Big Trend Fisher Reversal Forex Trading Strategy

Many traders hope to catch one of those big market moves. These are markets or forex pairs that would start to gain momentum and later on develop into a full-blown trend. Trading trends using trend reversal and trend following strategies are some of the best ways to trade the forex market. This is because traders who can catch a trade at the beginning of the trend and exit at or near its end can make a lot of money which could be several times bigger than the risk they placed on the trade. However, catching a huge trend is quite difficult.

One of the best ways to identify a trend is by waiting for a pullback confirmation. A pullback confirmation is basically a scenario wherein price would pullback to a support or resistance level after a momentum shift or a breakout. Breakout traders would usually use the resistance level that turned support as a basis for such pullback or vice versa. However, new traders might find this a bit difficult as identifying significant support or resistance levels is very subjective and requires experience and skill.

In this strategy, we will be looking at how a modified moving average line which could act as a dynamic support or resistance level can be used as a basis for a pullback entry.

Big Trend

Big Trend, also known as the Slope Direction Line, is a custom technical indicator which is based on a modified moving average line.

The Big Trend indicator plots a modified moving average line which is characteristically very smooth yet very responsive. This allows the line to provide reliable trend reversal signals with less false signals, while at the same time provide timely signals with less lag.

The moving average line it plots can also be modified based on parameters such as period, method, and price source.

The line plotted by the Big Trend indicator also changes color to indicate the direction of the trend. A blue line indicates a bullish trend while a tomato line indicates a bearish trend. Consequently changes in the color of the line could indicate a trend reversal and can be used by traders as a trend reversal entry signal. The line can also be used as a trend direction filter based on the color of the line in order to avoid low probability trades that are traded against the direction of the trend.

Fisher Indicator

The Fisher indicator is a custom technical indicator which is based on the Gaussian normal distribution. This indicator basically identifies and highlights price extremes based on the recent price data from previous candlesticks or periods. This may help traders identify potential reversals coming from such extreme price conditions as well as the minor swings within a longer trend.

It is an oscillator type of indicator which was developed to help traders anticipate potential trend reversals. It basically plots histogram bars which oscillate around its midline, which is zero. Positive lime lines indicate a bullish trend bias, while negative red lines indicate a bearish trend bias.

Traders can use the shifting of the bars from positive to negative or vice versa as a basis for a potential trend reversal.

Trading Strategy

Big Trend Fisher Reversal Forex Trading Strategy is a simple trend reversal strategy which identifies potential trend reversal entries based on the confluence of signals coming from the Big Trend indicator and the Fisher indicator.

The Big Trend indicator is used to identify trend direction. This is based on the changing of the direction of the slope of the line, as well as the color of the line.

The Fisher indicator is also used to confirm the trend direction. This is based on the whether the bars are positive or negative.

Confluences between the two signals increase the likelihood that the trend might be reversing.

However, the final confirmation is based on a pullback and rejection of the price action against the Big Trend line. After the reversal, price action should pullback towards the Big Trend line and reject it again. This is based on the wicks that push against the Big Trend line.

Indicators:

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

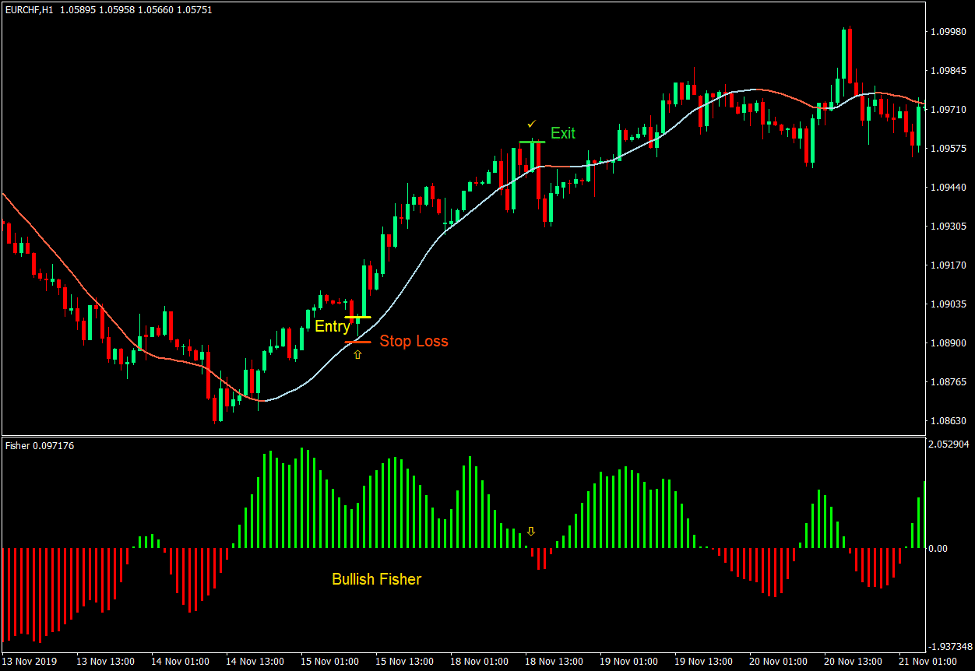

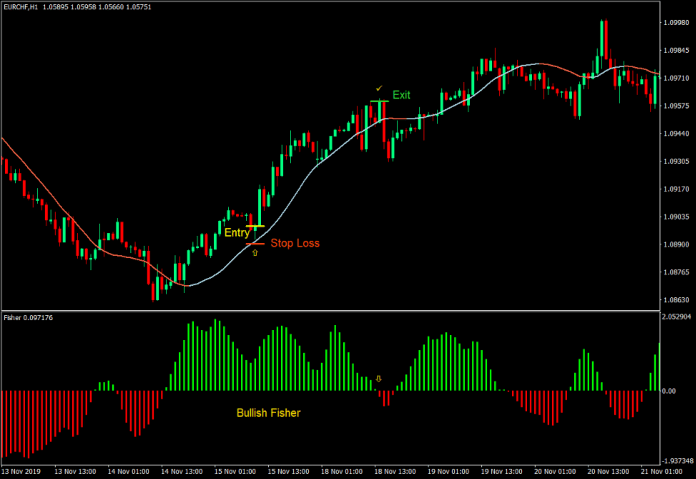

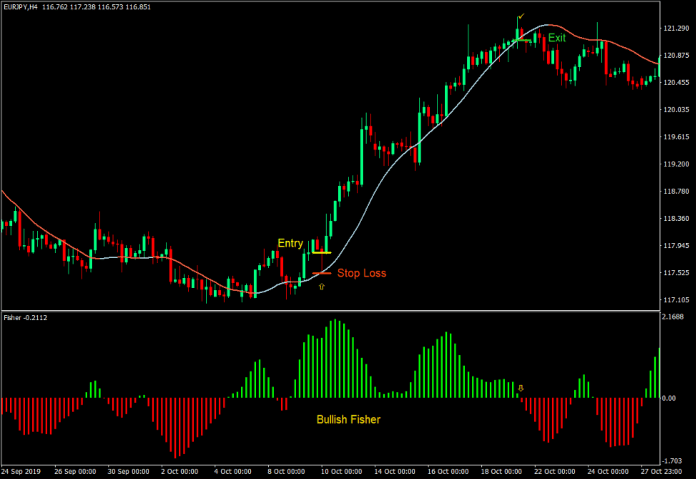

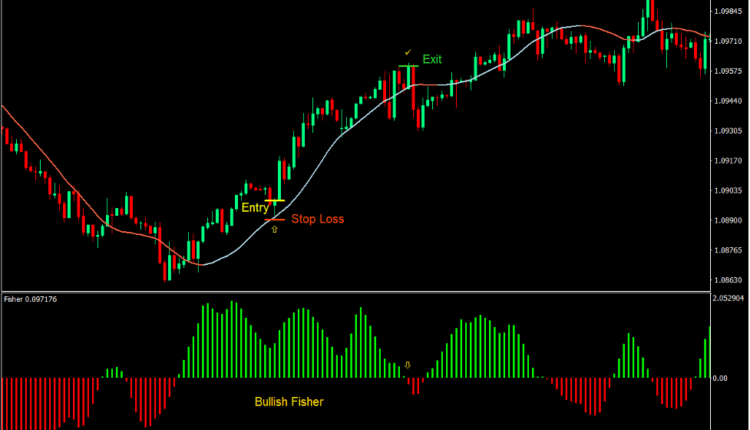

Buy Trade Setup

Entry

- Price action should cross above the Big Trend line.

- The Big Trend line should change to blue.

- The Fisher bars should shift above zero and should change to lime.

- Price action should pull back towards the Big Trend line.

- Price action should reject the Big Trend line as a dynamic support level identified by a pin bar candle.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Fisher bars shift below zero and change to red.

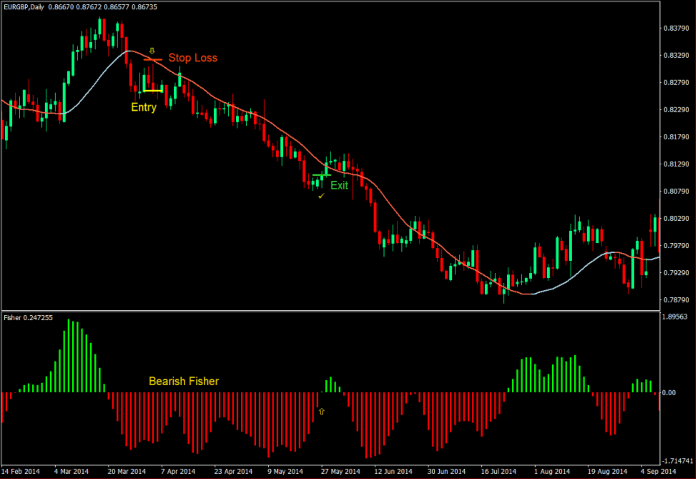

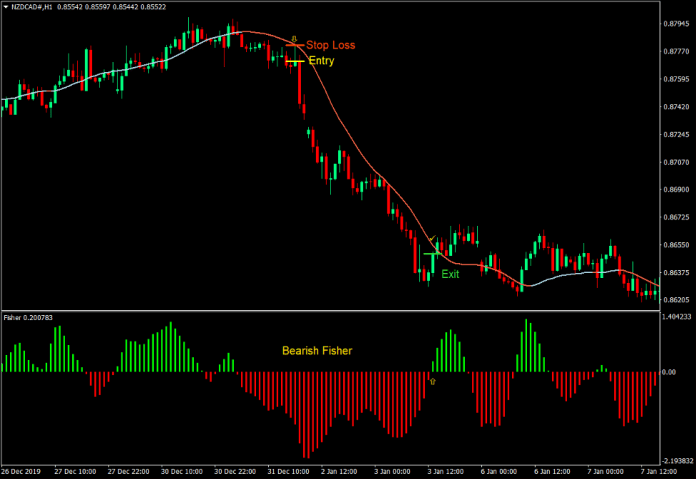

Sell Trade Setup

Entry

- Price action should cross below the Big Trend line.

- The Big Trend line should change to tomato.

- The Fisher bars should shift below zero and should change to red.

- Price action should pull back towards the Big Trend line.

- Price action should reject the Big Trend line as a dynamic resistance level identified by a pin bar candle.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Fisher bars shift above zero and change to lime.

Conclusion

This trend reversal strategy is a high yield type of trend reversal strategy. This means that the strategy relies on the high returns that winning trades produce rather than high win rates. Although this strategy leans more towards high returns rather than accuracy, traders can still be profitable using this type of strategy over the long run due to the higher yields that could cover some of the losses.

Given the nature of the strategy, which is a trend reversal type of strategy, it is normal to emphasize returns over accuracy.

However, this strategy also tends to increase the likelihood of a winning trade compared to most price action and moving average crossover reversal type of strategy. The pullback and rejection confirmation is the reason for this improved accuracy. Traders who can identify such trade setups well could earn profits using this type of strategy.

Forex Trading Strategies Installation Instructions

Big Trend Fisher Reversal Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Big Trend Fisher Reversal Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Big Trend Fisher Reversal Forex Trading Strategy?

- Download Big Trend Fisher Reversal Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Big Trend Fisher Reversal Forex Trading Strategy

- You will see Big Trend Fisher Reversal Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access

Comments are closed.