Oil steady as OPEC+ fails to deliver above-market expectations

- WTI Oil steady near $76, failed to breach $80 on Thursday.

- The US Dollar is flat for this week and might flip into a positive performance on Powell comments.

- Oil could sink lower now that markets are lacking conviction of further upside in Oil prices.

Oil prices are starting to wobble and could start to sell-off as markets clearly are disappointed by the deal delivered on Thursday by OPEC+. It almost seemed the deal was constructed out of duct tape and some kids glue, with Russia being the only parent in the room to save the deal. The split division clearly has bitten into OPEC+’s credibility and might put questions going forward on if a price floor in Oil is manageable by the group seeing their recent lacklustre performance.

The US Dollar (USD) meanwhile is soaring and erased all losses from the past week. With just one trading day left, the week could still close in the green for the US Dollar Index (DXY). All eyes will be on US Federal Reserve (Fed) Chairman Jerome Powell who will speak twice this Friday ahead of the Fed’s official blackout period prior to its last rate decision for 2023.

Crude Oil (WTI) trades at $76.17 per barrel and Brent Oil trades at $80.87 per barrel at the time of writing.

Oil news and market movers: OPEC+ dropped the ball

- India is shoring up its Oil imports, with a restart of imports of Venezuelan Oil after a three-year drought.

- More India news on the wires as it has increased Oil imports from Russia and Iraq in the last month as refiners are looking for stock with soaring production demand in place.

- Market analysts remain very sceptical in the aftermath of the OPEC+ meeting on Thursday. The cuts are not enough and remain voluntary, which is not enough to create a substantial floor in the price of Oil.

- COP28 is now taking place in Dubai with all big leaders of state having arrived overnight. headlines are expected to come out throughout this Friday and over the weekend.

Oil Technical Analysis: Done and dusted

Oil prices have had a wild ride on Thursday, though looking back the credibility of OPEC+ has been dented. The fact that Russia had to step in and take one third of the supply cuts, circumventing Angola and Nigeria refusing to comply with any production cuts whatsoever, shows that the group is missing a leader who can create momentum and decisive decision making. Expect markets to send Oil further south as the placement of a price cap by OPEC+ has failed and will see more downturn as of this week.

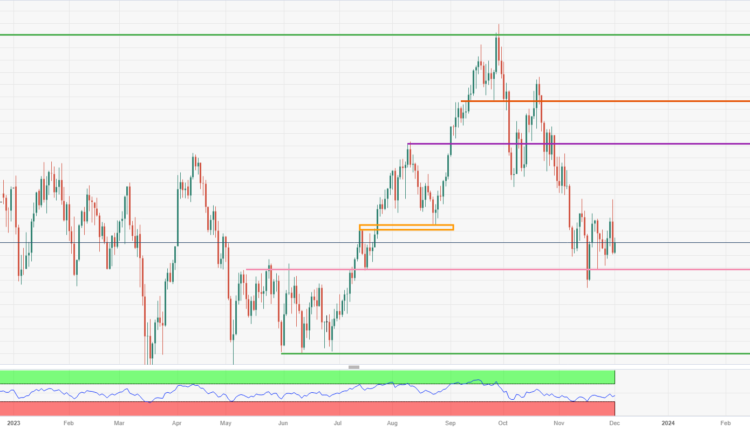

On the upside, $80.00 is the resistance to watch out for. Should crude be able to jump above that again, look for $84.00 (purple line) as the next level to see some selling pressure or profit taking. Should Oil prices be able to consolidate above there, the topside for this fall near $93.00 could come back into play.

On the downside, traders are seeing a soft floor forming near $74.00. This level is acting as the last line of defence before entering $70.00 and lower. Watch out for $67.00 with that triple bottom from June as the next support level to trade at.

-638370265617671970.png)

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Comments are closed.