XAU/USD Faces Busy US Focused Trading Day

GOLD OUTLOOK & ANALYSIS

- US retail sales, Fed speak and US debt ceiling updates under the spotlight today.

- Implied Fed funds futures remain skewed to the dovish-side.

- Technical analysis mirrors ambiguity in macro environment.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold prices remained relatively rangebound once again this Tuesday as markets anticipate the upcoming US debt ceiling meeting. Yesterday’s Fed officials revealed mixed views from maintaining aggressive monetary policy to becoming more vigilant and holding interest rates at current levels. Traditionally, Fed guidance has been highly respected by financial markets but of recent, this has dwindled and I believe incoming data will carry more weight for the USD and gold respectively. That being said, today holds yet more Fed speakers (see economic calendar below) throughout the trading day where we will see whether the majority favors another hike or not.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

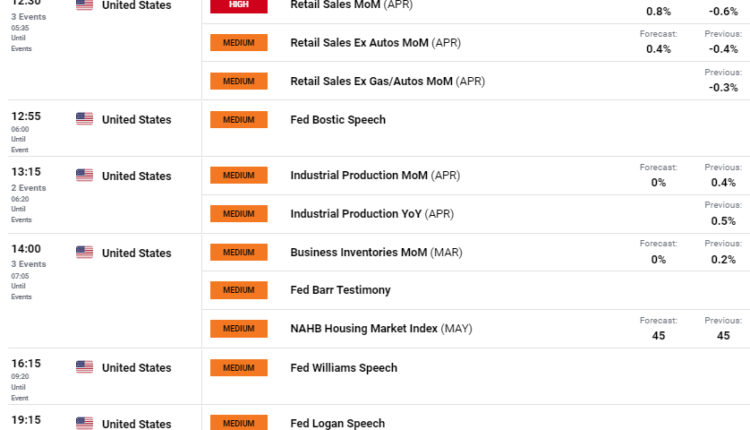

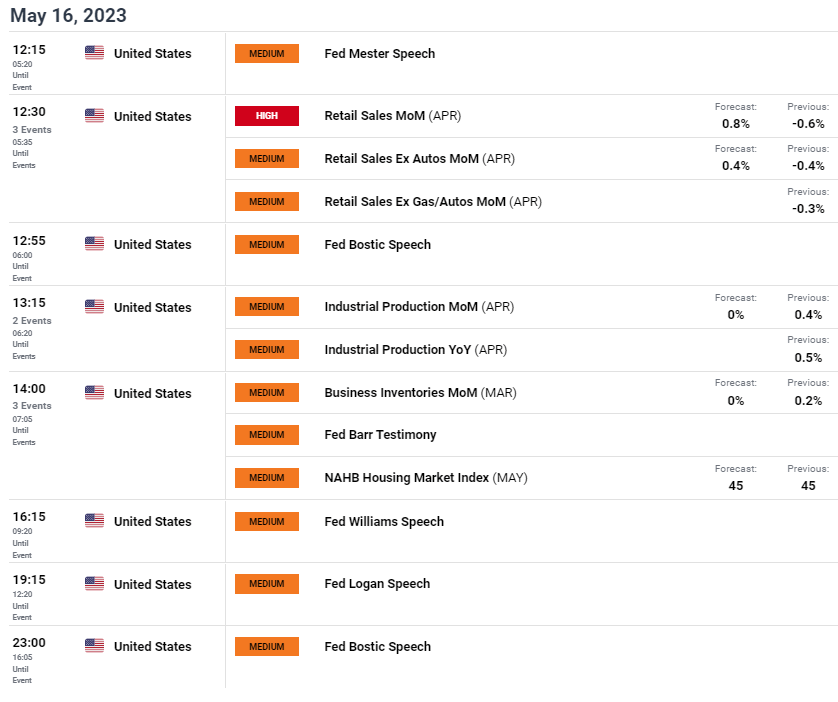

Retail sales data dominates the calendar as the only high impact event scheduled and is expected to come in higher than the March print leaving gold exposed to further downside.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

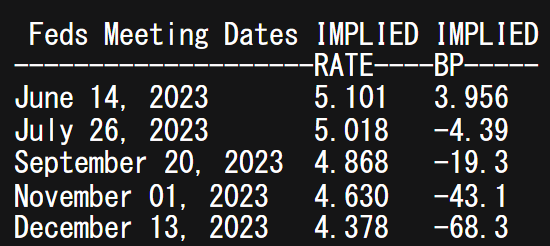

Money markets are expecting roughly 68bps of rate cuts by year end which I believe may be premature at this point. More data is needed and there is a high chance that this pricing may be revised (lesser rate cuts) and could weigh negatively on bullion.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

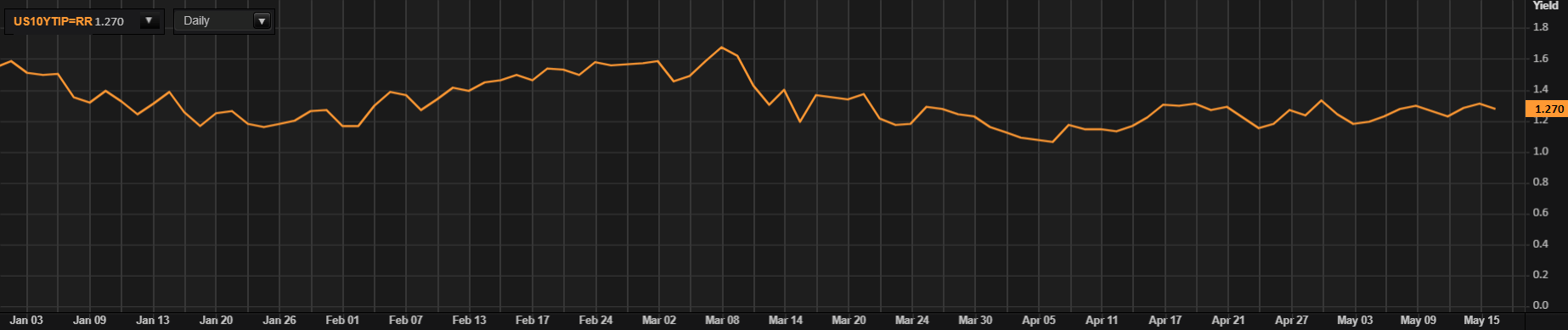

Real yields (refer to graph below) are reflective of a more cautious market and with so much uncertainty from a macro perspective, markets require direction before we see a convincing move. Real yields are highly correlated to gold prices as a higher real yield increases the opportunity cost of holding the yellow metal and vice versa.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US 10-YEAR REAL YIELDS

Source: Refinitiv

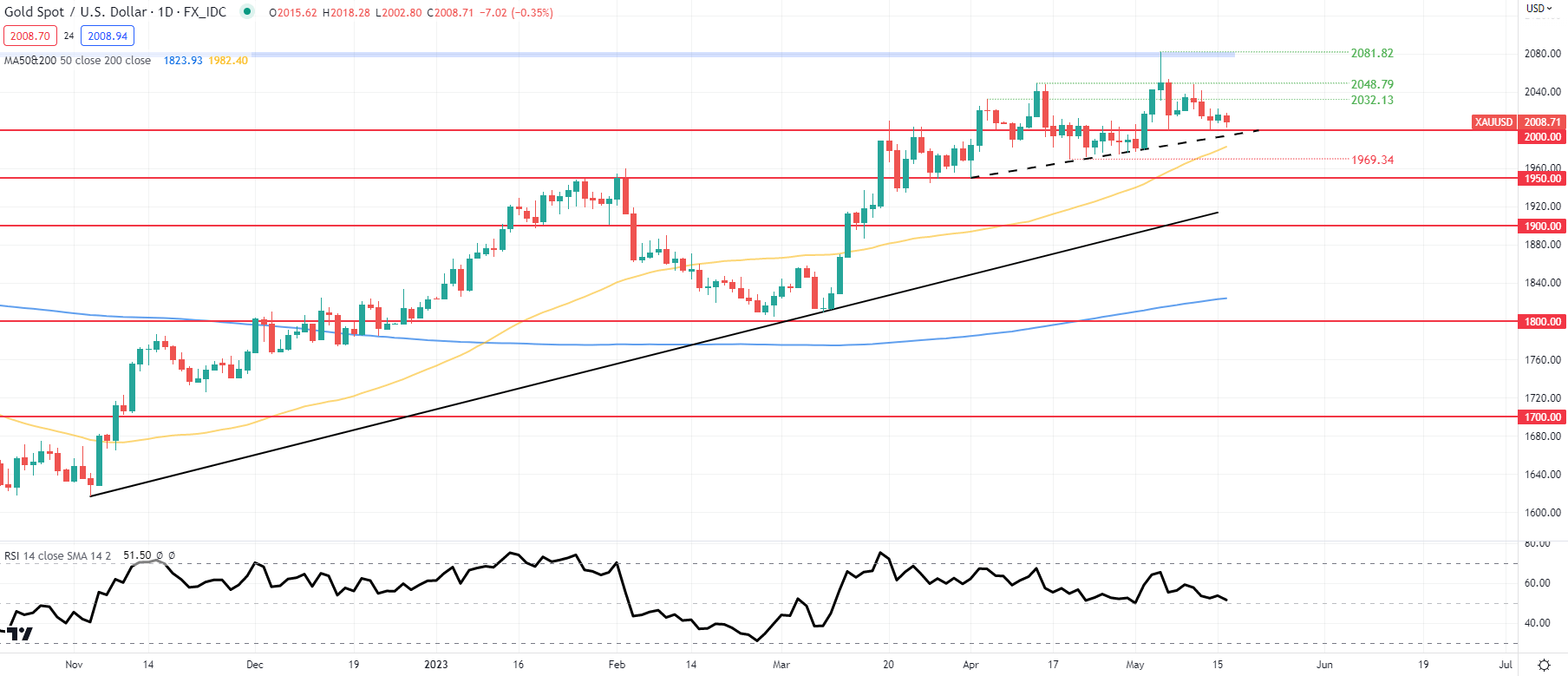

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action has been subdued lately as fundamental factors dictate. The $2000.00 psychological support handle still holds after a pullback from all-time-highs at $2081.82. As I mentioned in prior analysis, bearish/negative divergence has now gained some traction after the long upper wick on the 4th of May. The current Relative Strength Index (RSI) reading suggests no preference for bulls nor bears and reflects the aforementioned fundamental variables influencing gold prices.

Resistance levels:

Support levels:

- 2000.00/Trendline support

- 50-day MA (yellow)

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 60% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.