Australian Dollar Up After RBA Minutes & China GDP Data; Will AUD/USD Sustain Gains?

AUD/USD, Australian dollar – Price Action:

- Minutes of the RBA April meeting showed members considered the case for a 25bps rate hike.

- Upbeat China GDP data bodes well for the economic outlook.

- What’s next for AUD/USD?

Recommended by Manish Jaradi

How to Trade AUD/USD

The hawkish tone of the Reserve Bank of Australia’s (RBA) minutes of the April meeting and upbeat China data could provide support to the Australian dollar against the US dollar.

Minutes of the RBA April 4 meeting showed board members considered the case for another 25 basis point increase as inflation “remained too high and the labour market was very tight”. The board also considered the faster-than-expected pickup in population growth and wage growth before opting to pause the rate hikes.

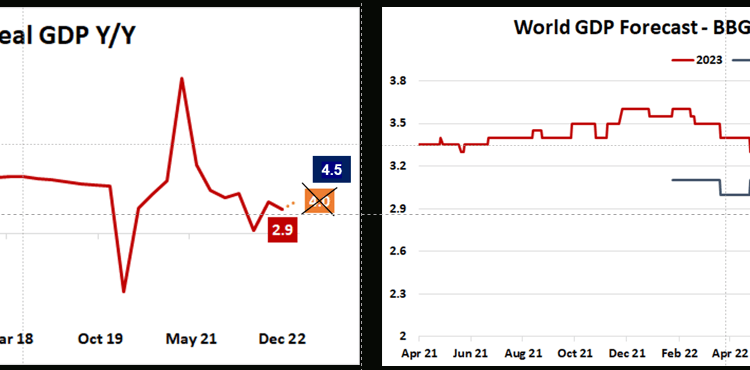

China GDP and Consensus Global Growth Expectations

Source data: Bloomberg; Chart prepared in Excel

Still, “it was important to be clear that monetary policy may need to be tightened at subsequent meetings”, suggesting that the Australian central bank may not be done just yet with tightening. Key focus is now on the Australia January-March CPI due April 26 – persistent inflationary pressures could boost the odds of a rate hike at the RBA’s May 2 meeting. The market is pricing in the RBA Cash Rate at 3.73% by August (Vs 3.6% now), up from 3.67% on Monday.

FX Speculative Positioning

Source data: Bloomberg; Chart prepared in Excel

Furthermore, data released on Tuesday Asia morning showed the Chinese economy grew 4.5% on-year in the January-March quarter, well above 4% expected, and 2.9% in the previous quarter. Industrial production rose 3.9% in March Vs 4% forecast, up from 2.4% in February, retail sales 10.6% last month Vs 7.4% expected, and above 3.5% in February, while fixed asset investment grew 5.1% in March Vs 5.7% expected, and 5.5% in February.

AUD/USD 240-minute Chart

Chart Created by Manish Jaradi; Source: TradingView

Broadly, China macro data have beaten expectations in recent weeks — the Economic Surprise Index for China this month hit the highest level at least since 2014 – reflecting the positive spillovers from the economic reopening. Given that China is Australia’s biggest export market, any improvement in China’s growth outlook could boost Australia’s growth prospects. Speculative positioning in AUD is short, and any repricing higher of RBA rates could be enough to trigger the unwinding of some of those short positions.

AUD/USD Daily Chart

Chart Created Using TradingView

On technical charts, AUD/USD has this month held above quite a strong support at the late-March low of 0.6625. However, the pair has been capped under a stiff hurdle around the 200-day moving average, roughly coinciding with the early-April high of 0.6795. AUD/USD needs to cross above the ceiling of around 0.6800 for the outlook to improve.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.