BoJ Minutes, US Credit Downgrade Cools Yen Selloff

Japanese Yen (USD/JPY, EUR/JPY) Analysis

- The yen claws back some losses after BoJ minutes and clarity from Deputy Governor Uchida on the intention of recent yield curve adjustment

- USD/JPY heads lower after BoJ meeting and US credit downgrade

- EUR/JPY advance stalls ahead of potential triple top

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free JPY Forecast

Yen Claws Back Some Losses after BoJ Minutes

The minutes of the Bank of Japan’s meeting last Friday provided insight into the thinking behind the decision to adjust its treatment of the cap surrounding the 10-year Japanese Government Bond yield. The committee is now prepared to allow the yield to move above the prior cap of 0.5% but recent revelations indicate that the new cap will be 1% depending on how fast rates rise to get there.

Members expressed the risk of changes to the yield curve being misinterpreted as a move towards tightening. Comments from Deputy Governor of the BoJ Mr Uchida clarified that the recent tool setting was implemented to prolong the current supportive policy in a more sustainable way, instead of signalling the start of policy normalization.

It is not yet conclusive amongst BoJ members that inflation is predominantly being driven by demand side dynamics (increased local spending/consumption, salary increases) as there is still evidence of supply-driven influences. What is conclusive however, is that the committee still maintain the view that accommodative policy is needed to ensure inflation remains sustainably above the 2% price objective.

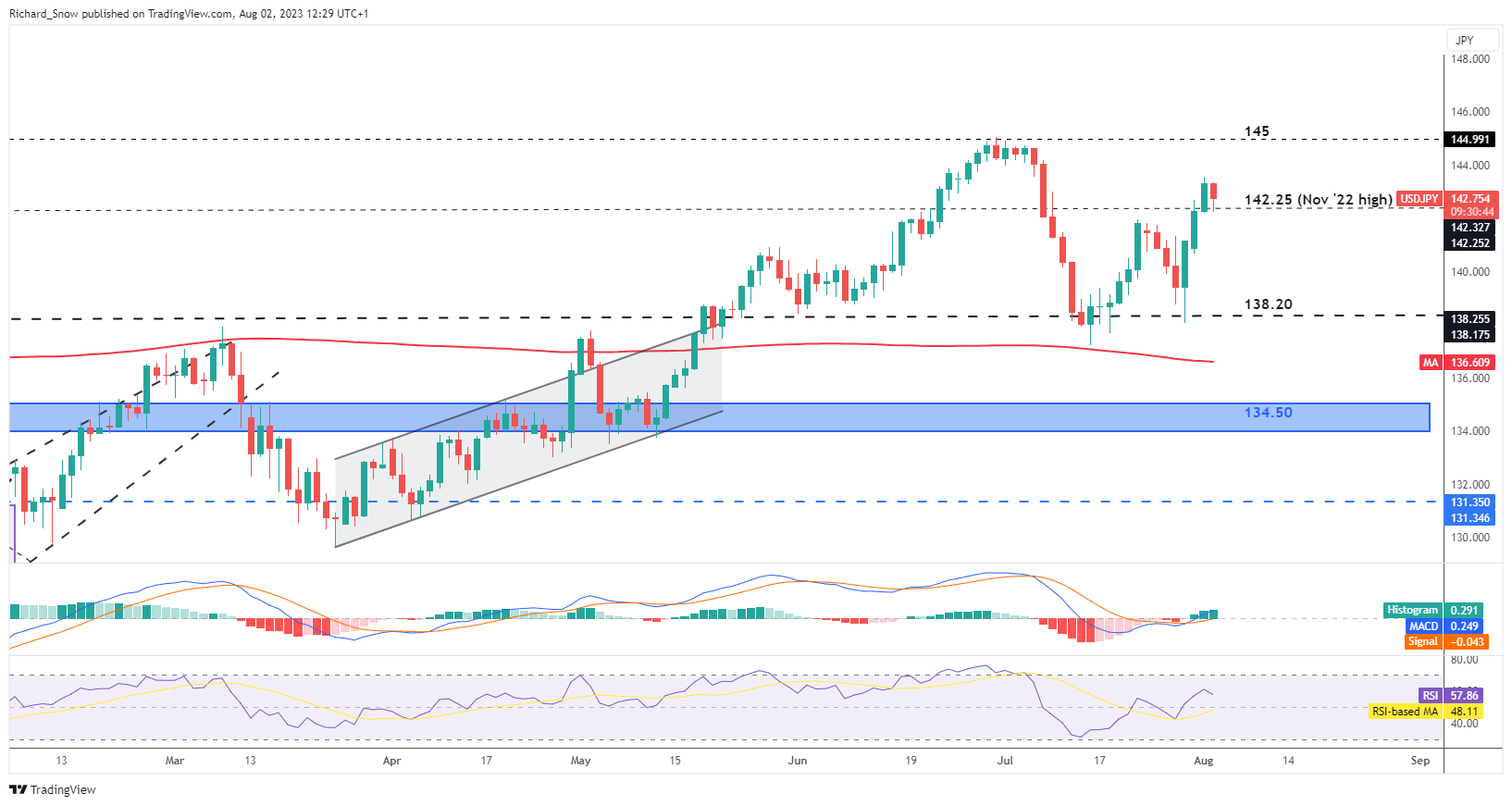

USD/JPY Heads Lower After BoJ meeting and US Credit Downgrade

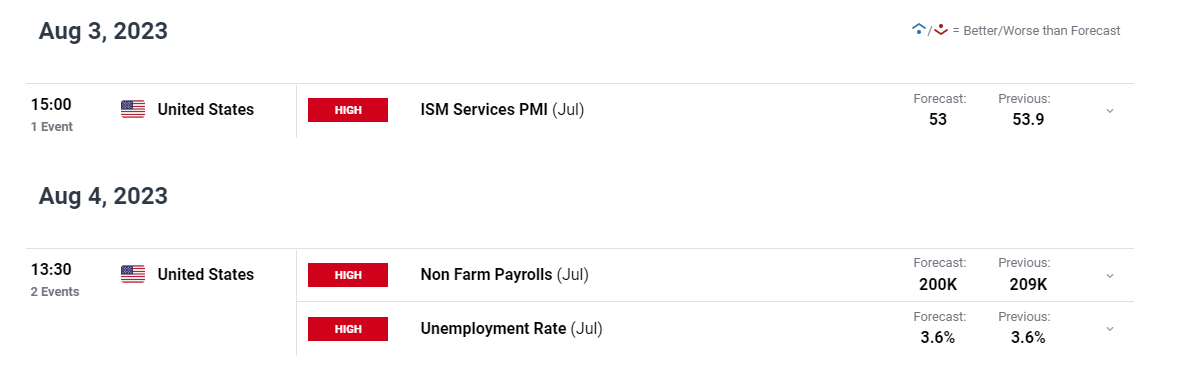

USD/JPY has eased slightly in the wake of the BoJ minutes and Fitch’s US credit downgrade from AAA to AA+ due to fiscal deteriorations expected over the next three years and governance issues that are seen to potentially affect the timely repayment of debt in the future.

The dollar basket (DXY) continues to trade higher but it heavily influenced by a weaker euro. USD/JPY heads lower with immediate support coming in at 142.25, the November 2022 high. Thereafter, it would appear that the pair has ample runway towards 138.20 – the level whether the recent bullish advance began. Should prices respect 142.25 and bullish continuation take over form here, the recent swing high at 145 becomes the next level of interest.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

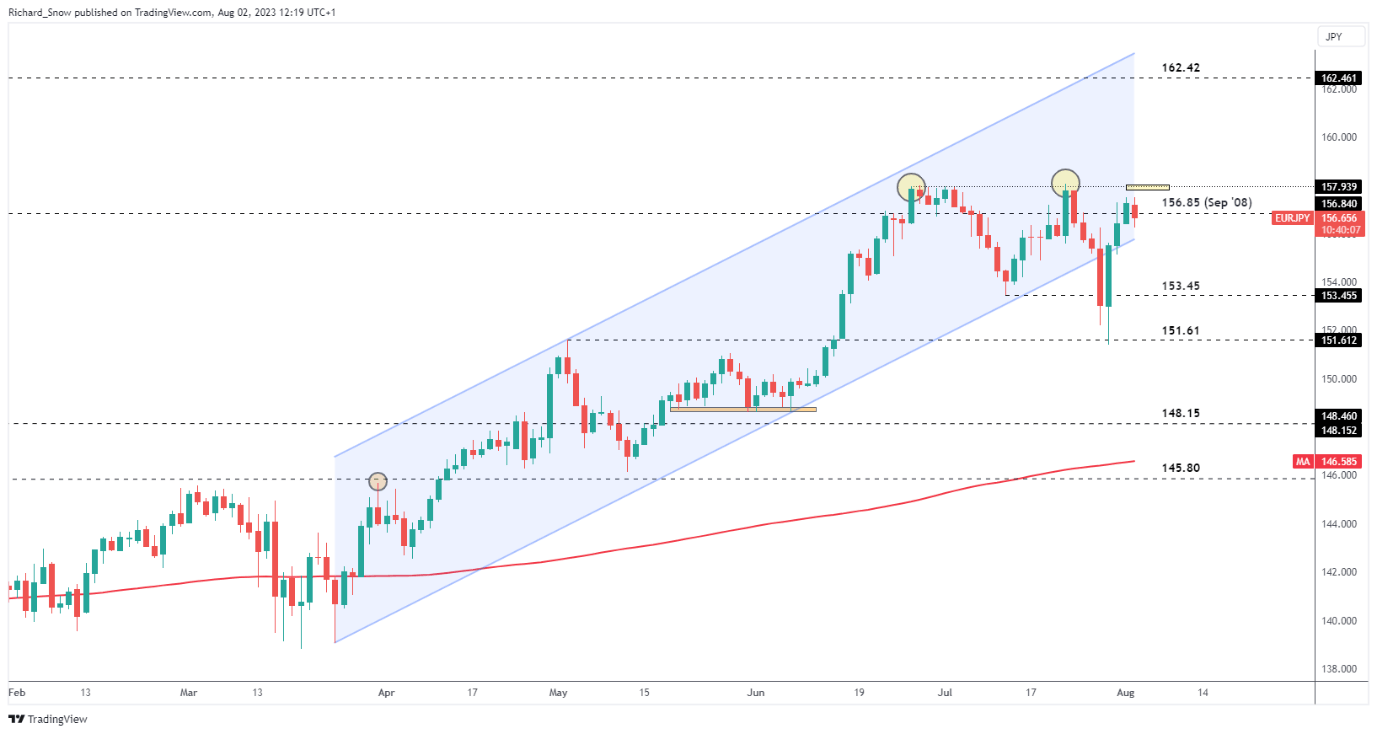

EUR/JPY Advance Stalls Ahead of Potential Triple Top

EUR/JPY has made solid headway after reversing the late July decline to attempt to trade back at the 157.93 level of the observed double top. Today however, the advance has stalled, bringing the 156.85 level of support into focus. A close above keeps the bullish recovery on track but a close below could indicate waning bullish momentum and a potential period of consolidation. Support lies at 153.45.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Trading Forex News: The Strategy

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.