Inflation Concerns Weigh on Risk Appetite

FTSE, S&P 500 Analysis

Recommended by Richard Snow

Find out what our analysts foresee in equites in Q2

UK Inflation Remains the Highest in Western Europe

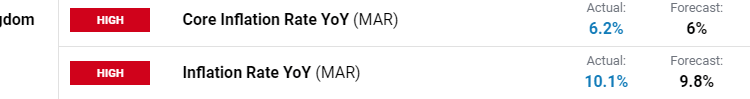

Earlier this morning the Office for National Statistics (ONS) released the March inflation data which signaled more concern despite printing lower than the February data. For in depth coverage of the report refer to the pound sterling market alert. Headline CPI dipped to 10.1% from 10.4% and therefore remains in double digits, motivating markets to almost fully price in a 25 basis point (bps) hike from the Bank of England early next month. Furthermore, markets now anticipate the BoE will raise the policy rate to 5% before year end as they desperately need to bring inflation down towards the 2% target.

Customize and filter live economic data via our DailyFX economic calendar

Elevated Rate Expectations and a Firmer Pound Weighs on the FTSE

The FTSE continues to be a standout performer and has fully recovered from the large declines witnessed around the banking turmoil that unfolded in March. However, after another stubborn CPI print in which core CPI remained at 6.2% and a pickup in pound sterling, the FTSE appears to be showing signs of a bullish pause.

The chart below reveals a level of resistance around the prior all-time high of 7912 where price action has halted for the last two days and appears on track for a third after the inflation data sent the FTSE lower.

While the current pause consolidates around 7912 for the time being, a bullish continuation would naturally bring the new all-time high into focus at 8044.Given past performance of the index, the possibility of a pullback may be considered should prices close below the February swing low of 7850.

FTSE 100 Index Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

S&P 500 Points to a Lower Open Ahead of Tesla Earnings

With core inflation in the US edging up despite the impressive decline in headline CPI, markets are revising the likelihood of the ‘higher for longer’ scenario from the Fed which appears to have capped a move higher in the S&P 500.

The extended upper wicks over the last few trading sessions above the zone of resistance indicate that bulls may be running out of momentum at such elevated levels. The Jan/Feb swing high found resistance at the same zone of resistance before declining, adding credibility to the zone.

Look out for any forward guidance from Tesla on the state of the global economy or insights on global demand as the electric car maker reports on its earnings for the first three months of the fiscal year.

On the bearish side, a move towards 4110 could spark a pullback and of course the major level of 4000 resurfaces as support if mega-cap earnings disappoint.

S&P 500 E-Mini Futures Daily Chart

Source: TradingView, prepared by Richard Snow

Risk Events Ahead

This week sees the end of the major US bank earnings combined with the start of the mega-cap tech stocks Q1 releases. With a large majority of index performance dependent on the heavyweights, look out for Tesla earnings after market close this evening.

Later today Fed Governors Christopher Waller and Michelle Bowman (hawks) are due to speak around 17:00 and 20:00 respectively as the countdown to the media blackout period starting on Saturday gets underway.

Recent comments by non-voting member of the Fed and ultra-hawk, James Bullard, were ineffective in leading the dollar higher but what did influence the greenback was the NY Empire State Manufacturing Index, surprisingly. Higher USD and interest rate expectations tend to weigh on the index.

Manufacturing has lagged the bigger, more important services sector and the return to expansionary territory for the index added to the ‘higher for longer’ scenario regarding the Fed funds rate.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.