AVQ Trend Direction Forex Trading Strategy

Often times, what separates good traders from great traders is that great traders know how to pick their battles. Great traders know that any market could present trading opportunities that could potentially give them a profitable trade. However, they also know that not all market conditions have a high probability of producing good profits. Good traders would take any trade as long as an opportunity is present. Great traders on the other hand would choose to trade only in market conditions which could give them the highest potential of earning a profit.

Trending markets are one of the most favorite types of market conditions that great traders want to trade in. This is because in a trending market condition price is more likely to move in the direction of the trend rather than against it. This eliminates the question of which direction to trade, which drastically increases their chances of having a winning trade. The next question is where they take their trades. Most traders would take a trade in the direction of the trend anytime they see a trend. Good trend following traders on the other hand would rather wait for a pullback. This allows them to enter the market at a better price, which gives them a positive risk-reward ratio. The combination of a high probability trade setup and a decent risk-reward ratio gives them the edge to consistently profit from the forex market.

Slope Direction Line

The Slope Direction Line is a custom trend following technical indicator which is based on moving averages.

In fact, the Slope Direction Line itself is actually a modified moving average. Most moving average lines tend to be very susceptible to false trade signals which often occur during choppy market conditions. Traders are often duped by the market to take trades at the peak of a bullish outlook or at the bottom of a bearish outlook in cases when the market would whipsaw to worse price. The Slope Direction Line tends to manage these situations very well because it tends to maintain its course during market spikes and indicates a reversal only when the market has clearly reversed. The smoothened characteristics of the Slope Direction Line make it more resistant to such whipsaw false signals.

The Slope Direction Line plots a line which changes color depending on the direction of its slope. A light blue line indicates bullish trend bias, while a tomato colored line is indicative of a bearish trend bias.

AVQ Trend

The AVQ Trend indicator is a custom momentum indicator which helps traders identify the direction of the short-term trend or momentum.

This indicator overlays bars on the price candles which change color depending on the direction of the momentum. In this setup, a blue bar indicates a bullish momentum while a red bar indicates a bearish momentum.

Given the nature of the AVQ Trend indicator, this indicator can be used as a short-term trend reversal entry signal. Traders can simply take trades in the direction of the trend as the color of the bars change. However, this reversal signal should also be aligned with a longer-term trend indication.

Trading Strategy

AVQ Trend Direction Forex Trading Strategy is a trend following trading strategy which trades on retracements using the combination of the 100-period Exponential Moving Average (EMA), the AVQ Trend indicator and the Slope Direction Line indicator.

Trades are first filtered based on the direction of the long-term trend. The long-term trend is identified based on the location of price action and the Slope Direction Line in relation to the 100 EMA line, as well as the slope of the 100 EMA line.

The mid-term trend direction is then confirmed based on the slope and color of the Slope Direction Line. The direction of the Slope Direction Line should agree with the direction of the long-term trend.

Then, we wait for price action to retrace towards the area of the Slope Direction Line. This should temporarily cause the AVQ Trend bars to change color. Trades are taken as soon as the AVQ Trend bars resume the color of the direction of the longer-term trends.

Indicators:

- AVQ_trend

- (T_S_R)-Slope Direction Line

- 100 EMA

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

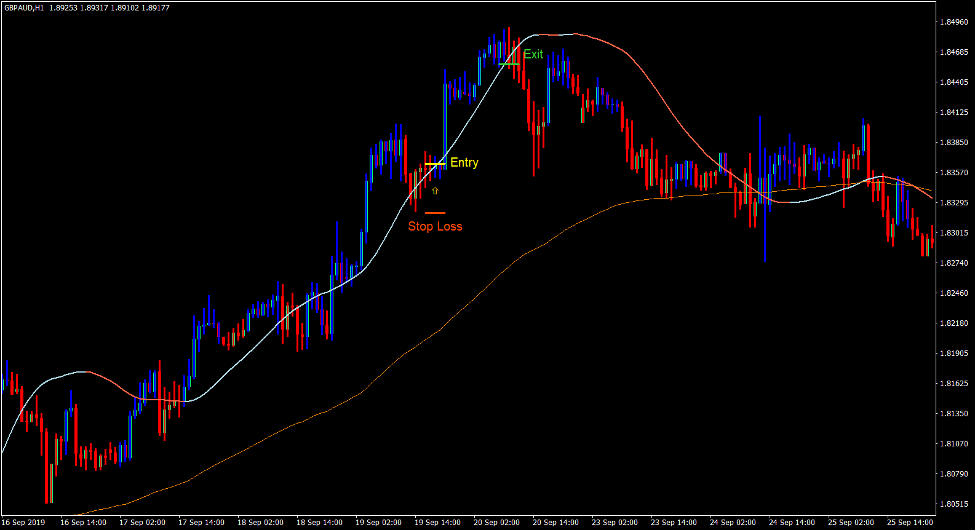

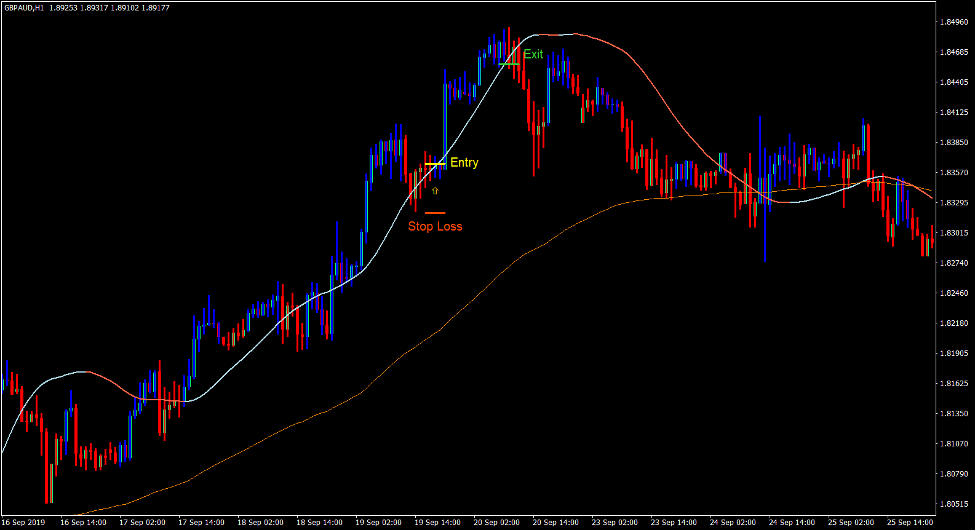

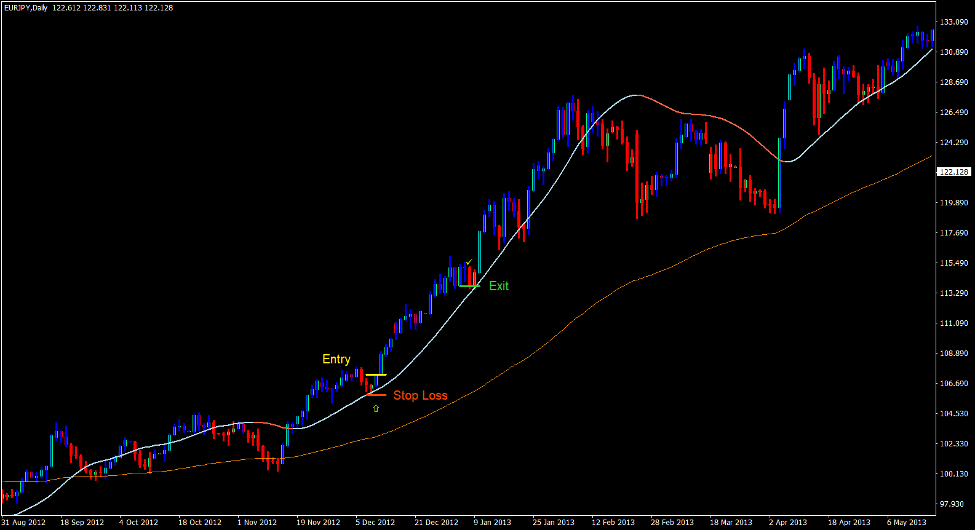

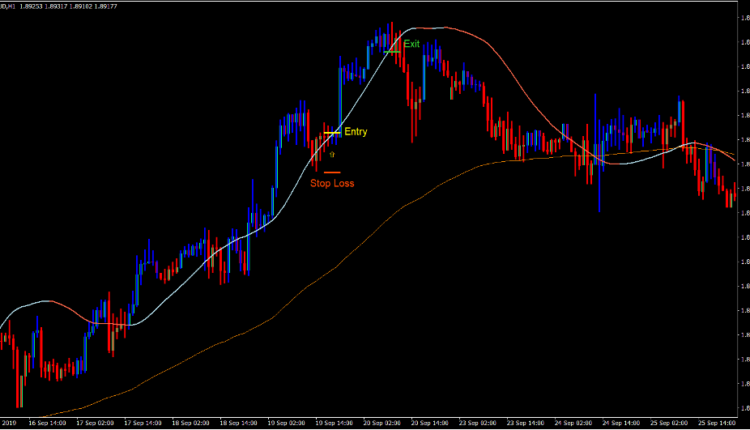

Buy Trade Setup

Entry

- Price action should be above the 100 EMA line.

- The Slope Direction Line should cross above the 100 EMA line.

- The Slope Direction Line should be light blue.

- Price action should pull back towards the Slope Direction Line causing the AVQ Trend bars to temporarily change to red.

- Enter a buy order as soon as the AVQ Trend bars change to blue.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the AVQ Trend bars change to red.

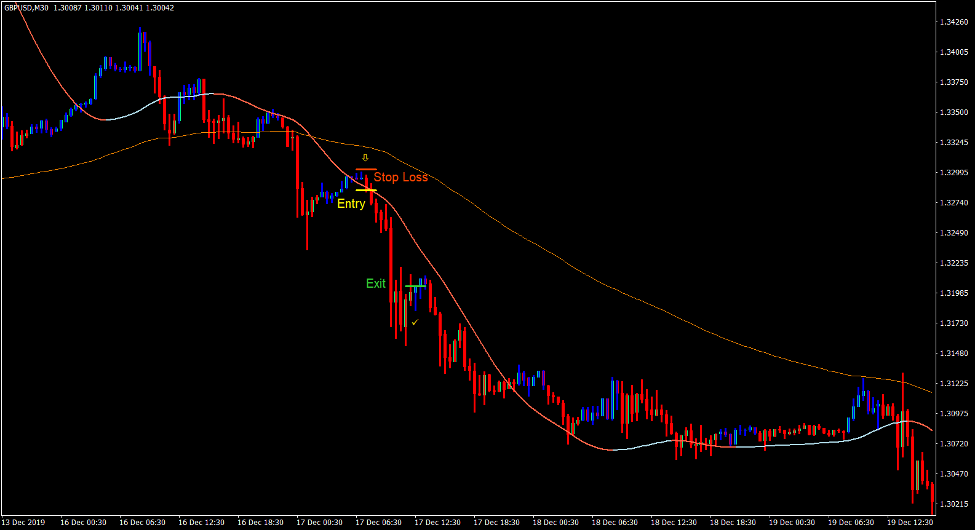

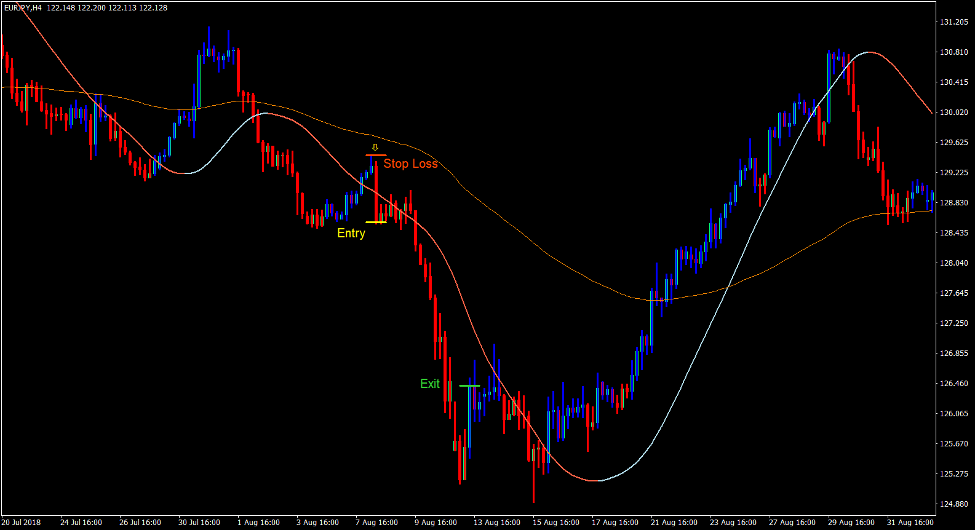

Sell Trade Setup

Entry

- Price action should be below the 100 EMA line.

- The Slope Direction Line should cross below the 100 EMA line.

- The Slope Direction Line should be tomato.

- Price action should pull back towards the Slope Direction Line causing the AVQ Trend bars to temporarily change to blue.

- Enter a sell order as soon as the AVQ Trend bars change to red.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the AVQ Trend bars change to blue.

Conclusion

This trading strategy is a simple trend following strategy which should allow traders to have trade setups with a decent win probability and risk-reward ratio.

The combination of aligning the long-term trend with the mid-term trend creates trade setups which have a good probability of moving in one direction.

Trading on pull backs based on a systematic trading signal allows traders to avoid second guessing themselves when trading the forex market.

This trading strategy could potentially produce good returns if used in a good trending forex pair.

Forex Trading Strategies Installation Instructions

AVQ Trend Direction Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

AVQ Trend Direction Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install AVQ Trend Direction Forex Trading Strategy?

- Download AVQ Trend Direction Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select AVQ Trend Direction Forex Trading Strategy

- You will see AVQ Trend Direction Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access

Comments are closed.