Daily Forex News and Watchlist: NZD/USD

The RBNZ surprised the markets with a larger rate hike today!

Can this be enough to sustain the climb on NZD/USD?

Before moving on, ICYMI, yesterday’s watchlist checked out a trend pullback on AUD/JPY after a downbeat RBA announcement. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. JOLTS job openings slowed from downgraded 10.56 million in January to 9.93 million in February, its lowest level since 2021, suggesting labor market slowdown

U.S. factory orders slipped 0.7% m/m in February vs. projected 0.4% dip, January reading downgraded from a 1.6% slump to a sharper 2.1% decline

Fed official Mester acknowledges that steps central bank took to stabilize banks appear to have been effective and that rates need to be raised above 5%

New Zealand dairy prices tumbled 4.7% in latest GDT auction, following earlier 2.6% drop

RBNZ hiked interest rates by 0.50% from 4.75% to 5.25% vs. estimated increase to 5.00% to ensure that core inflation expectations begin to moderate

RBNZ head Orr hints that tightening moves are not yet over, as central bank aims to bring inflation to 1-3% target range while banking sector remains well-capitalized

BOJ increased outright purchase offer for 10-year to 25-year JGBs from 200 billion JPY to 250 billion JPY

German factory orders surged by 4.8% m/m vs. projected 0.2% uptick and previous 0.5% gain, marking its third consecutive monthly gain

French industrial production rebounded by 1.4% m/m after previous 1.2% slump vs. estimates of a 0.5% uptick

Price Action News

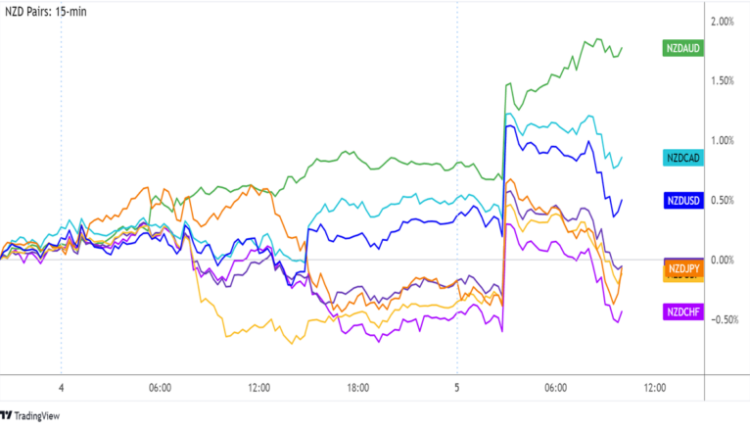

Overlay of NZD Pairs 15-min

After consolidating against its forex counterparts in the previous trading day, the Kiwi popped sharply higher when the RBNZ decision took place.

That’s because the central bank decided to stick to its hawkish stance and hike interest rates by 0.50% instead of the estimated 0.25% increase, citing the need to tame inflation and reassuring that New Zealand’s banks aren’t in trouble.

Governor Orr even mentioned that they plan to keep tightening until they can bring inflation back within their target range, as policymakers noted that price pressures remain skewed to the upside.

However, the Kiwi gave back some of its gains towards the end of the session, particularly against the yen and franc.

Upcoming Potential Catalysts on the Economic Calendar:

U.S. ADP non-farm employment change at 12:15 pm GMT

U.S. ISM services PMI at 1:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

NZD/USD 15-min Forex Chart by TradingView

Even after that post-RBNZ pullback, NZD/USD remains above its short-term rising trend line visible on the 15-minute time frame.

This happens to be right around an area of interest just past .6300 and the previous day highs, making it a pretty strong support zone.

We’ve got a couple of data points coming up from Uncle Sam and, judging by the reaction to the latest JOLTS job openings release, it seems that dollar traders are paying extra close attention to labor market figures.

Now the ADP report is slated to show a bit of a slowdown in hiring for March, which would dampen expectations for the official NFP release on Friday.

A decline in the ISM services PMI‘s jobs component could add to downbeat expectations for the U.S. jobs report, underscoring the view that a jobs slowdown is taking place.

With that, this pair might be in for a pop higher to the nearby resistance levels such as R3 (.6370) of the Standard Pivot Points near the swing high.

Just stay on the lookout for any upside surprises in U.S. employment data since this could counteract the bleak outlook from earlier in the week, possibly leading to more gains for the Greenback and an uptrend reversal for NZD/USD.

Comments are closed.