Pullback continues as global banking crisis fears ease, yields rise, India demand lessens

- Gold price pullback picks up pace after news First Citizens Bank has taken over SVB.

- US Treasury yields rise and reduced demand from India add downside pressure for Gold price.

- Gold remains in an uptrend as long as price stays above $1,934.

XAU/USD trades lower in the $1,950s at the time of writing as easing bank stress have lessened Gold’s safe-haven appeal. Rising US Treasury bond yields, a robust US Dollar and reports of falling demand from India – one of Gold's chief markets – are further depressing prices.

News of Silicon Valley Bank takeover soothes markets

The news that First Citizens Bancshares Inc, the holding company of North-Carolina based First Citizens Bank, has bought defunct lender Silicon Valley Bank (SVB) has brought some temporary relief to markets on Monday, March 27, lessening demand for safe-haven Gold.

First Citizens has taken over all of SVB’s $119B deposits and loans, and has bought $72B of its assets, at a $16.5B discount, a press release from the FDIC said.

The deal limits the damage from SVB’s failure but does not eradicate it: the bank’s collapse is still thought to have cost the FDIC $20B.

Rise in yields a headwind

The reduction in global banking fears brought about by the SVB takeover has translated into a rise in US Treasury bond yields, which has supported the US Dollar (USD) – both are seen as negative headwinds for Gold price.

All across the US yield curve bonds of different maturities have gained. The benchmark 10-year US Treasury bond yield is rising 2.49% to 3.462 at the time of writing. The 5-year has seen the greatest rise, however, up 3.45% to 3.53 on the day. Higher yields suggest a greater opportunity cost for holding Gold, which yields nothing, making it a less attractive asset to investors.

The fact that US Treasury yields are rising suggests that the market now thinks the Fed will continue raising rates to combat inflation at the more aggressive pace it was raising them prior to the banking crisis.

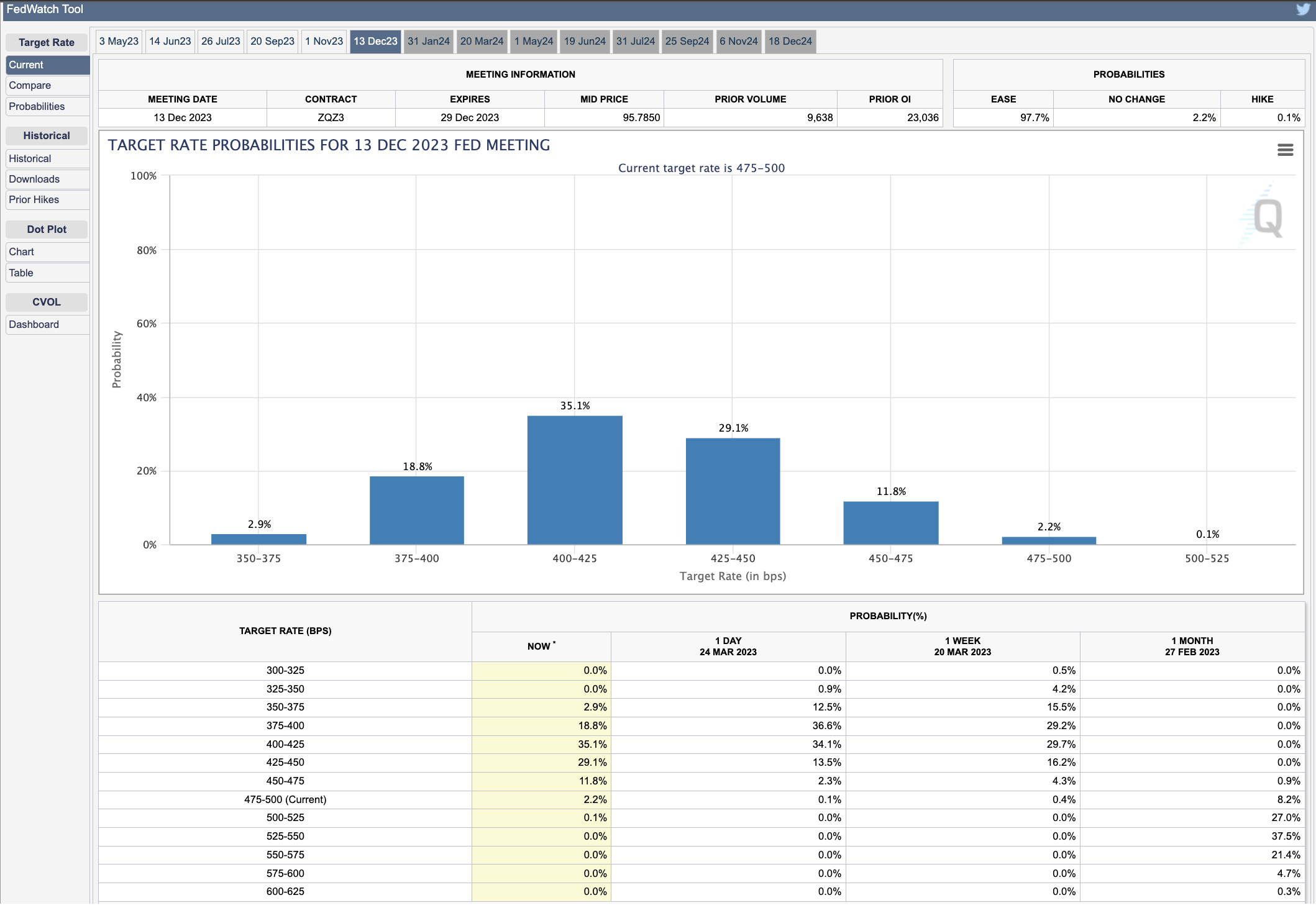

As a counterweight to this view, however, the Fed Fund Futures curve is pricing in an alternative scenario of three interest rate cuts, by the Fed before the end of the year. This can be seen on the CME FedWatch Tool chart below, which uses Fed Funds Futures to assess the probabilities of the Fed making changes to its Fed Funds rate at future meetings.

The chart shows the probabilities of what the future Fed Funds rate might be after the December 13 2023 meeting. The range with the current highest probability of 35.1% is between 4.00-4.25%, which suggests the Fed will cut rates by 0.75% from its current range of 4.75-5.00% before the end of the year – the equivalent to three 25 basis points cuts.

India stops buying Gold

Reports that demeand from buyers in India has fallen may have further weighed on prices. The spike in Gold prices because of of the banking crisis pushed price to a bitting point above which Indian Gold traders are not willing to pay.

“A rally in gold prices to an all-time high in India is deterring local buyers in the runup to what is normally a key demand period next month, according to the World Gold Council,” said the Bloomberg report.

“If prices steady around current levels, demand may return for the key buying day of Akshaya Tritiya in April, but continued volatility will force people to stay away,” said P.R. Somasundaram, regional Chief Executive officer for India at the London-based council, in the Bloomberg Television interview.

Gold price uptrend intact until $1,934 breached

Gold price remains in an uptrend on a short to medium-term basis, as it makes higher highs and lows on the daily chart. A break below the key lower low at $1,934, however, would bring into doubt the uptrend and paint a much more bearish picture for Gold price. As long as the level holds, however, the trend remains bullish and likely to resume.

-638155123938258026.png)

Gold price: Daily Chart

The next upside target for Gold price lies at the $2,070 March 2022 highs. A break and close above the $2,009 highs of March 20 when markets went into panic mode due to Credit Suisse’s failure, however, is a necessary prerequisite for confirming a move higher.

A break below the key $1,934 level, however, would probably lead to a steeper deline to a target at around $1,888, where the 50-day SMA lies, on a conservative basis.

The Average Directional Index (ADX) indicator, which measures the strength of a trend, however, is giving a 34 reading which suggests the uptrend is robust. 34 is also in a sweet spot – if it was much higher, say above 45, it might indicate a market top, or overbought state. Meanwhile, if ADX was below 20 it might indicate Gold is in a sideways market.

Comments are closed.