XAU/USD Tentative Awaiting Fundamental Catalyst

GOLD OUTLOOK & ANALYSIS

- Hawkish Fed remains a strong theme going into next week.

- US economic data in focus including FOMC minutes, GDP,PCE and consumer sentiment reports.

- Long lower wick may indicate short-term upside but strong US data may leave gold vulnerable to further weakness.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

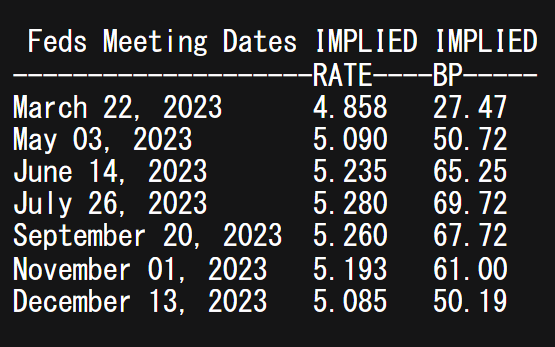

Gold prices recovered some of its losses towards the end of last week. Although the change was minor, bullion remains in a strong downtrend. Much of gold’s volatility has been driven by US factors, particularly a more aggressive Federal Reserve after stronger than expected economic data (Non-Farm Payroll (NFP), CPI and retail sales). A host of Fed officials have subsequently echoed the need for a sustained tight monetary policy environment with some even projecting the possibility of a 50bps interest rate hike in March. While this is unlikely with money markets favoring a 25bps increment (see table below), additional data reinforcing a strong US economy could heighten the hawkish rhetoric moving forward.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

Looking at the week ahead, the FOMC minutes will kick-off the week in terms of high impact economic data whereby details around the decision to hike by 25bps in the previous meeting should show some preference towards 50bps by some committee members. This will be followed by US GDP, core PCE and consumer sentiment. Core PCE will be given much of the spotlight being the Fed’s preferred measure of inflation and should this reading follow on from the CPI report, there could be further upside for the USD, leaving gold exposed on the downside.

Recommended by Warren Venketas

Get Your Free USD Forecast

Other noteworthy risk events stem from US housing data and PMI statistics, both of which are expected to improve once again acting as a brace for the greenback. Scattered throughout the week, Fed speakers are once again featured and could use any positivity around data to expand on their current stance to do more to soften inflationary pressures.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action shows a long lower wick from Friday’s close which can indicate subsequent upside to come; however, this may be too soon to call considering the pressure coming from a strong US dollar. Next week will ebb and flow according to the economic data guidance and while there is room for some gold strength, the longer-term trend remains in favor of the downside. Should we see a daily close below the 1830.00 psychological support handle, a move towards the 200-day SMA (blue) could be on the cards.

Resistance levels:

Support levels:

- 1830.00

- 1818.97

- 1810.04

- 1800.00

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently distinctly LONG on gold, with 69% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.