Japanese Yen (JPY) Pares Some Losses As Key Inflation Data Near

Japanese Yen (JPY) Analysis and Charts

• USDJPY retreat has slowed into the Thanksgiving Break

• Latest Fed Minutes were seen as hawkish

• Japanese inflation numbers come as BoJ policy is in focus

Recommended by David Cottle

Get Your Free JPY Forecast

The Japanese Yen was very modestly higher against the United States Dollar as Thursday’s European afternoon wound down, with trade momentum predictably sapped by the US Thanksgiving holiday break. In some respects that break has come at an inopportune time for Dollar bulls. This week’s release of minutes from October’s Federal Reserve monetary policy meeting has been taken by the market as at least relatively hawkish, although whether or not they really were is perhaps debatable. For sure the central bank stands ready to raise rates again should inflation not continue to relax, but in this as elsewhere the minutes appeared to say little the Fed hasn’t said before.

In any case, the market reaction was to buy the Dollar against most things, and certainly against the Yen, with USD/JPY posting two straight days of gains. This may of course be only a temporary respite. The markets’ expectation is that inflation will continue to decelerate as a result of interest-rate rises already undertaken and that, not only will the Fed not increase rates again, it may indeed be in a position to cut them in the first half of next year.

This thesis is likely to undermine the Dollar for as long as it endures, with this week’s generally weaker run of US economic data only likely to underline it.

On the ‘JPY’ side of USD/JPY, the Japanese economy is also struggling. Tokyo downgraded its view on the country’s likely fortunes this week, the first such downgrade in ten months. The Japanese government feels that Japan’s post-Covid recovery is now ‘pausing’ with weak demand weighing on both capital spending and consumers’ mood. Hopes that the Bank of Japan might at last be ready to alter its unchanged and extremely accommodative monetary policy in the face of rising inflation have offered the Yen some rare domestic support. They may continue to do so. But news that Tokyo is worried about local demand conditions is bound to give traders some pause here.

Still, official Japanese inflation data are due later on Thursday, with the core rate expected to have ticked up to 3% in October, from 2.8% in September. An as-expected print could see USD/JPY lower, but holiday-thinned conditions could blunt any data impact.

Download our Complimentary USD/JPY Trading Guide

Recommended by David Cottle

How to Trade USD/JPY

USD/JPY Technical Analysis

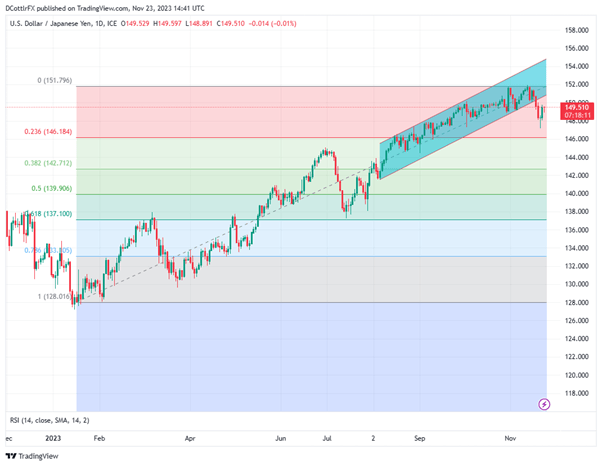

USD/JPY Daily Chart Compiled Usiing TradingView

USD/JPY has fallen this week out of the upward-trending trade band which had previously bounded the market since August 7 and which, in any case, was only an extension of the climbs seen since the start of this year. The Dollar showed clear signs of exhaustion in the 151.60 area, which has capped the pair twice in the past month and, probably not coincidentally, was also the peak of 2022. For now, that level continues to offer formidable resistance to Dollar bulls, with the former channel base at 150.76 offering a barrier below it. Before getting there, bulls will need to retake psychological resistance at 150.00, and there seems to be some sense that holiday-induced torpor is really all that’s stopping that, at least.

Slips will find support at Tuesday’s low of 147.103, ahead of the first Fibonacci retracement of this year’s overall rise. That comes in at 146.184 and has yet to face a serious test.

This looks like a market in which it might be best to trade very cautiously now, if at all pending a bit more clarity on both sides of the currency pair.

IG’s own sentiment data shows traders have mixed feelings about USD/JPY, as well they might given the uncertainties in the current fundamental picture. There is a bias towards being short at current levels, however.

| Change in | Longs | Shorts | OI |

| Daily | -8% | 3% | 1% |

| Weekly | 4% | 5% | 5% |

–By David Cottle for DailyFX

Comments are closed.