GBP/USD recovery to remain limited unless 1.2000 resistance fails

GBP/USD outlook: Renewed bears probe again through key support zone

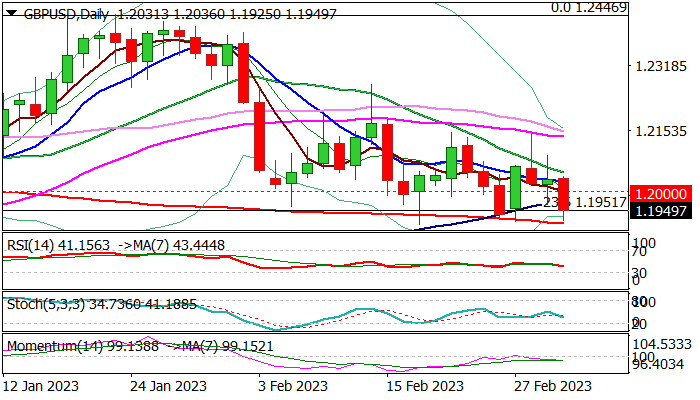

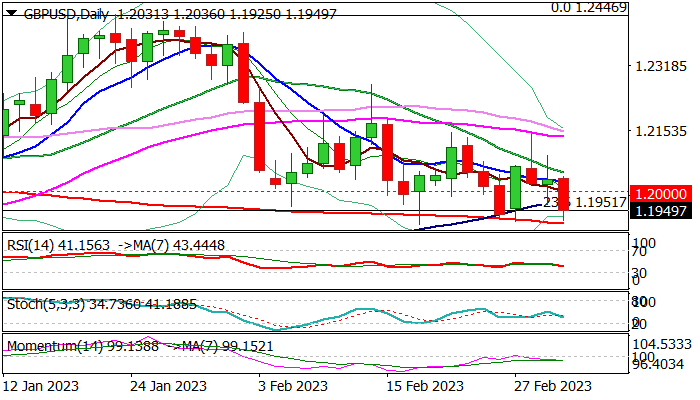

Cable lost ground after recovery was strongly rejected at the base of falling weekly Ichimoku cloud on Tuesday and fresh bearish acceleration on Thursday broke psychological 1.20 level, to test key support zone at 1.1950/14 (Fibo 38.2% of 1.1146/1.2446 / 200DMA / Feb 17 spike low), which contained several attacks in past three weeks.

Weakening structure of daily studies (negative momentum is rising / RSI is heading south / moving averages almost in full bearish setup) is maintaining downside pressure, while descending weekly cloud continues to weigh on near-term action after larger recovery was capped by the cloud base on Jan 23. Read more …

GBP/USD Forecast: Recovery to remain limited unless 1.2000 resistance fails

GBP/USD has managed to stage an upward correction during the Asian trading hours on Friday and continued to edge higher toward 1.2000 in the early European morning. The pair needs to flip that level into support to attract buyers and extend its rebound.

After the data from the US revealed on Thursday that Unit Labor Costs rose by 3.2% in the fourth quarter, the benchmark 10-year US Treasury bond yield climbed to its highest level since early November above 4% and provided a boost to the US Dollar. In the late American session, however, Atlanta Fed President Raphael Bostic's cautious comments on policy tightening helped the market mood improve and limited the USD's upside, allowing GBP/USD to find support. Read more …

GBP/USD steadily climbs back closer to 1.2000 mark amid broad-based USD weakness

The GBP/USD pair attracts fresh buyers in the vicinity of a technically significant 200-day Simple Moving Average (SMA) and reverses a part of the overnight losses back closer to the weekly low. The pair sticks to its intraday gains and is currently placed near the top end of the daily range, just a few pips below the 1.2000 psychological mark.

A modest pullback in the US Treasury bond yields prompts some selling around the US Dollar, which, in turn, is seen as a key factor pushing the GBP/USD pair higher. The British Pound draws additional support from rising bets for additional rate hikes by the Bank of England (BoE). It is worth recalling that the BoE Governor Andrew Bailey said on Wednesday that some further increase in bank rates may turn out to be appropriate, though added that nothing is decided. Read more …

Comments are closed.