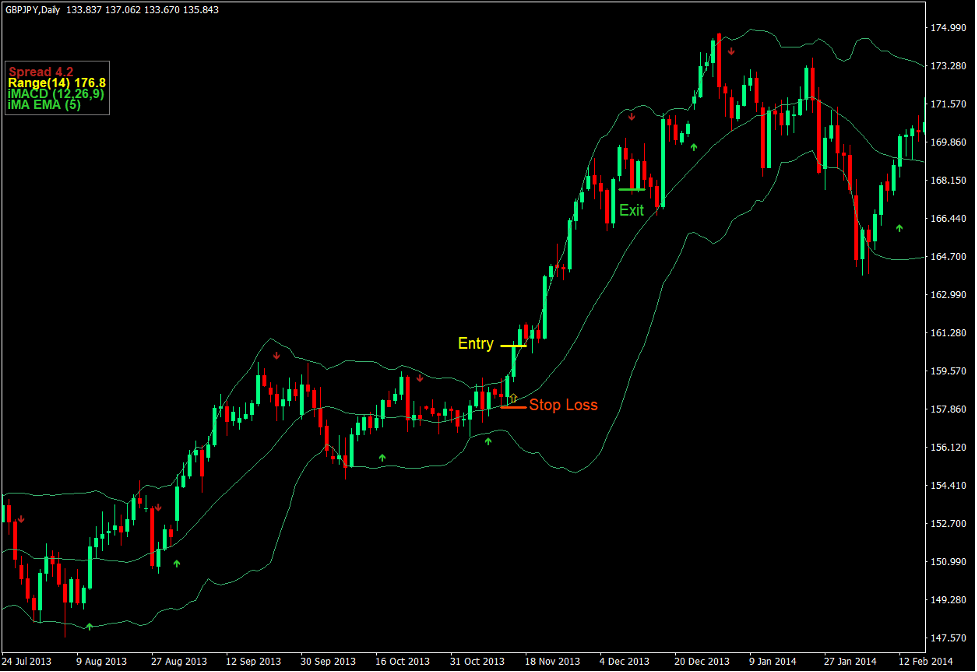

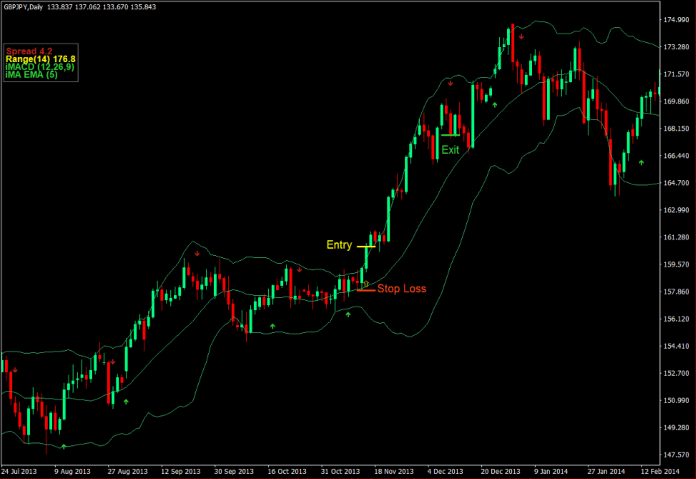

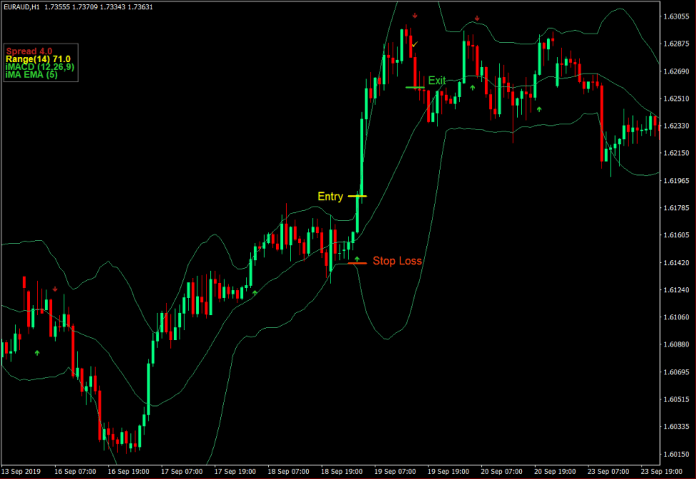

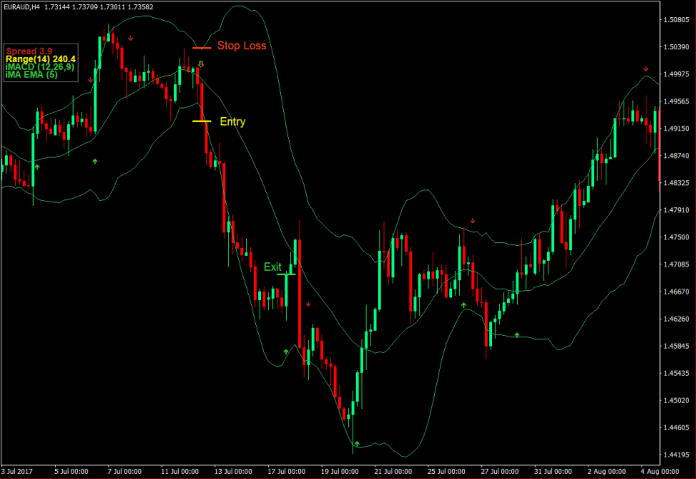

Buy Trade Setup

Entry

- The Bollinger Bands should contract indicating a market contraction phase.

- The Indicator Arrows should plot an arrow pointing up.

- Enter a buy order as soon as a bullish momentum candle breaks above the upper Bollinger Band line.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing down.

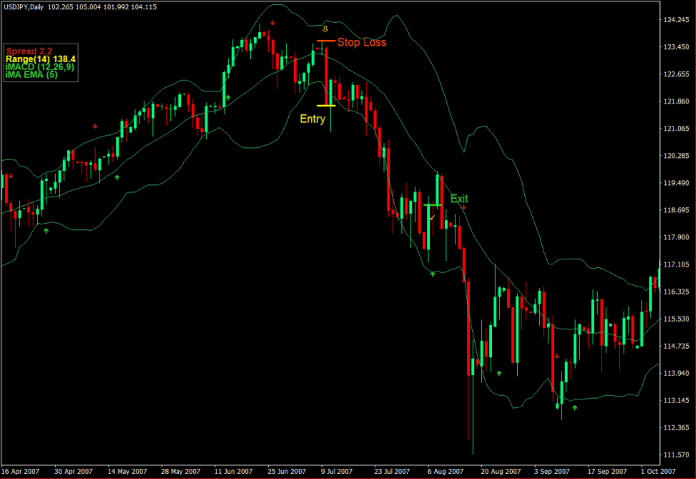

Sell Trade Setup

Entry

- The Bollinger Bands should contract indicating a market contraction phase.

- The Indicator Arrows should plot an arrow pointing down.

- Enter a sell order as soon as a bearish momentum candle breaks below the lower Bollinger Band line.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing up.

Conclusion

Momentum breakouts coming from a contracted Bollinger Band is a working momentum trading strategy. Many traders use this type of strategy with great success.

However, new traders may often mistake a non-contracted Bollinger Band as a market contraction phase, which may result in a failed momentum breakout trade. Momentum breakouts are usually successful because of the pent-up volume that is not yet traded as indicated by the market contraction phase. Traders who can have a feel for such contraction and expansion phases can make money using this type of strategy.

Forex Trading Strategies Installation Instructions

Bollinger Bands Arrow Breakout Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Bollinger Bands Arrow Breakout Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Bollinger Bands Arrow Breakout Forex Trading Strategy?

- Download Bollinger Bands Arrow Breakout Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Bollinger Bands Arrow Breakout Forex Trading Strategy

- You will see Bollinger Bands Arrow Breakout Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access

Comments are closed.