Dow Jones, S&P 500, US Dollar, Gold, USD/CAD, AUD/USD, GDP

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Global market sentiment deteriorated this past week, setting traders up for volatility moving forward. On Wall Street, the Dow Jones, S&P 500 and Nasdaq 100 fell 2.61%, 2.94%, and 3.89%, respectively. Across the Atlantic, the FTSE 100 and DAX 40 sank 1.57% and 1.76%, respectively. Japan’s Nikkei 225 and Hong Kong’s Hang Seng Index fell 0.88% and 3.43%, respectively.

Counter to the stock market, the US 2-year Treasury yield soared to 4.82%, marking the highest confirmed close since 2007. On Friday, the US PCE Core Deflator crossed the wires higher across the board, pushing up hawkish Federal Reserve monetary policy expectations amid fears of stickier prices amid historically low unemployment.

Taking a closer look at market pricing, implied policy bets show that so far this month, traders have added at least 2 rate hikes to the outlook, with markets increasingly looking at a third. This is a recipe for volatility going forward as bets of a pivot continue fading.

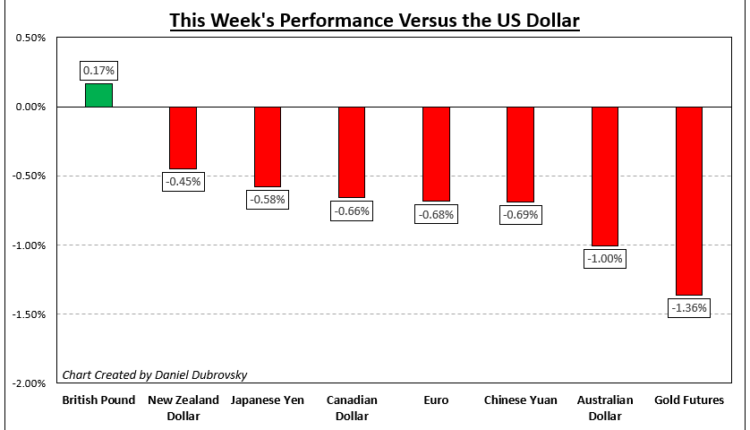

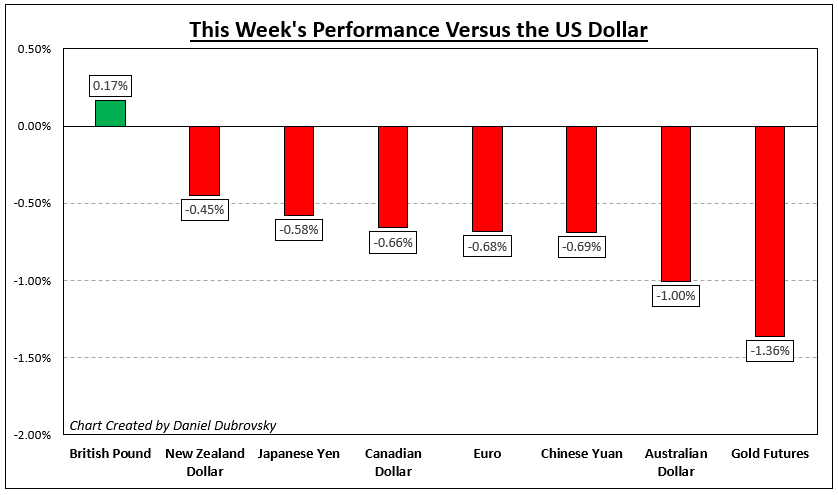

As a result, the US Dollar rallied across the board. It strongly performed against the Australian Dollar, Chinese Yuan and Euro. Anti-fiat gold prices also took a thrashing, with XAU/USD sinking 1.73% last week. Gold is shaping up for a 6.14% drop this month. That would be the worst decline over such a period since June 2021.

What should traders be watching going forward? From the US, we have ISM manufacturing and non-manufacturing PMI data due. For USD/CAD and AUD/USD, all eyes are on Canadian and Australian fourth-quarter GDP data, respectively. China will also release the latest official manufacturing PMI figures. What else is in store for markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – Week of 2/20

Fundamental Forecasts:

Euro Weekly Forecast: EUR/USD Gains As Eurozone Data Show Modest Return To Growth

The Euro ticked higher on news that its home economy expanded at last in January, raising hopes that recession can be sidestepped.

Pound Weekly Forecast: Good Data Fails to Reverse GBP Trajectory

The pound’s gains early this week have reversed, and the pound looks more vulnerable despite advancing talks in Ireland and slightly better consumer data.

Australian Dollar Outlook: What Happens Down Under, Stays Down Under

The Australian Dollar has been smashed as the US Dollar reclaimed momentum in a world of central banks racing to hose down self-inflicted inflation problems. Where to for AUD/USD?

US Dollar Outlook Turns More Bullish as Bond Yields Skyrocket Post PCE Data

The U.S. dollar (DXY) has risen to its best level since early January, driven by surging U.S. Treasury yields in response to a hawkish repricing of the Fed’s tightening path amid sticky inflation.

Gold Price Fundamental Forecast: XAU/USD Under Pressure From Raging Dollar

Gold prices head into the week on the backfoot after a resilient dollar remains supported by salivated inflationary pressures. XAU/USD eyes 1800.

Technical Forecasts:

US Dollar (DXY) Technical Forecast: Bullish Dollar Index Facing Technical Challenges in the Week Ahead

The Dollar Index enjoyed a stellar week as US data saw further increases in peak rate expectations. Can the momentum continue?

Nasdaq 100, Dow Jones, S&P 500 Technical Forecast: Key Support Breaks Hint at Losses

The Nasdaq 100, Dow Jones and S&P 500 all marked notable bearish technical developments last week. Is this setting the stage for more disappointment in the week ahead?

USD/CAD at Fresh 2023 Highs After Bullish Breakout, Oil Forges Bearish Pattern

USD/CAD presents a constructive outlook after this past week’s bullish breakout. Meanwhile, oil exhibits a negative technical bias as prices continue to develop a bearish chart formation.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.