Quiet Start for Gold, Manufacturing PMI in Focus

GOLD OUTLOOK & ANALYSIS

- Upbeat dollar sets the tone for gold prices this Monday morning.

- Gold markets seek guidance from US data as tentative Fed pricing endures.

- $1900 could come under pressure once again.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

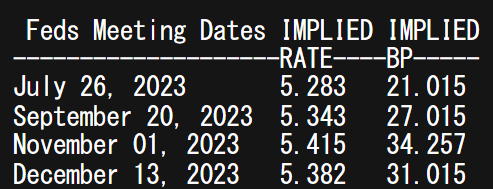

Gold prices open the week relatively flat, marginally lower on the back of a stronger US dollar. Bullion remains at the mercy of US factors as last weeks core PCE deflator narrowly missed estimates. Since then, money market pricing (see table below) for the Fed’s future interest rate’s favors a 25bps hike with roughly 85% probability. There is still a possibility of an additional hike later in the year but at this point, markets are undecided.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

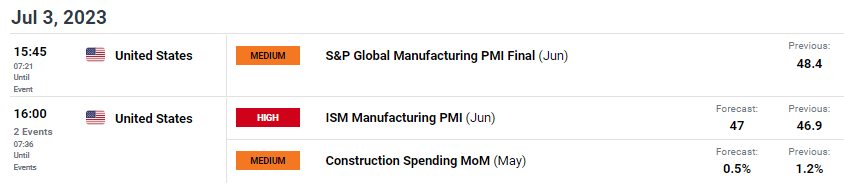

Clarity is needed which brings into focus this weeks economic data including Friday’s Non-Farm Payroll (NFP) report. For today, attention will be firmly set on the US ISM Manufacturing PMI release. Although not as significant as the Non-Manufacturing read (US is primarily a services driven economy), the manufacturing sector has been in contractionary territory since November 2022 and has not shown signs of improvement. Any slight uptick could buoy the greenback ahead of tomorrow’s Independence Day holiday that should keep volatility low before US markets re-open on Wednesday.

GOLD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

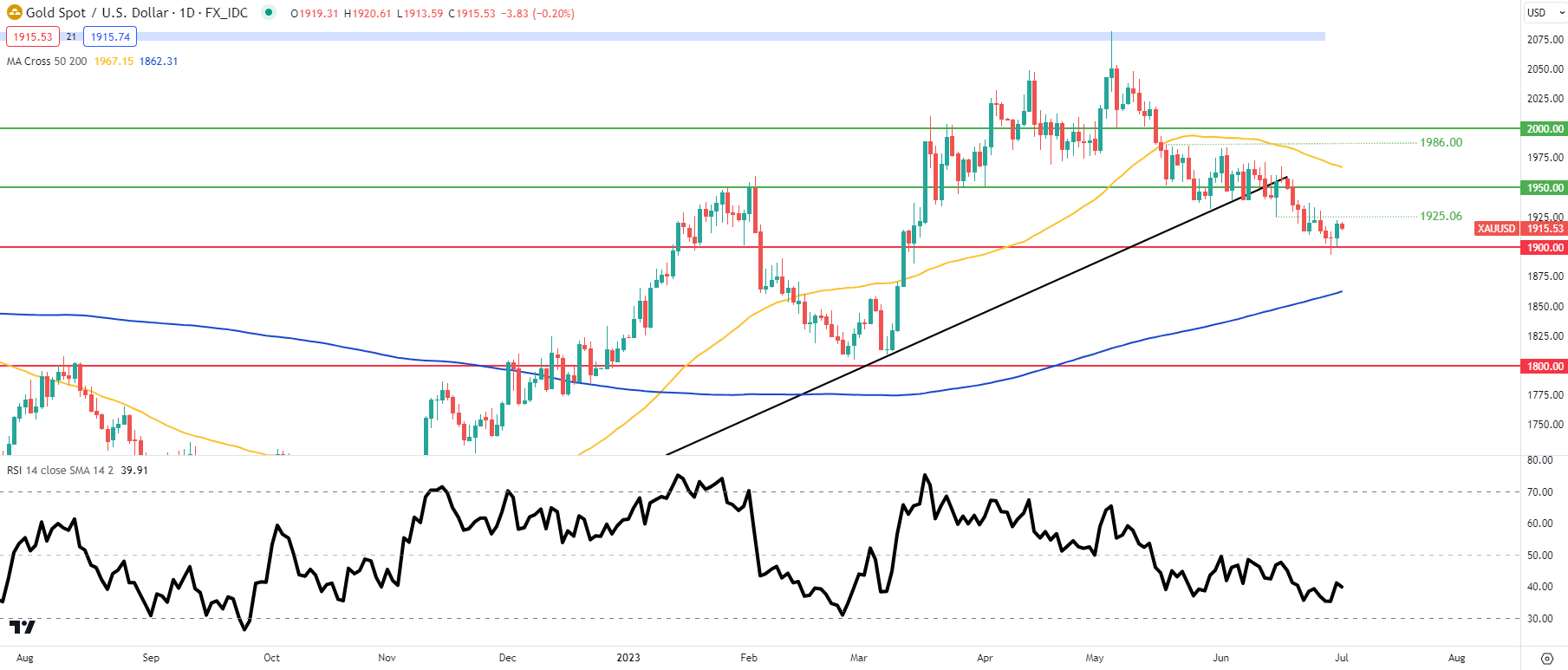

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

XAU/USD price actions shows the 1900.00 psychological support handle holding firm but with a hawkish Fed narrative gaining traction, strong US economic data this week could exacerbate this viewpoint and weigh negatively on gold prices short-term.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently distinctly LONG on gold, with 72% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.