EUR/USD Doesn’t Look Ripe for a Break Above 1.10 Ahead of H.8 Data

US Dollar, Euro, EUR/USD – Outlook:

- Upside in EUR/USD could be capped ahead of US H.8 data.

- Downside in EUR/USD could be contained amid expectations of ECB rate hikes.

- What are the key signposts to watch?

Recommended by Manish Jaradi

How to Trade EUR/USD

The break last week above an important resistance has boosted hopes of a fresh leg higher in EUR/USD. However, it may be premature to conclude an unambiguously bullish view just yet.

Both the European Central Bank and the US Federal Reserve delivered the widely expected rate hikes this month with a dovish tilt, with both central banks underscoring a data-dependent approach going forward. However, financial markets are pricing in roughly two more rate hikes by the ECB by September, compared with no more rate hikes by the Fed on the view that tightened US financial conditions via reduced credit availability would compensate for rate hikes.

Whether the impact of the tightening of lending standards is large or small (hence overcompensates or under compensates for rate hikes) would be important for the dollar’s trend. If the actual tightening from lending conditions isn’t as large as some expect, the US dollar could benefit as the focus would shift back to Fed rate hikes.

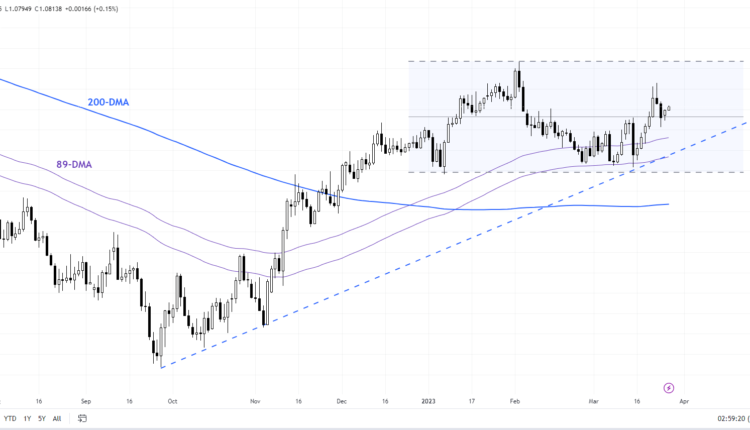

EUR/USD Daily Chart

Chart Created Using TradingView

In this regard, the Fed’s H.8 banking data, an estimate of the weekly aggregate balance sheet of the US banking system, due on Friday will be closely watched. Analysts note the H.8 data released last Friday showed a significant shift in deposits from small banks to large banks, as well as the first outright decline in small banks’ deposits in nearly four decades. Any signs that liquidity strains have been contained could support USD.

Furthermore, the relative macro data is USD supportive: the US Economic Surprise Index continues to run around a 10-month high. In comparison, Euro area data have been less upbeat – the Economic Surprise Index is still in positive territory but retreated since the beginning of February.

EUR/USD Weekly Chart

Chart Created Using TradingView

On technical charts, EUR/USD’s rebound from near-strong support at the January low of 1.0480, coinciding with the 89-day moving average confirms that the broader trend remains up (a break below would have disrupted the higher-top-higher-bottom pattern since September). The subsequent break above the hurdle at the mid-March high of 1.0800 confirms that the immediate downward pressure has reduced.

However, the resistance break wasn’t accompanied by strong momentum, suggesting that EUR/USD could find it tough to break above the early February high of 1.1035. At the same time, prospects of additional ECB tightening could cushion the euro’s downside. In sum, there is a chance that the pair could hover in a 1.0500-1.1000 in the near term.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.