Nasdaq 100, Dow Jones, US Dollar, Gold, Debt Ceiling, NFPs, AI Frenzy

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Global stock market sentiment mostly deteriorated this past week with a few exceptions. On Wall Street the tech-heavy Nasdaq Composite crushed its competition, soaring 2.51% while the blue-chip-oriented Dow Jones sank -1%. Across the Atlantic Ocean, the DAX 40 and FTSE 100 fell -1.79% and -1.67%, respectively. Meanwhile, the Hang Seng Index dropped almost 5%.

The vast majority of gains this past week were driven by tech, amplified by a blowout earnings report from Nvidia Corp. The company underscored AI-fueled demand and projected earnings that were far above expectations, causing the stock to soar over 25% and creating a rippling effect for the tech sector. Marvell Technology’s stock followed a similar path after mentioning 2024 revenues would “at least double” in demand from AI. The stock soared 32%.

A closer look at the stock market shows an uneven distribution of gains. The top 7 companies in the S&P 500 are up about an average of over 40 percent since December. The S&P 500 is up about 10% since then, with the remaining 493 companies up just 1% on average. Meanwhile, economic data has continued to clock in robustly of late.

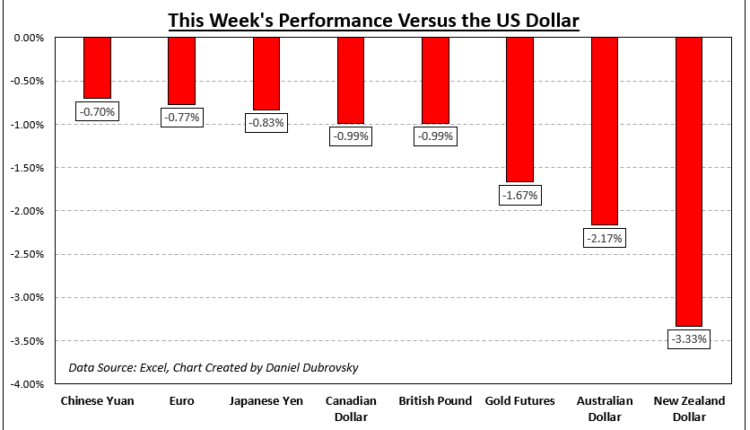

As a result, financial markets have been quickly pricing out rate cuts from the Federal Reserve this year. In fact, another 25 basis point rate hike is priced in for July. The latest PCE core deflator (the Fed’s preferred inflation gauge) surprised higher this past week amidst a still-tight labor market. The US Dollar soared, and gold prices continued to weaken.

Ahead, all eyes turn to a couple of notable event risks. The first is ongoing US debt ceiling talks. The US Treasury highlighted that debt-limit measures will run out by June 5th. Optimism about a deal has been contributing to gains in market sentiment, but for the time being, it seems markets are not fully respecting the monetary policy implications of a deal and robust economic data. That is setting up for volatility risk down the road.

Other notable pieces of data next week include Chinese manufacturing PMI (global growth story), Canadian GDP data for USD/CAD, and Euro Area inflation for EUR/USD. What else is in store for markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – Week of 5/22

Forecasts:

British Pound Week Ahead: UK Rates and US Data Will Drive GBP/USD

The UK government bond market (gilts) is having a torrid time post-inflation data with yields jumping as markets price-in a fresh round of BoE rate hikes.

Australian Dollar Outlook: US Dollar Dominates Proceedings

The UK government bond market (gilts) is having a torrid time post-inflation data with yields jumping as markets price-in a fresh round of BoE rate hikes.

Euro Weekly Forecast: EUR/USD Recovery Hinges on Debt Ceiling Deal

A big week ahead in terms of event risk as Euro eyes a recovery. Euro Area inflation likely to be overshadowed by a potential deal on the debt ceiling. Time for a EUR/USD retracement?

Gold Prices at Risk of Deeper Correction on Surging Real Yields, USD Strength

Gold prices could continue to slide in the near term if real yields and the U.S. dollar extend their rebound on the back of a hawkish repricing of the Fed’s policy outlook.

US Dollar Weekly Outlook: Will US Debt Ceiling Deal and Jobs Report Boost DXY Further?

The US Dollar climbed 3 percent over the past 3 weeks, sustained by economic data that has been pouring cold water on Fed rate cut bets. Ahead, eyes turn to US non-farm payrolls.

S&P 500, Nasdaq Week Ahead: Momentum Surges on Debt Deal Optimism

US equity indices look set to extend gains in the coming week on rising hopes of a deal to raise the US debt ceiling. What are the key levels to watch in the S&P 500 and the Nasdaq 100 index?

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.