Advice on how to earn 1’000’000 which is better than a million tips on how to earn (receiving 521’429% per annum). – Analytics & Forecasts – 30 October 2023

We will talk about what method of predicting the dynamics of quotes on the financial market should be used so that financial investments in the stock market and the FOREX market generate income.

There is a widespread belief that making money by speculatively trading on FOREX is the same as making money in a casino, that is, it is impossible. This judgment is not unfounded because it is extremely difficult to find examples of successful trading in the financial market, in contrast to the endless number of examples of losses from such trading.

Trading, as you know, is actually quite profitable. Trading in the financial market and the market for goods/services is essentially the same trading, and if trading in the financial market brings losses, then most likely those receiving losses are doing something wrong.

Trade, as someone said, is the engine of progress and making money by trading is not at all shameful. We don’t think about it, but our whole life is continuous trading. Everywhere you look, someone is buying or selling something. Every day, leaving your home or not even leaving it anymore, you will absolutely definitely buy something from someone, or someone will definitely sell you something. Whatever field of economic activity you are engaged in, you cannot talk about any income, and therefore progress, until the goods or services you produce are sold to someone. In general, everything around us is permeated with purchase and sale transactions for the purpose of making a profit.

Everyone is trying to make money, that is, buy cheaper and sell more expensive. Some people do it well, and some don't do it very well. The key to success in any business, and especially in trading, is analyzing the market for where, what, when and at what price to buy, in order to then sell at a profit. The positive difference between the sale price and the purchase price is your income, otherwise it is a loss, and in this sense, trading goods/services is no different from trading in the financial market.

However, trading in the financial market occupies a special place because it makes it possible to make an unlimited number of purchase/sale transactions with an endless number of financial instruments literally in seconds. And the success of trading in the financial market, as well as in the market of goods and services, is also not possible without analyzing what to buy, when to buy and at what price.

Financial analysis of economic activity is a clear thing and has long been described in detail. Regarding the analysis of the global financial market, a completely reasonable question arises: is it possible to analyze it at all? If yes, then how to analyze the financial market in order to understand which financial instruments to buy and which to sell, at what price to buy and at what price to sell and when, at what point to do this?

There is a specific answer to a reasonable question – YES! The financial market can and should be analyzed. Moreover, profitable trading in the financial market is impossible neither without fundamental analysis, nor without technical analysis and modeling based on this analysis to determine possible future trends in the currency, stock, commodity and commodity markets.

An effective method of analyzing the financial market, allowing you to determine possible future trends and invest profitably, is the Niro Method, based on chaos theory and fractal geometry. This method is a method of technical analysis and allows you to simulate the possible future dynamics of quotations of currencies, stocks, precious metals, raw materials, as well as index values and other financial derivatives, calculating possible future cost and time ranges of fluctuations.

You can learn more about the Niro Method by following the link in the article “Apophenia as an apologist for clairvoyance in capital markets”.

The Niro method allows you to analyze the fractal structure of a chart of the value dynamics of any financial instrument to identify and determine both already formed fractals and fractals that are and will be formed in strict accordance with the global fractal of the highest order in order to model possible future scenarios for the development of value dynamics on the chart.

One example of the practical application of the Niro Method can be seen by following the link in the article “Bitcoin. Back to the Future”, in which, using the example of analyzing a graph of the dynamics of Bitcoin (BTC/USD) quotes, a forecast is made for the future dynamics of quotes for this cryptocurrency.

Investing profitably in the financial market means knowing what to buy, at what price to buy and when to buy, as well as when and at what price to sell. The Niro method provides answers to these questions.

Future dynamics of quotes can be modeled. Let's look briefly at how.

Let's start with the fact that the financial market is a global nonlinear dynamic system, which includes other nonlinear dynamic systems in the form of financial instruments traded on the market.

The chart of a single currency pair, stock, index or some derivative is a chart that displays non-linear dynamics, that is, fluctuations in value over time.

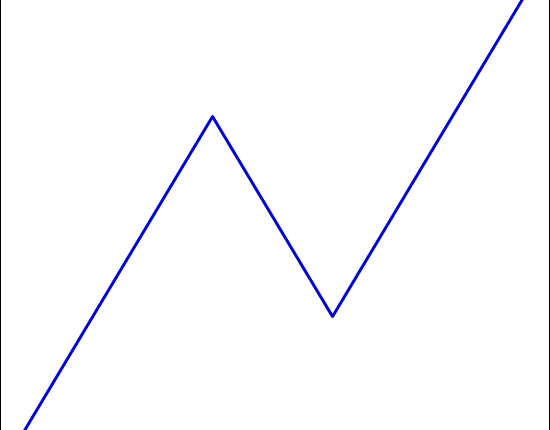

The simplest oscillatory movement can be represented in the form of three consecutive segments following one after another, one of which (the second segment) has the opposite direction to the other two segments (the first and third).

It is these simple fluctuations, alternating with each other, that make up the graph of the dynamics of the value of any financial asset. In other words, any graph of price dynamics can be decomposed into its simplest fluctuations, which follow as segments one after another.

The dynamics are not linear, which is why real graphs are quite complex and the simplest fluctuations rarely appear on them with such an ideal structure as in Fig. 1.

A fractal is understood as the simplest attractor of oscillatory motion, consisting of three segments, of which one segment is directed in the opposite direction to the other two segments.

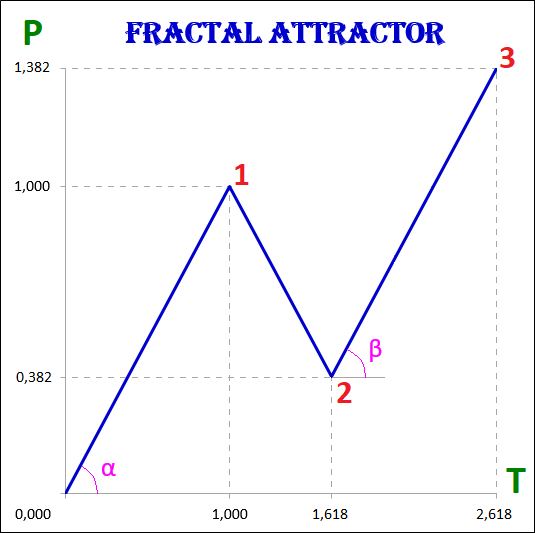

The basic (Fig. 2) will be called a fractal-attractor, in which the values of the cost and time intervals of the 1st and 3rd segments are equal, and the values of the cost and time intervals of the 2nd segment are determined by the golden proportion (golden section) to the values of the cost and time intervals of the 2nd segment. time intervals of the 1st segment:

1. The 3rd segment is equal in both time and price to the 1st segment (α=β):

P1 = P3, T1 = T3;

2. The 2nd segment is correlated with the 1st segment both in price and time with a Fibonacci ratio of 0.618:

P2/P1 = 0.618, T2/T1 = 0.618.

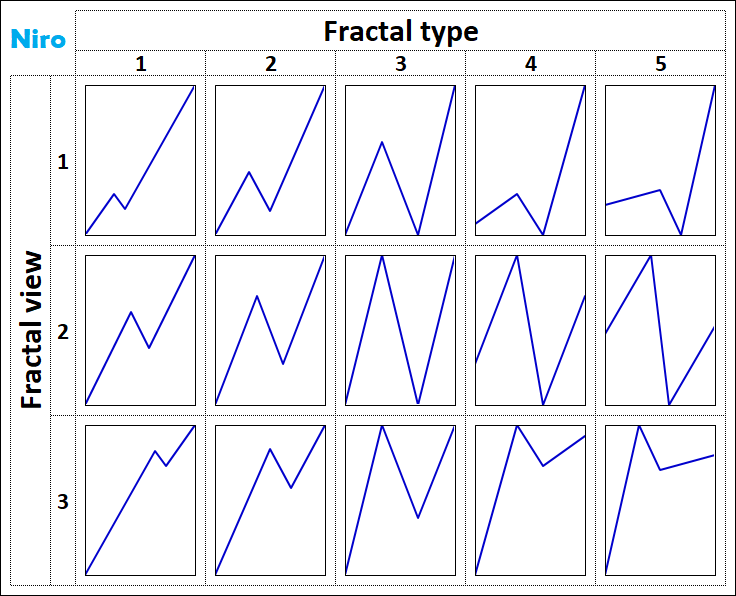

Fractals are divided into types and types depending on the size of the cost and time intervals of their segments.

According to the property of self-similarity, fractals of lower order form fractals of higher order, respectively, fractals of higher order consist of fractals of lower order.

Any fractal, in addition to the cost and time values of the intervals, has the following characteristics that describe it:

1. The order of the fractal, indicating which segment it is in relation to fractals of a higher order and which segments of fractals of a lower order it is formed by.

2. Fractal type.

3. View of fractal.

Fractal structure is the relationship of fractals of various orders, types, and types with each other.

Any chart of a financial instrument can be represented as a global fractal structure consisting of small fractal structures, which ultimately consist of individual fractals. In a sense, the global fractal structure, consisting of other fractal structures and fractals, can be compared to meaningful text. Just as a text consists of chapters, chapters consist of sections, sections consist of paragraphs, paragraphs consist of paragraphs, paragraphs consist of sentences, sentences consist of words, words consist of syllables, syllables consist of letters, so any chart of a financial instrument ultimately consists of fractals. A fractal is in some ways like a letter.

If we take a meaningful text, remove all punctuation marks from it and connect all the letters together, then we will get something like a chart of a financial instrument, looking at which its future dynamics will be absolutely incomprehensible, just as the meaning behind the set of letters is not clear, which cannot be read immediately.

When we begin to work with a sequential set of letters in search of meaning, then after some time we will be able to compose words from letters, break words into sentences, from which we will understand what is written. Just as not every set of letters is a word, and not every set of words is a semantic sentence, so not every combination of fractals is a fractal structure, and not every combination of fractal structures is a more complex fractal structure. Just as a set of 33 letters can be used to write a meaningful text, a set of 15 fractals can be used to describe any graph to understand its future dynamics.

You can learn more about how to read charts to understand their future dynamics by following the link in the article “To know what to buy, what to sell, you need to read charts”.

You can familiarize yourself with the alphabet for reading graphs by clicking on the link and watching the short video “Types and types of fractals. Alphabet of Niro Attractors”.

The Alphabet of Attractors Niro consists of 15 fractals, including the base one (Fig. 3). Fractals are divided into views and types. There are only three views and in each view there are five types of fractals.

An example of constructing a fractal structure of a graph up to the 5th order using a basic fractal can be found by following the link and watching the video “Dynamics of a basic fractal attractor”.

The essence of the method for modeling cost dynamics is to identify the fractal structure of the chart and describe it using attractors from the Niro Alphabet.

The process of formation of the fractal structure of an attractor by dynamic fractals is cyclical, which means it is predictable, i.e. It is possible to simulate the future dynamics of quotes of any financial instruments.

On the graphs of the dynamics of the value of financial assets there is a cycle, which consists in the formation of a fractal and is expressed in:

1) Formation of the 1st segment of the fractal;

2) Formation of the 2nd segment of the fractal, directed in the opposite direction to the 1st;

3) Formation of the 3rd segment of the fractal, which has the same direction as the 1st.

After the completion of this cycle, exactly the same cycle begins, but in the opposite direction. All these actions continue ad infinitum – the first segment is always replaced by the second segment, the second segment is always replaced by the third segment, and the third segment is always replaced by the first segment.

The cyclical process of formation of fractals and fractal structures in accordance with a certain order gives an understanding of which segment of the fractal and in which direction will be formed after the formation of the current segment is completed.

At any moment in time, the dynamics of the value of any financial instrument is not in chaos, but in a certain order, that is, in the formation of one of the three segments of the fractal – the first, second or third. After the first segment of a fractal, a second segment of the same fractal is always formed, after which a third segment of the same fractal is always formed, and then the first segment begins to form again, but of a different fractal, which has either the same order or a greater one, and which is necessarily directed in the opposite direction the previous fractal.

In this case, the extreme points on the graphs will be points at which either the first segments end and the second begin, or the second segment ends and the third begin, or the third segment ends and the first begin. Extremum points determine the boundaries of cost and time intervals of fractals in fractal structures.

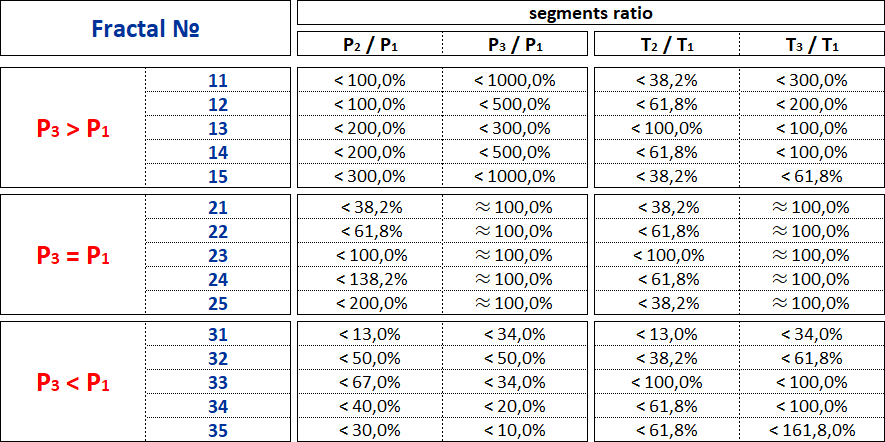

The proportions (Fig. 4) between the values of cost and time intervals of segments allow us to determine:

• what segments they are – first, second or third,

• what views and types of fractals these segments form, and

• what is the order of the formed fractals in the fractal structure in relation to each other.

The method for modeling the dynamics of quotations of financial instruments is based on determining what the current fractal segment is in the fractal structure – the first, second or third, in order to further determine which fractal segment will be the next one after the current one, thereby determining the future trend of quotations on the chart.

The Alphabet of Attractors Niro consists of 15 fractal attractors, to which the price dynamics chart of any financial instrument will tend.

Modeling the future dynamics of value begins with the analysis of the main (global) fractal structure, consisting of fractals of the highest order, that is, with the analysis of graphs built on annual time frames. As part of the analysis of the main fractal structure, it is determined which of the 15 types of attractors the graph of the dynamics of the value of a financial instrument belongs to.

Having identified the attractor of the main fractal structure, it is possible to make not only long-term forecasts of price dynamics, but also medium-term and short-term forecasts, because the formation of fractal structures consisting of fractals with an order lower than the highest will occur in strict accordance and subordination to the main fractal structure.

Thus, in order to understand the chart and clearly see the future dynamics of the financial market, you need to know the Alphabet of Attractors Niro and be able to use it to read and describe the fractal structures of charts of financial instruments traded on the currency, stock, and commodity markets.

Niro's Alphabet of Attractors eliminates any chaos and uncertainty from the dynamics of the financial market and makes the pattern in the dynamics of the value of financial assets clear and understandable.

Only after acquiring the necessary knowledge, skills and experience in modeling future dynamics and successful trading on a demo account can you begin real trading on the financial market. After all, it is absolutely clear that, having thoroughly studied all musical literacy and watched countless times how professional musicians play the piano, and having sat down at this same piano, it is impossible to play Rachmaninov’s 3rd concerto the first, hundredth, or even thousandth time, this will require many, many years of training. In this sense, to successfully play FOREX also requires very serious preparation over many years.

continued further

Comments are closed.