Daily Forex News and Watchlist: USD/CAD

Canada’s labor market numbers are due so you know we gotta take a look at at least one CAD pair!

Have you seen USD/CAD’s short-term support zone?

Before moving on, ICYMI, yesterday’s watchlist looked at NZD/USD’s uptrend pullback after the RBNZ’s 50bps rate hike. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

In another sign that the economy is slowing, the ADP report showed private sector hiring decelerating in March. Payrolls rose by just 145K against February’s 261K uptick and the expected 210K reading.

The U.S. goods and services trade deficit expanded from $68.7B to $70.5B in February, its widest in four months, as exports (-2.7%) decreased more than imports (-1.5%).

ISM’s survey showed the U.S. services sector decelerating more than expected in March, falling to 51.2 vs. February’s 55.1 reading and the estimated 54.3 print. A measure of prices paid by service providers also fell to its lowest in three years, which is good for the Fed’s fight against inflation.

Canada’s trade surplus narrowed sharply from 1.20B CAD in January to 422M CAD in February as both exports (-2.4% m/m) and imports (-1.3%) declined. January’s surplus was also revised way lower from its 1.92B CAD initial reading.

Cleveland Fed President Loretta Mester says rates still need to go “somewhat” higher to drag inflation to 2%, with the Fed funds rate moving above 5% and the real Fed funds rate “staying in positive territory for some time.”

Strong export and refining demand dragged the U.S. crude oil stockpiles down by 3.7 million barrels vs. the expected 2.3 million-barrel drop in the week to March 31.

RBA’s quarterly review recognized increased global stability risks and high interest rates putting pressure on household budgets

Australia’s trade surplus widened from 11.27B AUD to 13.87B AUD in February as imports (-9.1.%) fell faster than exports (-2.9%)

A jump in new orders and job creation pushed China’s Caixin services PMI from 55.0 to a 2.5-year high of 57.8 in March.

Germany’s industrial production rose by more than expected, up by 2.0% m/m in February when analysts only saw a 0.1% increase.

Switzerland’s unemployment rate ticked lower from 2.1% to 2.0% in March, its lowest reading since November.

Price Action News

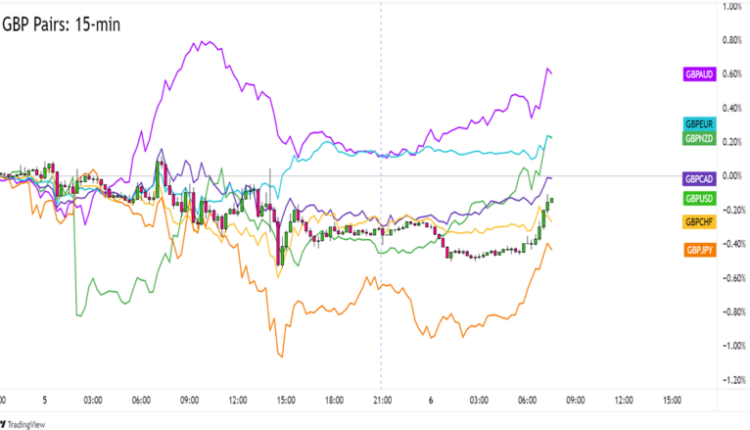

Overlay of GBP Pairs 15-min

The British pound started the day near its U.S. session ranges but the arrival of Asian session traders saw GBP slightly lower against safe-havens like USD, JPY, and CHF.

GPB continued to gain against other “risky” currencies though, probably because the Bank of England (BOE) remains hawkish while central banks like the RBA are thinking of pausing their tightening programs.

Demand for GBP picked up at the start of European session trading despite a lack of direct catalysts. Focus will likely be on the U.S. high and lower-tier releases which can highlight recession risks in the U.S. (and the rest of the world.)

Upcoming Potential Catalysts on the Economic Calendar:

U.K.’s construction PMI at 8:30 am GMT

Challenger job cuts at 7:30 am GMT

U.S. initial jobless claims at 8:30 am GMT

Canada’s labor market data at 8:30 am GMT

Canada’s IVEY PMI at 2:00 pm GMT

Japan’s household spending and average cash earnings at 11:30 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/CAD 15-min Forex Chart by TradingView

A scheduled labor market report from Canada got me taking a closer look at USD/CAD!

The pair started the day with a sharp upswing until USD bears showed up just under the 1.3490 level near the R1 of today’s Standard Pivot Points.

USD/CAD is now back at 1.3460, which is almost at the pivot point level and the bottom of an ascending channel that’s been around all week.

Look out for Canada’s employment numbers. Weaker-than-expected readings would give the Bank of Canada (BOC) extra confidence to ease the pedal from the metal on their tightening.

On the other side of the trade, the U.S. is printing its initial jobless claims data.

If the weekly report supports the weak labor market picture that other leading indicators had painted, then global growth concerns could extend USD/CAD’s uptrend to new weekly highs.

Comments are closed.