Cable at the Mercy of the Dollar, UK jobs and Inflation Data Next

GBP/USD News and Analysis

- Sterling’s countertrend rise at risk after sticky US CPI report lifts USD

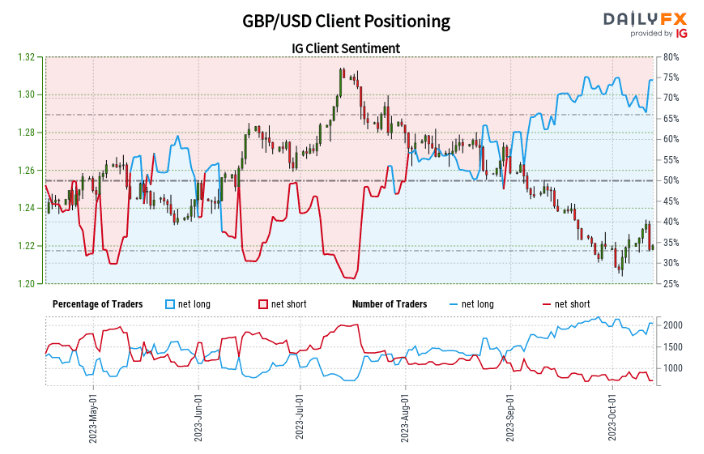

- IG client sentiment reveals notable divergence between positioning and trend

- Risk events: UK unemployment and UK CPI

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Pound Sterling’s Countertrend rise is at risk after Sticky US CPI Report Lifts USD

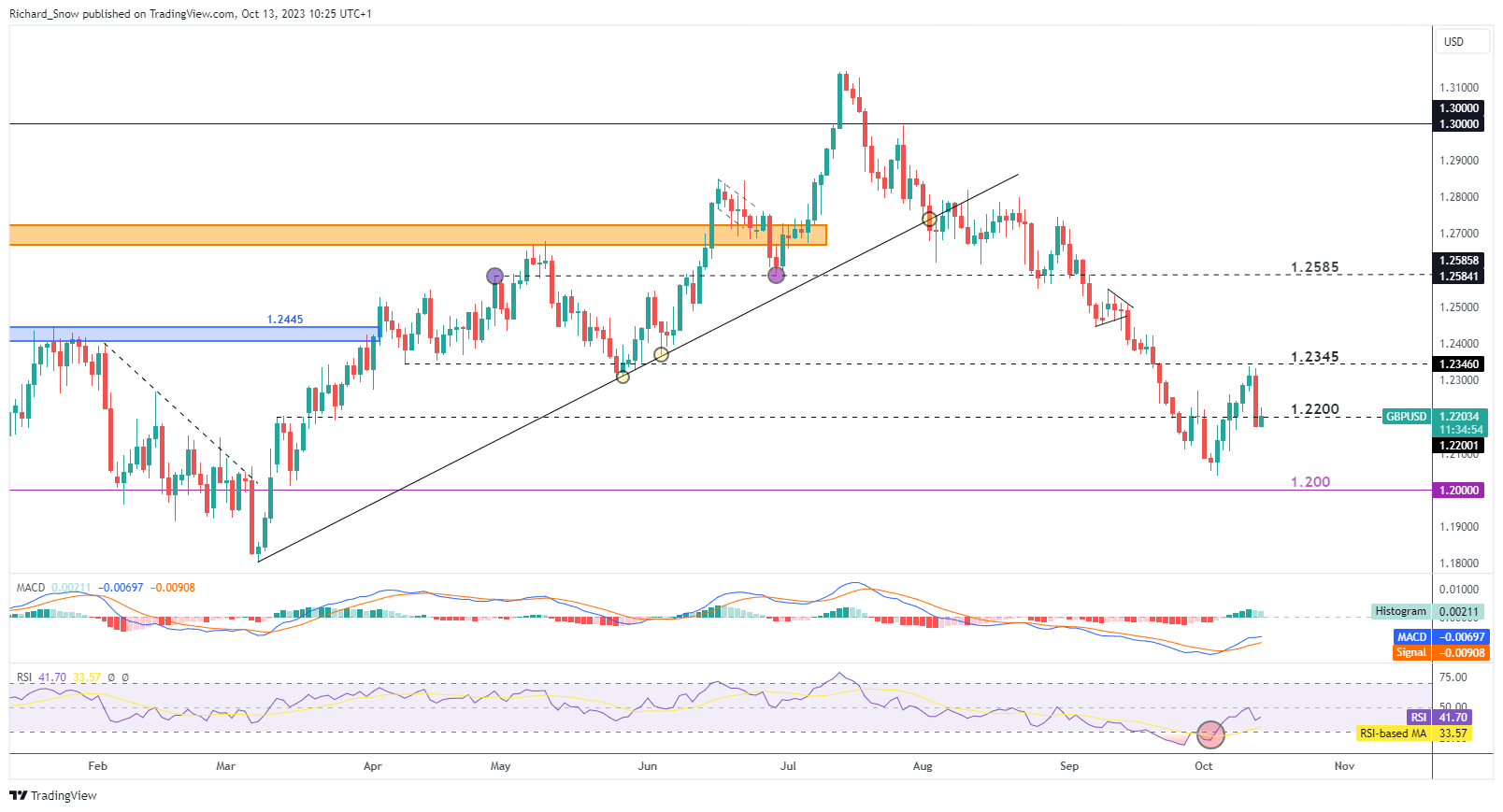

Stickier inflation in the US prompted a lift in the US dollar yesterday, with the ripple effect bringing an end to the recent countertrend move across major FX pairs vs the dollar. Cable is no different, seeing the pair surrender some of the recent gains after failing to breach the 1.2345 level.

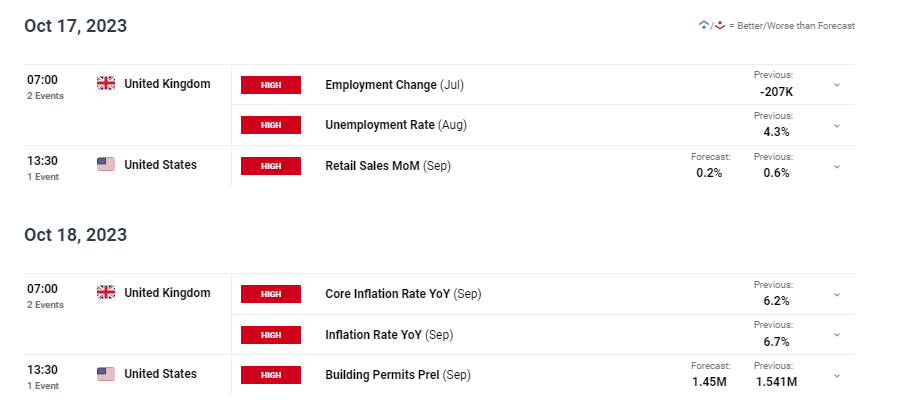

Next week presents an opportunity for local UK developments to drive the pair, something that has been absent for some time now, as UK unemployment and inflation data comes due. The UK has experienced a moderate easing in the job market of late and this week’s IMF World Economic Outlook revealed challenges to growth this year and particularly in 2024. These developments should help contain inflation but higher energy prices have threatened to reignite upside risks to inflation.

Heading into the last day of trade, GBP/USD tests the psychological level of 1.2200. Achieving such a feat may delay a continuation of the longer term downtrend but a close below suggests further pain for cable bears. Support resides at 1.2000.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

With the Bank of England appearing content with the recent disinflation and easing in the UK jobs market, is there a case for further selling pressure in the final quarter of 2023? Read our Pound Sterling Q4 forecast below:

Recommended by Richard Snow

Get Your Free GBP Forecast

IG Client Sentiment Reveals Notable Divergence in Positioning vs Trend

Source: IG, DailyFX, prepared by Richard Snow

GBP/USD:Retail trader data shows 72.56% of traders are net-long with the ratio of traders long to short at 2.64 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Read the full IG sentiment report based off actual client positioning data to find out why the contrarian indicator issues a bearish GBP/USD-bearish trading bias.

For more on how to understand the popular contrarian indicator, read our dedicated guide below:

| Change in | Longs | Shorts | OI |

| Daily | 2% | 2% | 2% |

| Weekly | 4% | -1% | 2% |

Major Risk Events for the Week Ahead

Keep an eye on average earnings which reached an impressive 8.5% previously and remains way too hot for the Bank of England’s liking. The bank is next to meet in early November but appears content with rates at current levels. Unemployment data and UK CPI data provides further insight into the effectiveness of past rate hikes which will have a knock on effect on the pound.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.