Gold Rangebound as Indecision Reigns Pre-NFP, Silver Eyes Support

GOLD (XAU/USD) PRICE FORECAST:

MOST READ: ISM Services Tops Estimates, Job Openings Plunge Weighing on the US Dollar

Gold prices recovered late in the day yesterday before continuing to trickle higher today. Looking at the larger timeframes and the price is caught in a range ahead of US jobs data due tomorrow.

Supercharge your trading prowess and stay up to date on the latest market developments by signing up for the DailyFX newsletter below.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

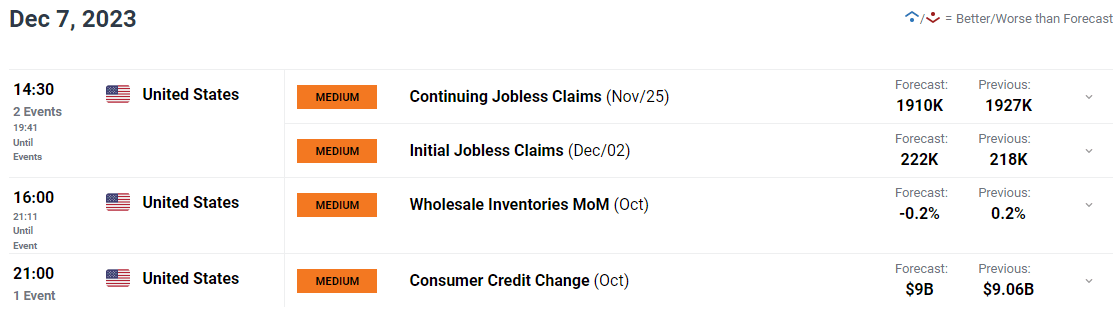

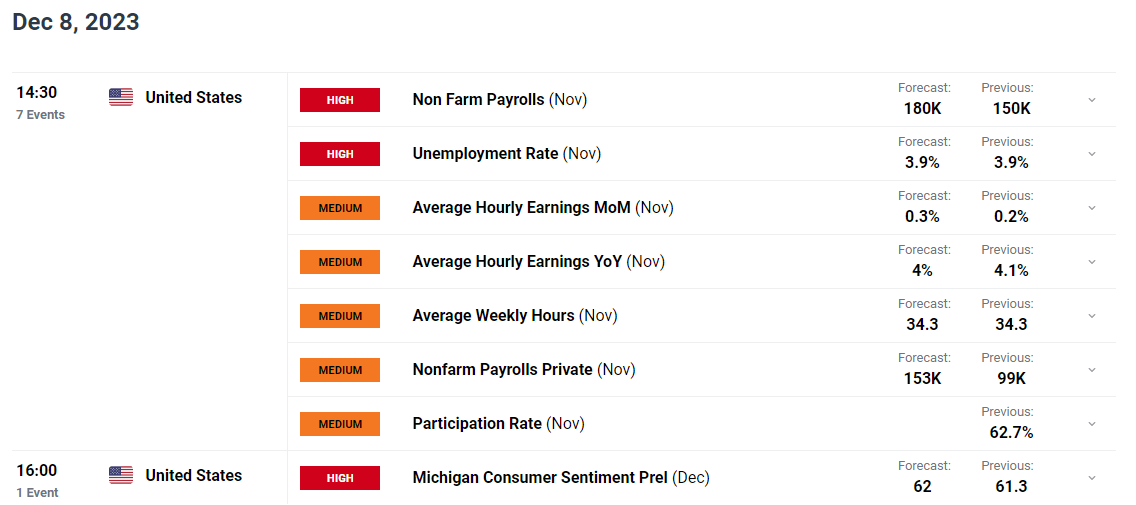

US TREASURY YIELDS AND JOBS DATA

Investors appear to be taking a pause ahead of the US jobs report due tomorrow after what can be described as a turbulent week for the precious metal. Opening the week with a new record high before a sharp selloff to within touching distance of the psychological $2000/oz level.

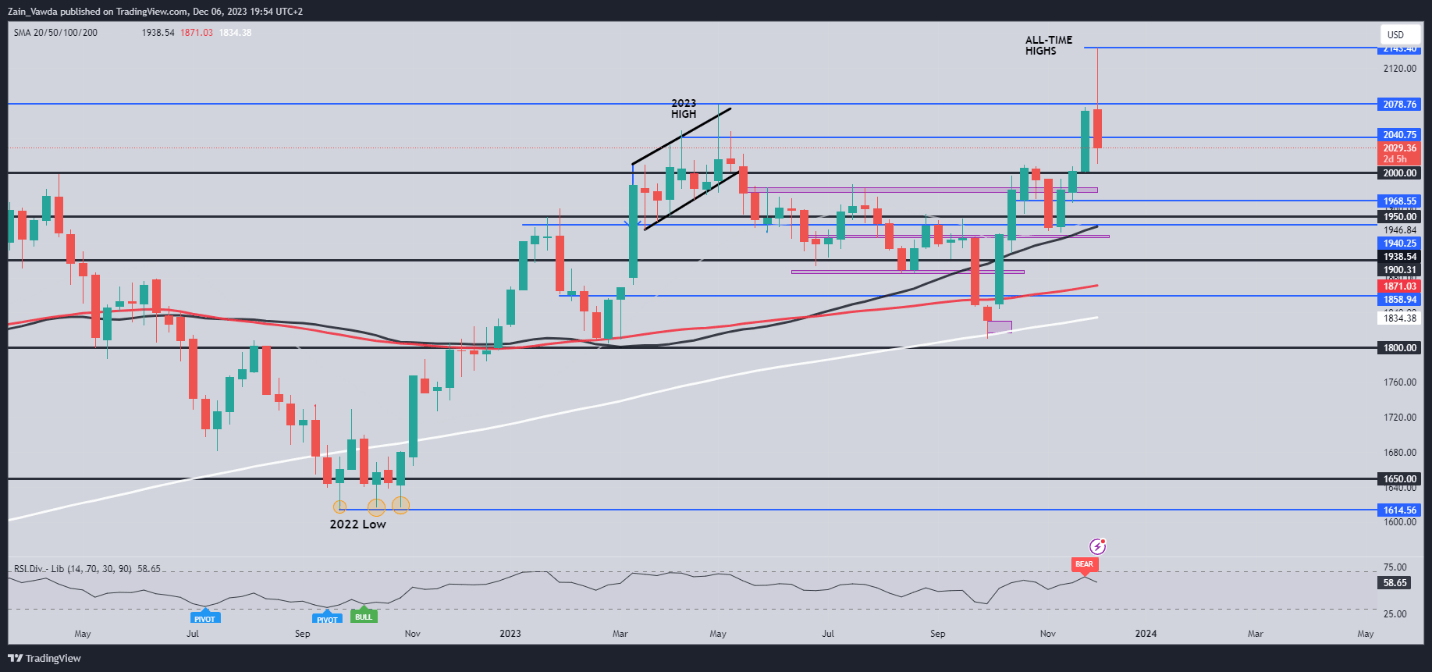

Today however saw US 10Y Yields hit a three-month low while safe haven appeal continues to keep the precious metal supported. The bigger picture for metals appears a bit clearer but in the short-term a potential retracement cannot be ruled out ahead of the year end. A lot of this will be down to the Jobs report tomorrow and the Fed meeting next week as market participants ramp up rate cut bets.

US 2Y and 10Y Yields

Source: TradingView

It appears we have the perfect cocktail for metal prices to rise heading into 2024 as demand grows. The uncertainty around global geopolitics as well the growing importance of metals in tech production leaves the metals sector in prime position heading into 2024, irrespective of the outcome at next week's FOMC meeting.

Looking ahead at tomorrow and we have a host of medium impact data with initial jobless claims likely to gain attention. Friday brings the NFP and Jobs report, which has become even more interesting given the drop in job openings and a softer ADP print. A sizeable miss on Friday and we could get further dollar weakness to end the week which in turn will likely boost Gold prices.

For all market-moving economic releases and events, see the DailyFX Calendar

Recommended by Zain Vawda

How to Trade Gold

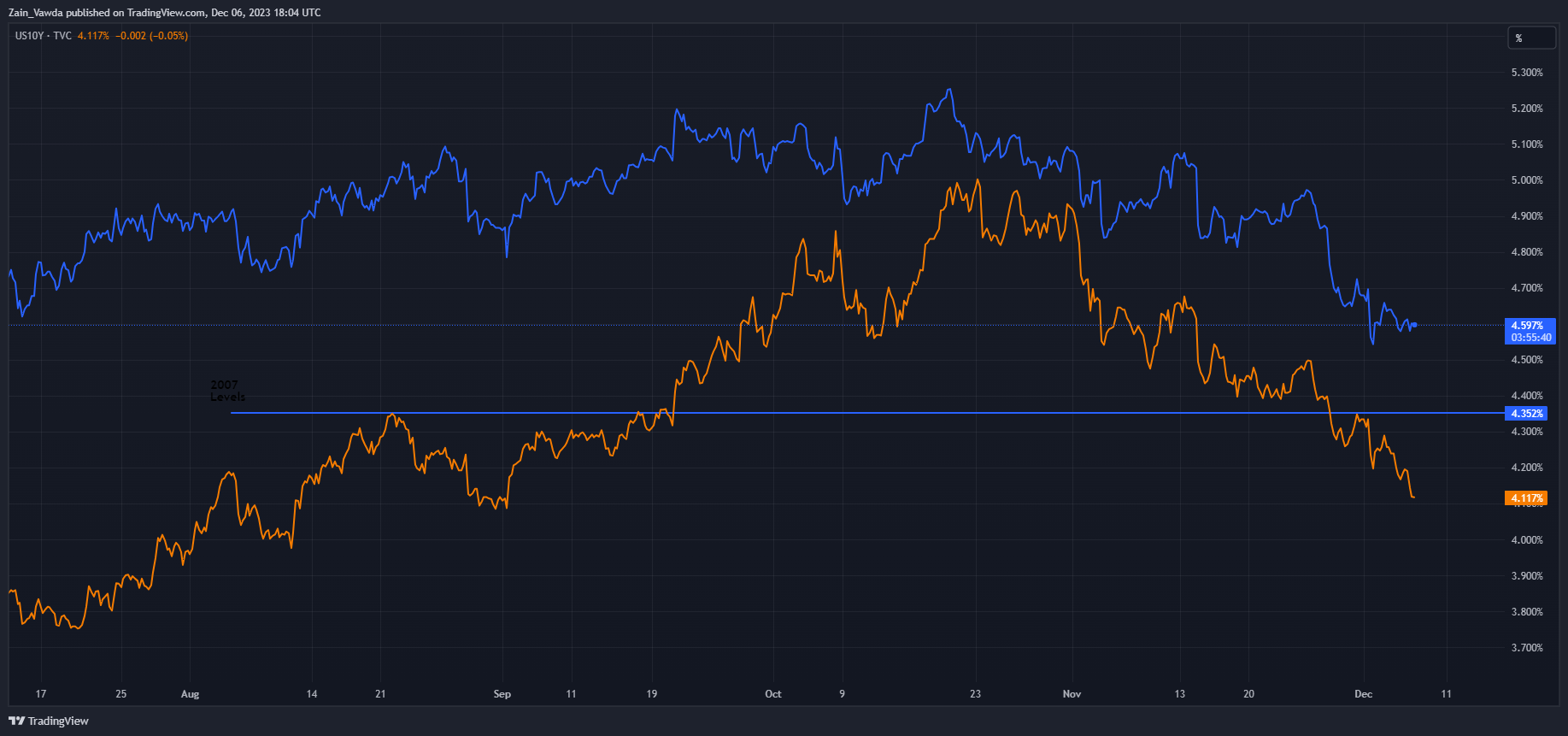

TECHNICAL OUTLOOK

GOLD

Form a technical perspective, Gold is caught n a range following the explosive move higher to start the week. We appear to be caught between the 2020 and 2031 levels at present with any spikes above or below these levels failing to find acceptance.

There is every chance that this continues heading into the NFP release on Friday. Either way the weekly timeframe now looks intriguing with a massive shooting star candlestick as things stand. However, with two days left there is a chance that this could change.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

Gold (XAU/USD) Daily Chart – December 6, 2023

Source: TradingView, Chart Prepared by Zain Vawda

SILVER

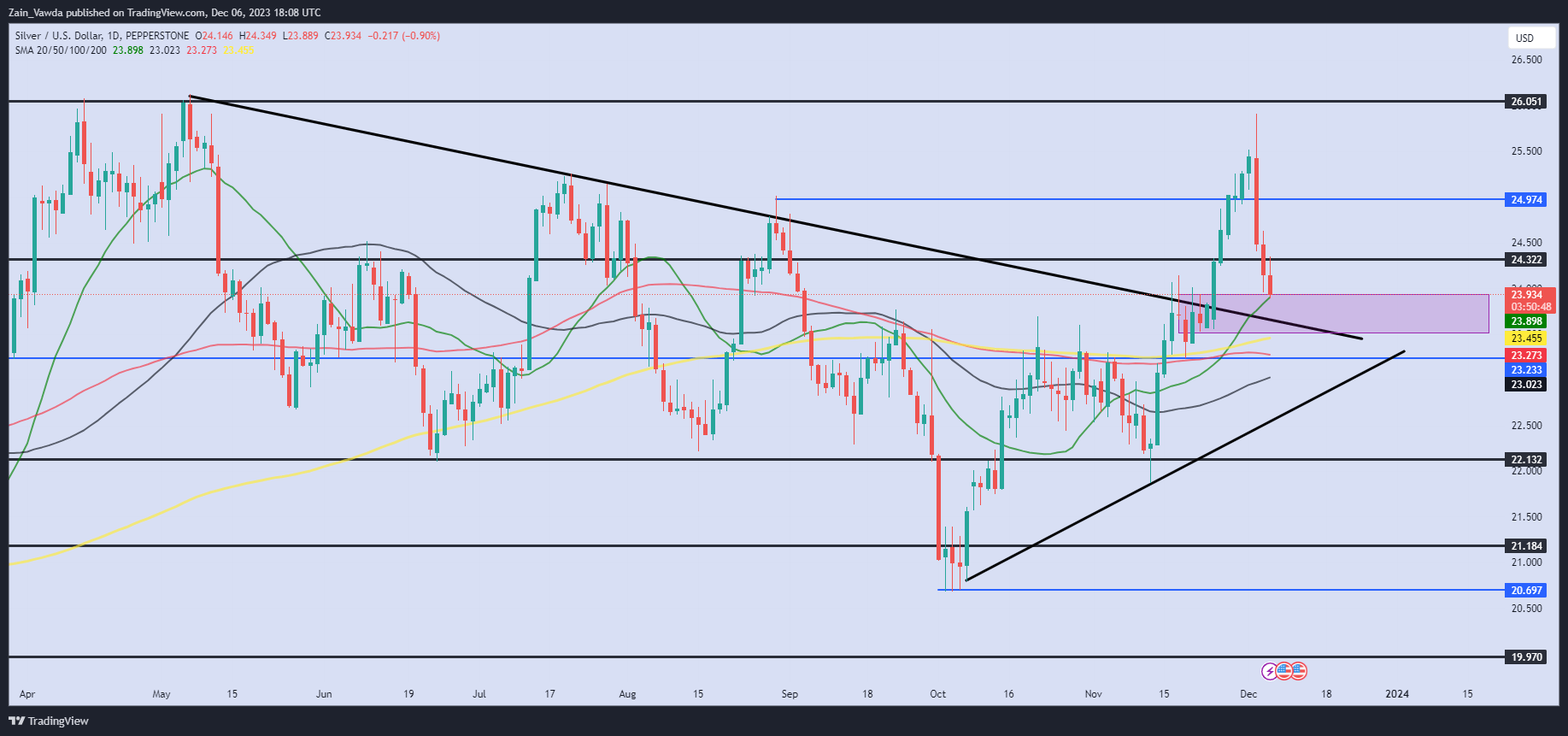

The technical outlook for silver may be setting up a continuation of the recent bullish move to the upside. The metal is on course for third successive day of losses but is approaching a key support area with a host of confluences. The area between 23.90-23.50 provide a host of confluences and could see the bullish move continue.

Looking at the overall structure and it would appear that silver still needs to complete a ‘wave 5’ and create a new higher high. A daily candle close below the 23.40 handle will mean a change in structure and invalidate the bullish continuation idea.

Silver (XAG/USD) Daily Chart – December 6, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Overwhelmingly Long on Silver with 69% of retail traders holding Long positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that Silver may break through the key support are and change structure?

For a more in-depth look at Silver client sentiment and tips and tricks to use it, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -4% | -1% |

| Weekly | 1% | 50% | 13% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.