AUD/USD: On the eve of the RBA meeting – Analytics & Forecasts – 30 June 2023

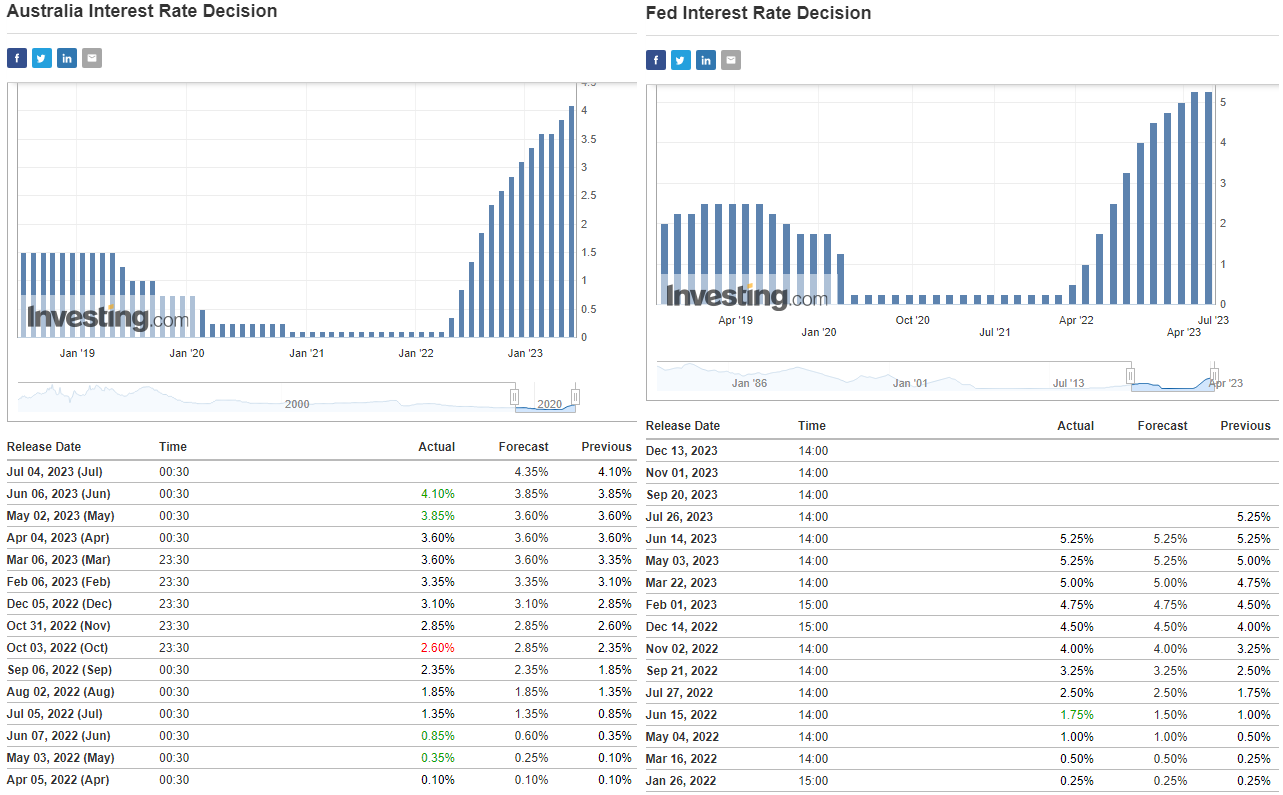

The Australian dollar strengthened sharply, while the AUD/USD pair rose after the RBA meeting ended at the beginning of the month, at which the bank's leaders unexpectedly raised the interest rate by 25 basis points to 4.10%. In an accompanying statement, they noted that they made the decision against the backdrop of continued inflation pressure, which remains at an unacceptably high level of 7.0% (the RBA target is 2.0% – 3.0%), also not ruling out the possibility of a further increase in the interest rate, if the economic situation corresponds to this, and economic growth and the well-being of citizens will not be significantly damaged.

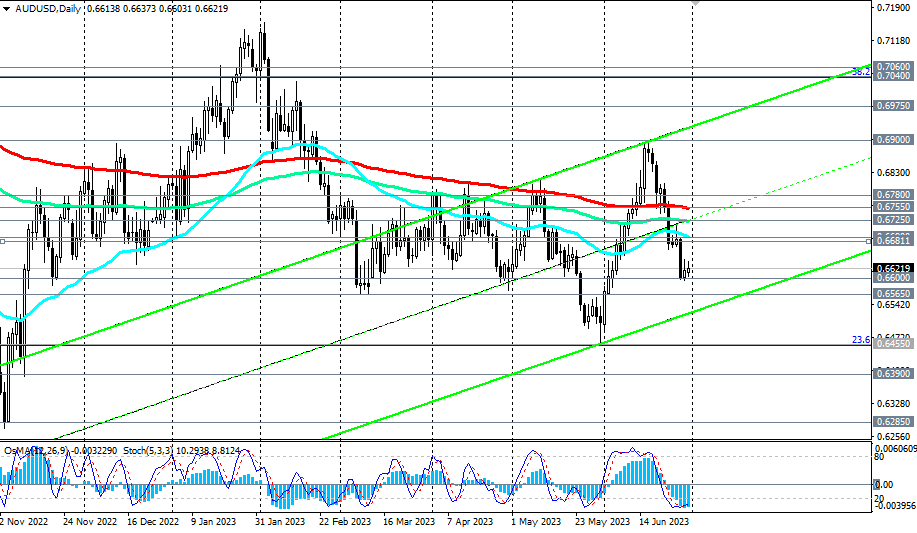

And yet, further on, the Australian dollar weakened, and the AUD/USD pair fell by now to the level of 0.6600, returning to the zone of bear markets – medium-term, long-term and global.

On Tuesday, July 4, the regular meeting of the Australian Central Bank will take place, and it is likely that a sharp decline in inflation in May will force RBA leaders to make another pause in raising interest rates. This is likely to negatively affect the position of the AUD, accelerating the decline in AUD / USD, including against the backdrop of continued expectations of a further increase in the Fed's interest rate.

This week the price tested the local support level 0.6600. A breakdown of the local support level at 0.6565 will be a confirming signal for the revival of the long-term downward dynamics of AUD/USD, sending the pair towards the lower border of the above downward channel, which is currently passing near local lows (since April 2020) and marks 0.6200, 0.6285.

Below the key resistance levels 0.7060, 0.7040 AUD/USD remains in the long-term bear market zone, and below the resistance levels 0.6755, 0.6725 and in the medium-term bear market zone, which makes short positions preferable in the current situation.

Support levels: 0.6600, 0.6565, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6640, 0.6681, 0.6690, 0.6700, 0.6725, 0.6755, 0.6780, 0.6800, 0.6900, 0.6975, 0.7000, 0.7040, 0.7060

Comments are closed.