Australian Dollar Slides After CPI Data; How Much More Downside in AUD/USD?

Australian Dollar Vs US Dollar, Australia Monthly CPI – Talking Points:

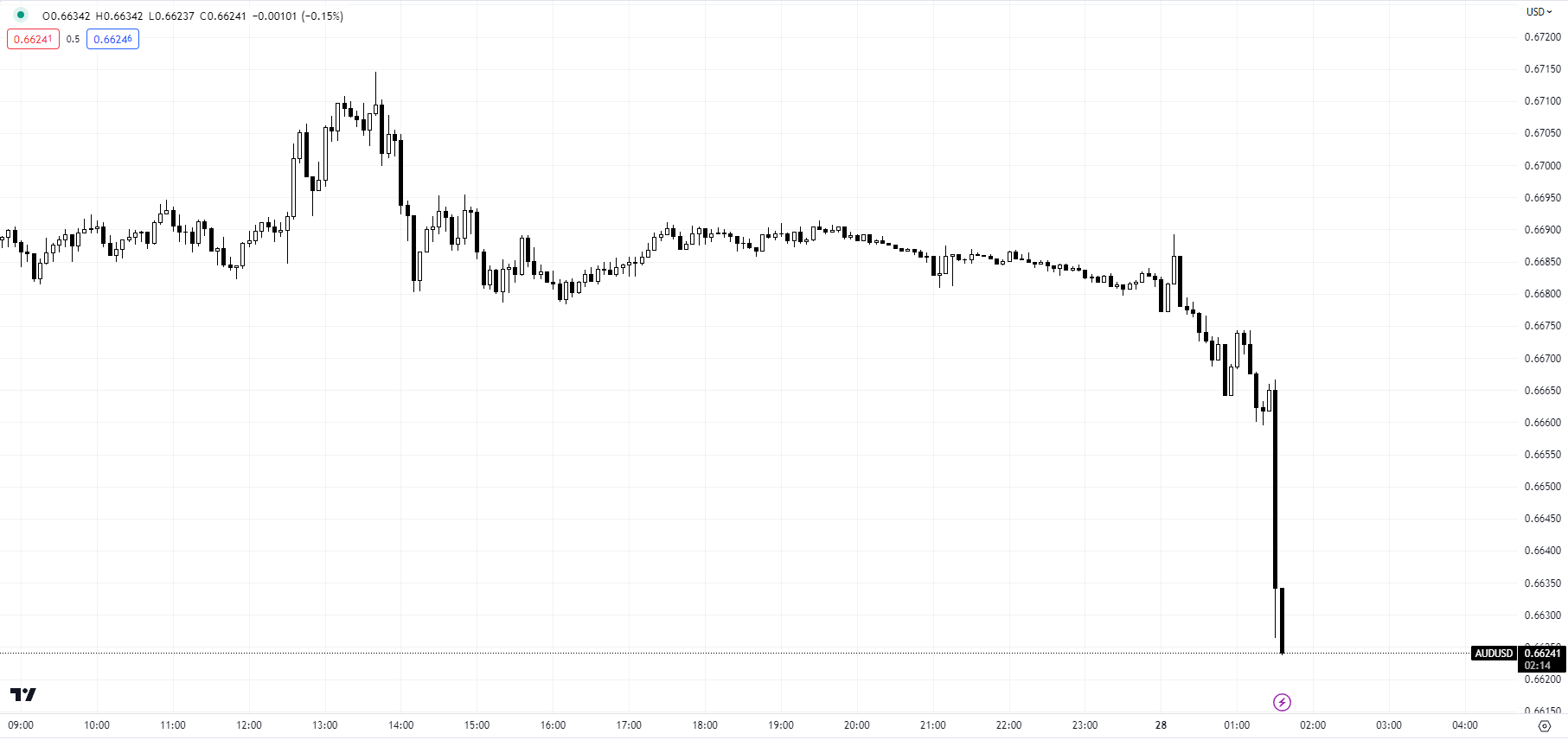

- AUD fell sharply after Australia monthly CPI came in well below expectations.

- RBA rate hike expectations for July have scaled back a bit after the data.

- What’s next for AUD/USD?

Recommended by Manish Jaradi

How to Trade AUD/USD

The Australian dollar dropped after Australia's monthly CPI indicator showed price pressures moderated more than expected last month which could lessen the need for aggressive interest rate hikes by the Reserve Bank of Australia (RBA).

Australia's May month CPI came in at 5.6% on the year, compared with the 6.1% forecast, down sharply from 6.8% in April. Odds of a rate hike by the RBA in July have scaled back slightly after the data release. RBA unexpectedly hiked interest rates by 25 basis points earlier this month and said some further tightening may be required in its determination to return inflation to its target. To be sure, the monthly CPI figures have been quite volatile and often not a good predictor of the quarterly CPI, which holds more relevance from RBA's perspective.

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

Key focus is now on Australian retail sales due Thursday and US PCE data due Friday. Retail sales are expected to have risen a touch in May to 0.1% on the month. A higher-than-expected number would reinforce resilience in global consumer spending even after the significant tightening in financial conditions. Data released on Tuesday showed US consumer confidence in June rose to the highest level in nearly 1-1/2 years.

US Core PCE Price Index is forecast to have remained flat in May at 4.7% on the year but probably softened a bit on a monthly basis to 0.3% from 0.4%. Headline PCE Price Index is expected at 3.8% on year compared with 4.4% in April. If the on-month data is in line or lower than expectations, it could weigh on the US dollar which rose quite a bit last week.

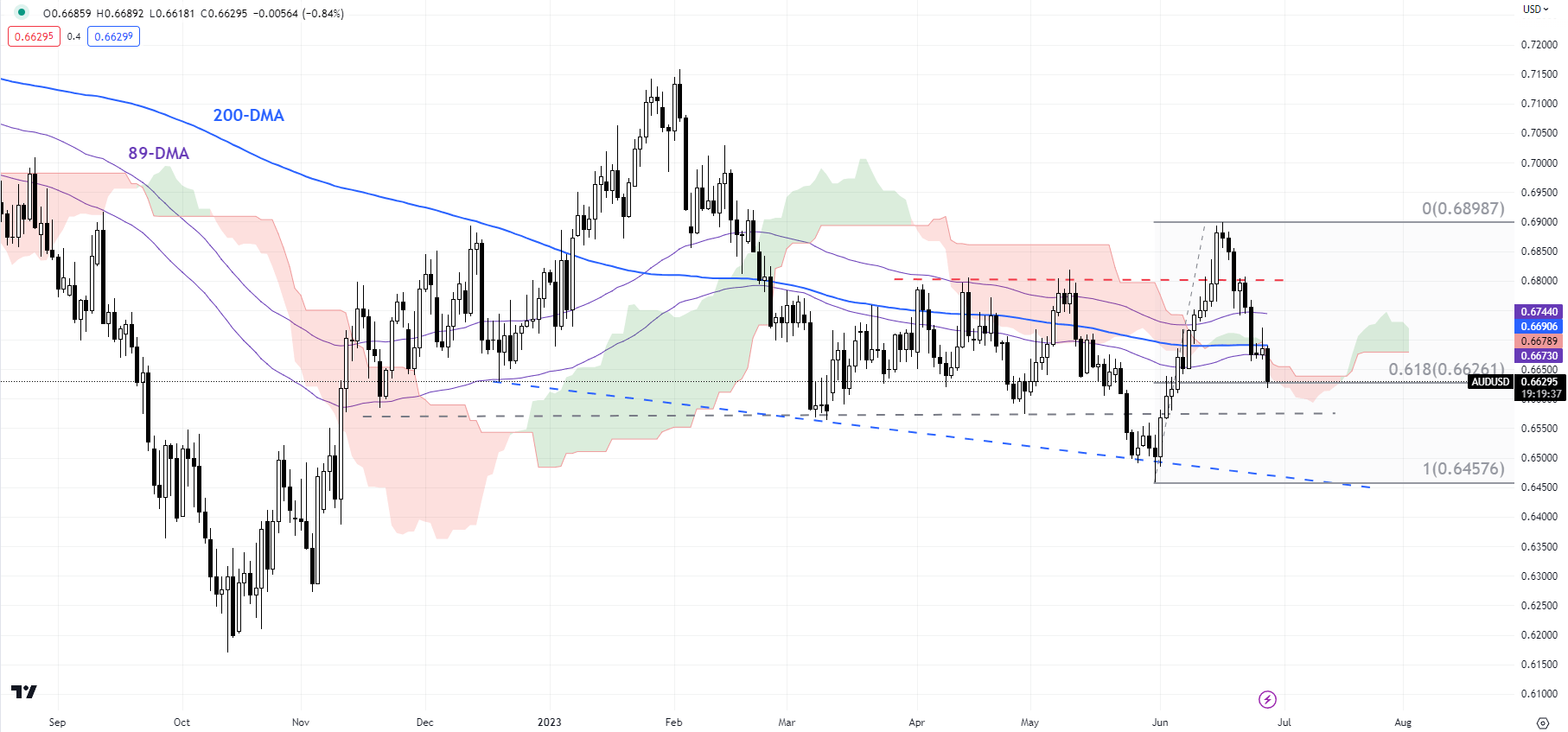

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Meanwhile, US Fed Chair Jerome Powell is due to speak later Wednesday at the European Central Bank Forum, which may not be much different from his testimony last week. He will be joined by Bank of England Governor Andrew Bailey, European Central Bank President Christine Lagarde, and Bank of Japan Governor Kazuo Ueda. Powell is likely to persist with the hawkish rhetoric given stubbornly high inflation. At the same time, he could reiterate his last week’s message that rates could rise at a careful pace.

On technical charts, AUD/USD is looking deeply oversold as it tests a vital converged cushion on the 89-day moving average and 0.6625 (the 61.8% retracement of the early-June rise), suggesting that further downside could be limited. However, the pair would need to rise above the initial ceiling at Tuesday’s high of 0.6720 for the immediate downward pressure to fade. The next support is at the March low of 0.6550.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.