XAU/USD Reacts to Real Yield Sensitivity

GOLD ANALYSIS & TALKING POINTS

- Fed hiking cycle revisions allow for decline in real yields as Fed speakers display mixed views.

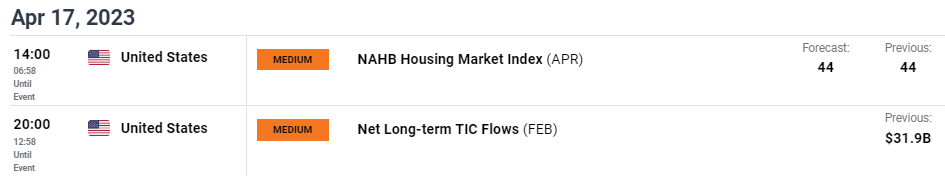

- Quite week for US economic data with attention on NAHB housing market index report today.

- Bearish divergence still in play but no sign of pullback just yet.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

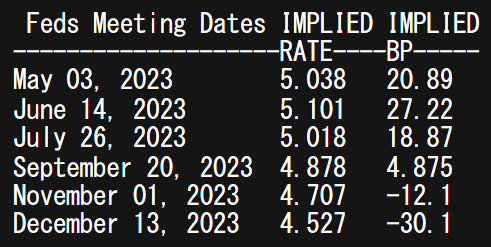

Gold prices continue to grind higher this Monday morning after a reassessment of the Federal Reserve’s interest rate hike cycle. Last week saw mixed messaging from Fed speakers with some opting for continued tightening while others erred on the side of caution. Current money market pricing (refer to table below) suggests another 25bps hike in the May meeting but may reduce the probability for another hike in June as concerns around a global slowdown and added pressure on banking systems gain traction – playing into gold’s safe-haven appeal.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

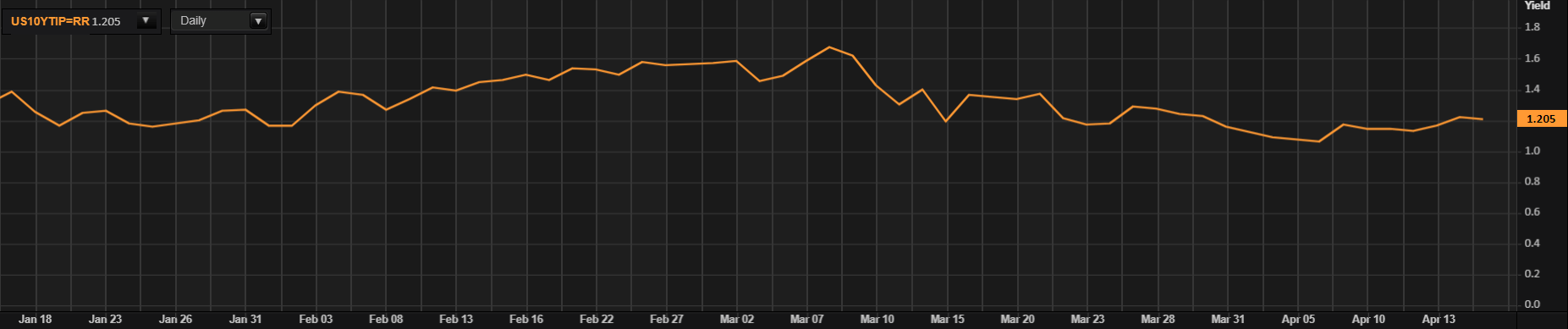

Recent US economic data including headline inflation, PPI and retail sales have compounded a dovish repricing of the Fed’s rate path resulting in a slight decline in real yields (see graph below). Bullion historically keeps an inverse relationship with real yields this correlation seems to be maintaining its bond giving spot gold a lift as lower real yields reduce the opportunity cost of holding gold. Looking ahead, real yields may extend the move lower as the Fed approaches its peak rate for 2023 thus weighing on the US dollar and supporting gold. I don’t expect this to be a linear move with gold likely correcting lower (see technical analysis below) with key resistance coming from the August 2020 high – March 2022 high resistance zone.

U.S. 10-YEAR TIPS – REAL INTEREST RATE

Source: Refinitiv

The economic calendar from a US standpoint is relatively light today and the rest of the week as US earnings take hold. The NAHB housing market index for April will be in focus today after making a turnaround in December last year. Expectations are to remain in line with the March print at 44 but remains below the midpoint 50 threshold that separates optimism from pessimism in the housing market as high interest rates make for tough conditions.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

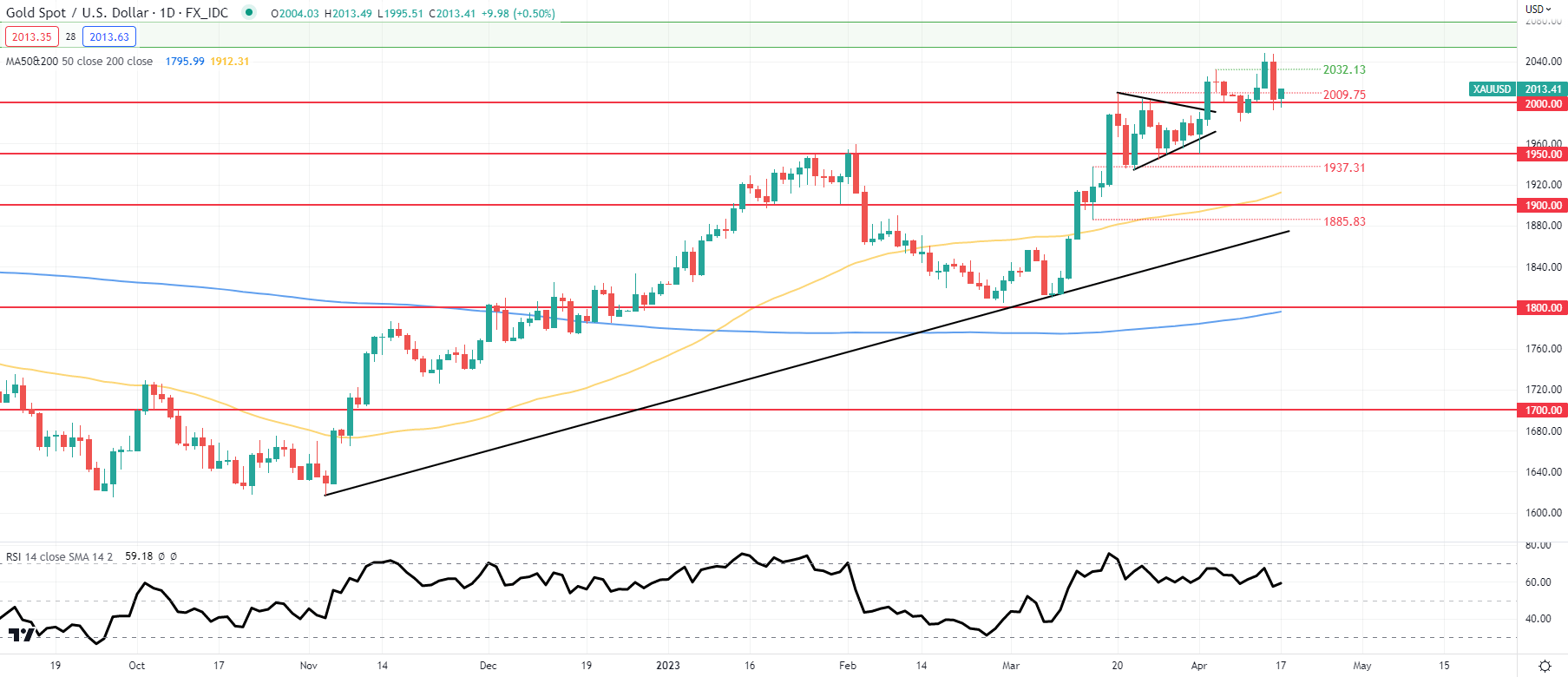

TECHNICAL ANALYSIS

XAU/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action has been flirting with opposing trends between price and the Relative Strength Index (RSI) reading known as bearish/negative divergence. While this phenomenon points looming downside, the timing can be ambiguous in most cases. That being said, I do believe there will be a correction in due course in line with mean reversion before another move higher.

Resistance levels:

- 2050.00 – 2080.00

- 2032.13

Support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently distinctly LONG on gold, with 60% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short position we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.