XAU/USD Rebounds Ahead of Key US NFP Report

Gold Price (XAU/USD) Talking Points:

- Gold prices rebound as Dollar strength subsides

- XAU/USD heads toward the 20-day MA (moving average) holding as resistance at $1,844.

- US NFP (non-farm payrolls) report in focus as Fed remains ‘data dependent’.

Recommended by Tammy Da Costa

Get Your Free Gold Forecast

Gold Prices Recover Ahead of US NFP Job Report

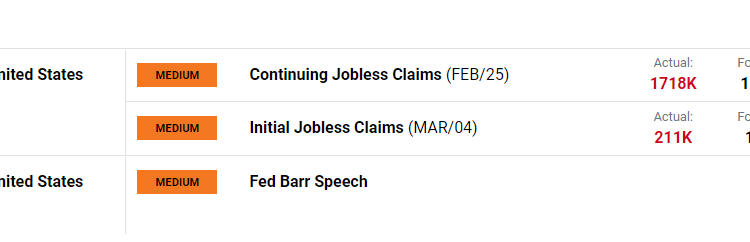

Gold prices are trading higher on the back of a softer Dollar and an uptick in US jobless claims.

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

As markets continue to digest Fed Chair Jerome Powell’s testimony, a slightly less hawkish second day of the two-day address, assisted in limiting further declines. After hinting at a higher than anticipated 50-basis point rate hike at the March FOMC, XAU/USD fell sharply on Tuesday, before stabilizing in yesterday’s session.

With a break of the 20-day MA (moving average) fueling the initial decline, prices continued to fall before reaching a low of $1,813. While the probability of higher rates has weighed on precious metals, an increase in jobless claims has placed the US NFP report at the forefront of risk sentiment.

While prices rise back above the $1,830 handle, the repricing of rate expectations and lower yields could see prices rise further, pushing gold futures toward $1,860.

Gold (XAU/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

On the contrary, if the job report highlights comes in higher than anticipated, prices may continue to falter, driving prices back toward $1,800.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Comments are closed.