XAU/USD Under Pressure From Raging Dollar

GOLD OUTLOOK & ANALYSIS

- US inflation weighs negatively on spot gold prompted a more aggressive Federal reserve.

- US economic data the focus for next week.

- More room for XAU/USD downside but approaching oversold territory.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

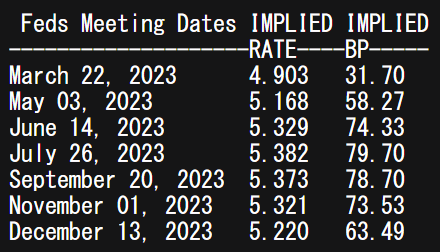

Gold prices continue to be decimated by a rallying USD after US core PCE data left XAU/USD floundering. Inflation and more specifically core inflation has been plaguing gold prices of recent due to a hawkish repricing of Fed rate hikes which now stand at a 5.382% peak rate in 2023. “Sticky” inflation has been raising the probability of a 50bps increment for March; however, consensus remains at 25bps for now (see table below).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

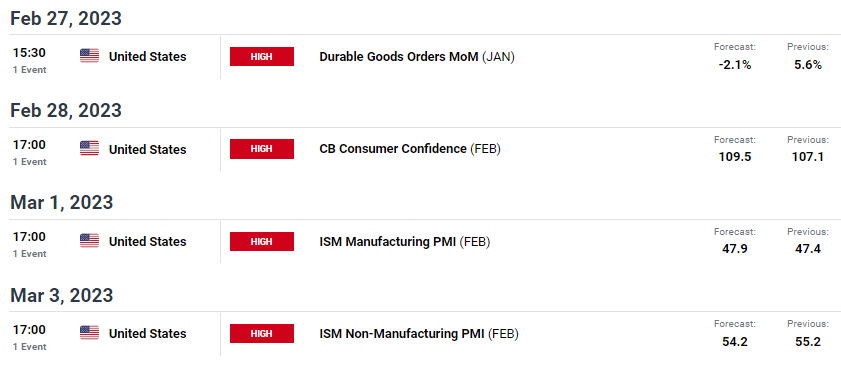

The week ahead looks to be skewed towards USD downside via the durable goods orders and ISM services PMI data which are expected to come in lower than the prior release. Durable goods which popped higher on the back of Boeing orders in December are naturally anticipated to fall while the ISM non-manufacturing PMI for February is expected to follow a similar trend. The services read carries more weigh in the US over the manufacturing statistic as the US is primarily a services driven economy.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

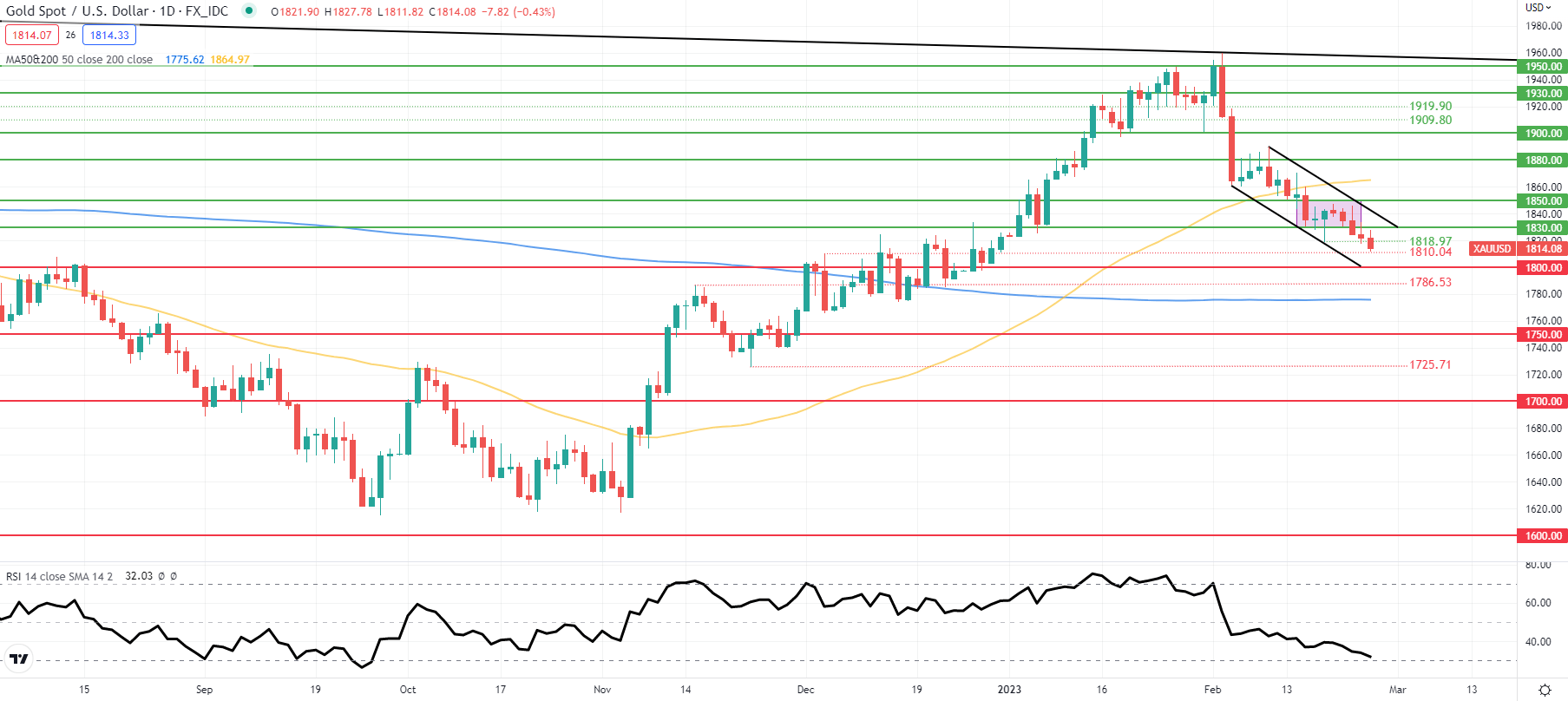

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action continued to trade within the short-term descending channel (black) looking towards the 1800.00 psychological support handle. A move lower could push the Relative Strength Index (RSI) into oversold territory but may see bulls defend around this zone as the dollar rally seems to be losing steam. Higher for longer seems to be baked into market pricing now which does not leave much room for an extended and sustained dollar move unless US data continues to surprise to the upside.

Resistance levels:

- 1830.00/Descending channel resistance

- 1818.97

Support levels:

- 1810.04

- 1800.00

- Descending channel support

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 76% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.