Banking Woes Support CHF Bid

Swiss Franc (CHF) Analysis

Recommended by Richard Snow

Top trading ideas identified by our analysts

Swiss Franc’s Safe-Haven Appeal Drives Currency Appreciation

The Swiss Franc has emerged as one of the top performers against the US dollar in 2023 as declining rate expectations in the US and safe-haven appeal of the franc influence the fundamental landscape. The franc has appreciated around 4.4% against the dollar in 2023 thus far, with the trend likely to continue should the US receive softer fundamental data – possibly starting this week with the NFP print and next week with the latest CPI data.

Adding to the bullish CHF outlook is its safe-haven appeal amidst the recent flare up in the US banking sector as two more potentially troubled lenders have emerged after JP Morgan absorbed First Republic Bank. The domino effect has led to massive declines in the respective share prices of PacWest Bancorp and Western Alliance, in a week filled with volatility.

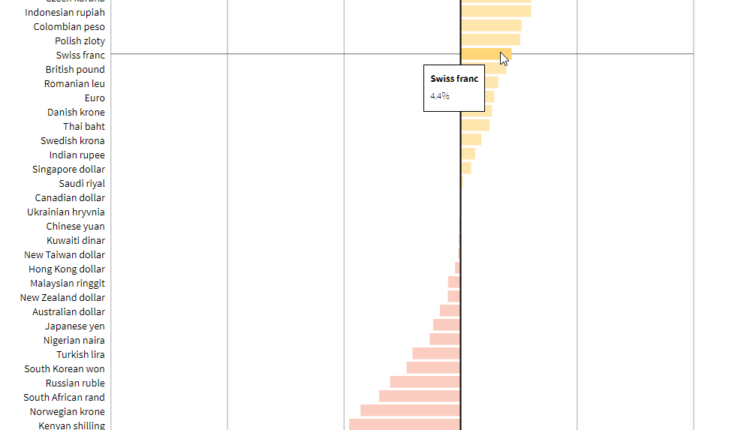

Global currencies versus the USD, performance year-to-date

Source: Reuters, prepared by Richard Snow

USD/CHF Technical Levels and Considerations

SNB Chairman Thomas Jordan maintained a hawkish stance towards both inflation and interest rates at a speaking engagement on monetary policy, stating that the former is too high, and the latter could still rise. Market implied rate expectations edged slightly higher in the aftermath with markets currently entertaining another 44 basis points worth of hikes – suggesting the terminal rate could emerge at 2%.

The daily USD/CHF chart reveals the overall bear trend as lower lows and lower highs remain the order of the day. Today, thus far there appears to be a temporary reprieve as the dollar recovers from prior sessions of intense selling. The pullback finds resistance at the 20 simple moving average (green line) which has acted as dynamic support throughout the rapid decline. Support comes in at the zone around 0.8850 followed by the swing low of 0.8820 and 0.8760.

USD/CHF Daily Chart

Source: TradingView, prepared by Richard Snow

The earlier mentioned level of support can be seen on the weekly chart, which corresponded to the area of support that appeared in late 2020 and early 2021.

USD/CHF Weekly Chart

Source: TradingView, prepared by Richard Snow

Later this afternoon, we will have a better idea of the US labour market via the NFP print. The earlier indication of private payrolls (ADP) revealed a sizeable beat to the upside but with correlations between the two data sets we will have to wait and see how many jobs were added in the month of April.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.