Daily Forex News and Watchlist: CAD/JPY

Can CAD/JPY sustain its short-term uptrend with the BOC decision lined up?

Here are the levels I’m watching.

Before moving on, ICYMI, yesterday’s watchlist looked at AUD/NZD’s range support test after the RBA decision. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. factory orders dipped by 2.1% m/m in July vs. projected 2.5% slump and earlier 2.3% decline

New Zealand dairy prices rebounded by 2.7% after earlier 7.4% decline, based on latest Global Dairy Trade auction

Australian GDP grew 0.4% q/q in Q2 2023 vs. estimated 0.3% expansion, previous quarter growth upgraded to 0.4% from initially reported 0.2% uptick

Chinese state-owned banks stage coordinated selloff of USD/CNY in the markets in order to prop up the yuan

Japan’s Finance Ministry’s Kanda says that “it’s important for currency moves to reflect fundamentals” and that they “won’t rule out any options if speculative moves persist”

German factory orders tumbled 11.4% m/m in July vs. expected 4.3% decrease and previous 7.6% gain (upgraded from initially reported 7.0% figure)

Price Action News

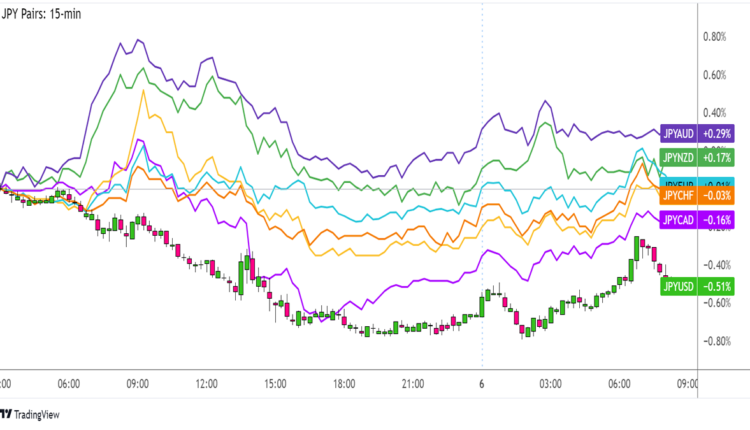

Overlay of JPY Pairs: 15-min

Most major currencies were treading carefully earlier today, with the exception of the Japanese yen that underwent additional volatility thanks to jawboning.

According to Japan’s Vice Finance Minister for International Affairs Kanda, they are watching FX moves closely and that they will not hesitate to step in if needed. The yen popped higher after his statement, although USD/JPY was quick to get back on its feet.

Meanwhile, the Aussie also got a bit of a boost thanks to upbeat Australian GDP and Chinese state efforts to keep the yuan supported.

BOE monetary policy report hearings at 1:15 pm GMT

BOC interest rate decision at 2:00 pm GMT

U.S. ISM services PMI at 2:00 pm GMT

Fed Beige Book at 6:00 pm GMT

New Zealand manufacturing sales q/q at 10:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

CAD/JPY 15-min Forex Chart by TV

This pair is in correction mode, as jawboning remarks from Japan’s top currency diplomat dragged price down to test a short-term rising trend line.

This is right smack in line with the 61.8% Fibonacci retracement level at 107.88 that might be enough to keep losses in check.

If so, CAD/JPY could resume the rally up to the swing high near the 108.50 minor psychological resistance or even test the next upside barriers at R1 (108.73) and R2 (109.18).

Of course this would likely depend on how the BOC decision turns out, as a “hawkish pause” might be needed in order to keep the Loonie supported.

Analysts are already expecting the central bank to keep rates unchanged at 5.00% for the time being, but any strong hints on resuming their tightening cycle soon could sustain the uptrend on CAD/JPY.

On the other hand, a break below the trend line spurred by a “dovish hold” could lead to a reversal from the short-term climb and a test of the nearby support levels at S1 (107.63) and the swing low near the 107.50 minor psychological mark.

Don’t forget to account for the average CAD/JPY volatility when trading this one!

Comments are closed.