GBP/USD sideways trade still likely

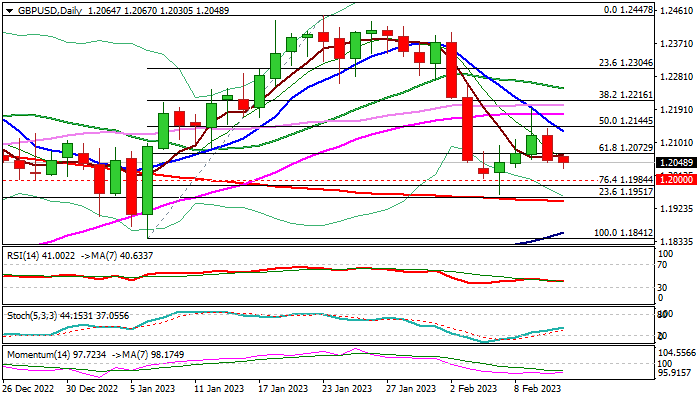

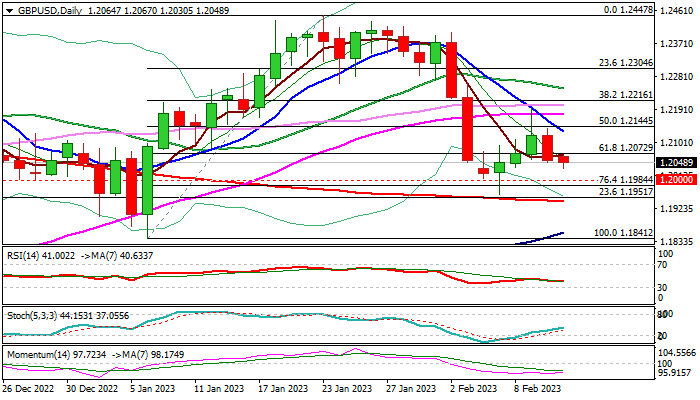

GBP/USD outlook: Bears pressure 1.20 support ahead of US CPI data

Cable dips further in early Monday’s trading, remaining at the back foot, following Friday’s 0.56% fall.

Fresh weakness retraced over 61.8% of last week’s 1.1960/1.2193 recovery leg, which was strongly rejected last Thursday and left a bull-trap above 55DMA.

Near-term structure is negative, as daily studies show strong bearish momentum and a multiple bear-crosses of 10;20;30;55 DMA’s.

Bears pressure psychological 1.20 support, where last week’s action faced strong headwinds and was rejected. Read more…

GBP/USD sideways trade still likely, range of 1.1950-1.2180 – OCBC

The British Pound has started the week on a softer footing. Economists at OCBC Bank expect the GBP/USD pair to trade within a range of 1.1950-1.2180 for the time being.

“Support here at 1.1950 (200-Day Moving Average, 23.6% fibo retracement of 2022 low to high), 1.1850 (100-DMA).”

“Resistance at 1.2190 (50-DMA), 1.2260 (21-DMA) and 1.2450 levels (double top).”

“Sideways trade still likely. Range of 1.1950-1.2180 within a wider range of 1.1850-1.2250.” Read more…

GBP/USD trades with modest losses around mid-1.2000s, lacks follow-through selling

The GBP/USD pair edges lower for the second straight day on Monday and remains on the defensive through the first half of the European session. The pair is currently placed near the mid-1.2000s, just a few pips above the daily low, and seems vulnerable to extending last week's retracement slide from the vicinity of the 1.2200 mark. Read more…

Comments are closed.