Minimalist Forex Strategy – Trading Strategies – 21 October 2023

- Introduction

- Step 1: Selecting Factions

- Step 2: Selecting Position

- Step 3: Confirming Candlestick Signals

- Conclusion

Welcome to a simplified Forex trading approach — the Price Action strategy. This method centers on reading candlestick patterns for efficient and precise trade entries. All products related to this strategy can be found in the MQL5 marketplace. Let’s dive in.

In brief:

- Patience Pays Off: Quality over quantity; we wait for prime opportunities to filter noise and boost our win ratio.

- Swift Action, Clear Outcome: No room for hesitation; this is an aggressive, all-or-nothing approach.

- Leveraging Supportive Elements: Price action-based factors enhance our filtering and winning capabilities.

- Risk Management: Prudent lot size calculation is key. Avoid risking over 10% of your account capital on a single trade.

- 60% Win Probability: We’ll evenly distribute the contributing elements for a 60% win/loss ratio: Leading Trends and Market Direction (40% * 60%); Position (30% * 60%); Entry Signal (30% * 60%).

Stay tuned for a detailed exploration of each step, including market trends, position selection, entry signals, and risk management.

In this pivotal first step, we will immerse ourselves in the process of determining your trading bias. Building a successful trading foundation necessitates a comprehensive understanding of current market dynamics and trends.

1.1. Assessing the Current Market Trend (*)

- At the core of every effective trading strategy lies the ability to identify the prevailing market trend. Are we amidst an uptrend or a downtrend? This foundational knowledge informs all subsequent trading decisions.

1.2. Deciphering Price Patterns

- To bolster our analysis, we will explore intricate price patterns, including the identification of crucial support and resistance levels. Proficiency in recognizing these patterns is invaluable for forecasting potential price movements.

1.3. Harnessing Technical Indicators

- Technical indicators such as Moving Averages, Relative Strength Index (RSI), and MACD can be potent tools for validating your analysis and fine-tuning entry and exit points.

1.4. Navigating Economic Calendar Events

- Staying well-informed about critical economic events and announcements capable of impacting currency pairs is imperative. Meticulously timing your trades around these events can significantly influence outcomes.

With a discerned trading bias, our focus shifts to the art of choosing optimal entry points, where precision plays an instrumental role.

2.1. Embracing Support and Resistance (*)

- We will delve deep into the profound significance of support and resistance levels, appreciating their role as pivotal areas for potential market reversals or continuations.

2.2. Unraveling Breakouts and the Power of Limit Orders

- We will explore breakout strategies in detail and unveil the efficacy of limit orders in capturing trading opportunities with precision.

2.3. Understanding Market Psychology

- A keen grasp of market psychology is pivotal. We will examine how collective sentiment influences price dynamics and how to seamlessly integrate this understanding into your trading decisions.

In this concluding step, we secure the authenticity of our trade signals, occupying a substantial share of our trading strategy.

3.1. Confirming Entry Signals

- Entry signals will be dissected comprehensively, constituting a substantial portion of our overall win ratio. This step is essential for augmenting the probability of a triumphant trade.

3.2. Delving into Candlestick Patterns (*)

- We will explore a myriad of candlestick patterns that provide invaluable insights into market sentiment and potential price reversals or continuations.

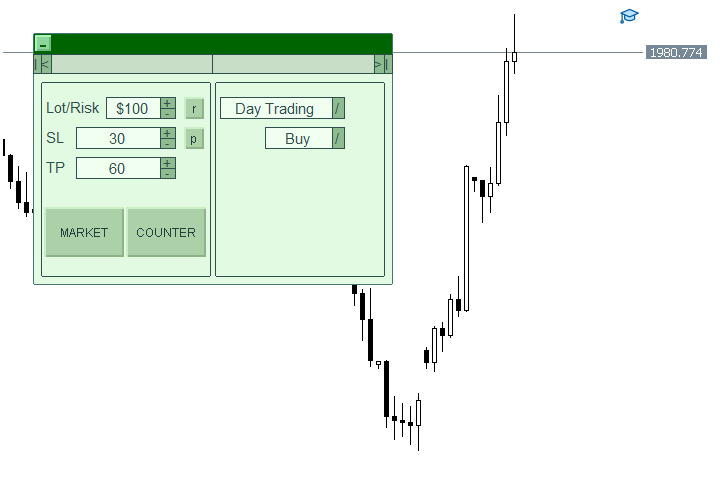

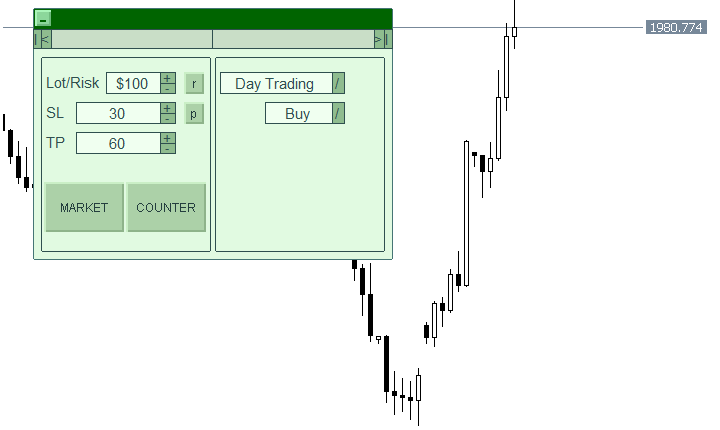

3.3. Mastering Risk Management and Strategic Order Placement

-

After following the steps outlined above, the key to long-term success in a trading strategy lies in maintaining a strong trading mindset. To thrive in the forex market, one must exercise diligent risk management and adhere to trading discipline. It is essential to manage risk with great care, ensuring that orders are consistently sized and executed with unwavering prudence. Keeping the risk per trade below 1% of your current account balance is crucial. This approach will make it easier to achieve the true win rate of your forex method and maintain an organized record of your placed orders.

-

I am currently offering a minimalistic yet highly effective product to streamline risk control during order placement and enhance trading discipline. If you find this intriguing, please visit “Entry Order Pro”

As we wrap up, I’d like to extend my gratitude for your dedicated readership throughout this journey. This strategy, rooted in the market’s fundamental nature, stands the test of time. Rest assured, I will continually refine and update the supporting elements in the future to ensure its effectiveness.

Stay tuned for ongoing enhancements and products on MQL5 that complement this strategy. Wishing you a day filled with successful trading endeavors.

This is not just a conclusion; it’s the beginning of a profitable trading journey.

Comments are closed.