XAU/USD Breaks Out as Yields Sink, Fed Pivot Hopes Build

GOLD PRICES OUTLOOK

- Gold prices rally and break above technical resistance in the $1,975/$1,980 area

- Bullion’s gains are driven by a steep pullback in Treasury yields following disappointing economic data

- This article examines key XAU/USD’s levels worth watching in the coming trading sessions

Most Read: EUR/USD Hits Snag After Breakout, Nasdaq 100 Stalls, Oil Prices at Risk of Meltdown

Gold prices (XAU/USD) rallied over 1.0% on Thursday, rebounding from a lackluster performance in the preceding trading session, propelled by a significant retreat in U.S. Treasury yields following disappointing labor market data released earlier in the day.

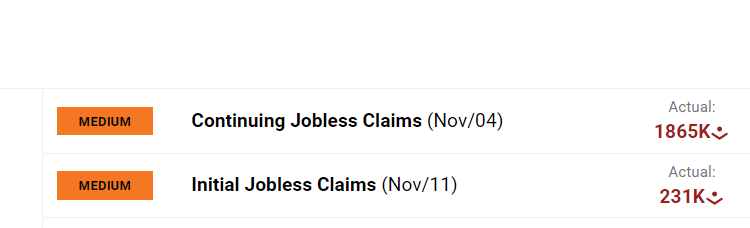

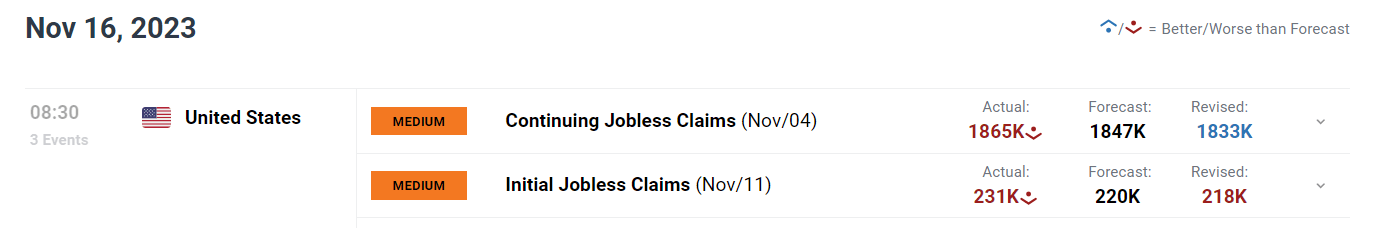

Focusing on the catalysts, applications for unemployment benefits for the week ending November 11 rose more than projected, clocking in at 231,000 versus a forecast of 220,000. Continuing jobless claims also surprised to the upside, surging to 1,865,000, the most in nearly two years, hinting at increasing difficulty in finding employment for Americans.

Eager to gain insights into gold's future trajectory and the upcoming market drivers for volatility? Discover the answers in our complimentary Q4 trading guide. Download it for free now!

Recommended by Diego Colman

Get Your Free Gold Forecast

US ECONOMIC DATA

Source: DailyFX Economic Calendar

Lackluster economic indicators, together with encouraging October CPI and PPI figures published yesterday and Tuesday, reinforced the view that the Federal Reserve’s tightening cycle is over and that the next move will be rate cuts. These expectations weighed on yields, sending the 10-year note below 4.45% and towards its lowest value since late September.

With the FOMC’s monetary policy outlook turning more dovish in the eyes of the market, gold could remain in an upward trajectory in the near term, especially if the U.S. dollar extends its recent downward correction. This scenario could materialize if incoming information reveals further economic weakness, as a deteriorating macro landscape may accelerate a Fed pivot.

Acquire the knowledge needed for maintaining trading consistency. Grab your “How to Trade Gold” guide for invaluable insights and tips!

Recommended by Diego Colman

How to Trade Gold

GOLD PRICE TECHNICAL ANALYSIS

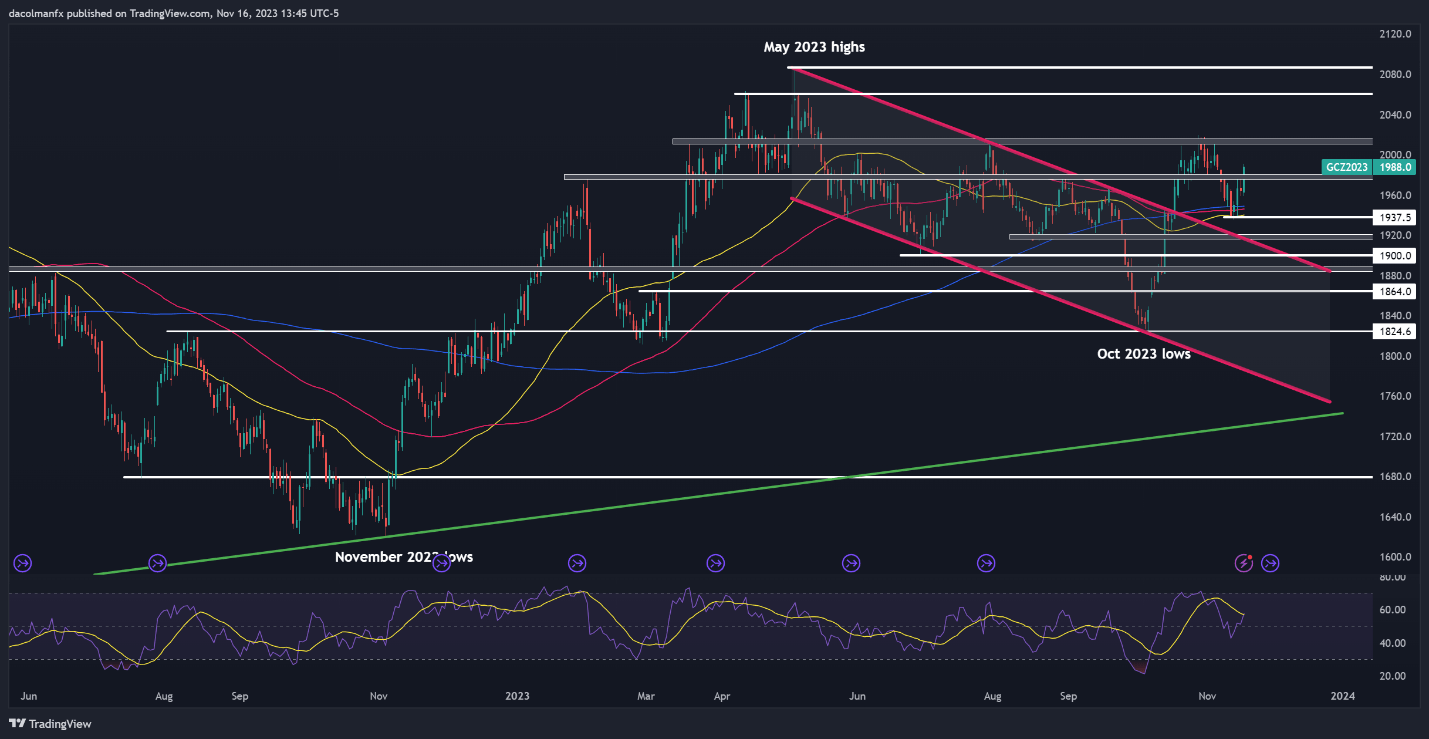

Gold prices, measured through futures contracts, took off on Thursday, breaching a key technical ceiling stretching from $1,975 to $1,980. If this breakout is sustained, prices could start consolidating to the upside in the coming days, paving the way for a move toward $2,010/$2,015. Additional gains from here on out might embolden the bullish camp to launch an attack on $2,060.

In the event of a bearish reversal, the first line of defense against a downturn is located in the $1,980-$1,975 zone. Although bullion may establish a base in this region on a pullback, a breakdown could trigger a deeper retracement, opening the door for a drop towards cluster support in the $1,950/$1,940 range (several key moving averages converge in this area). Below this floor, the focus shifts to $1,920.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you seek—don't miss out, download it now!

| Change in | Longs | Shorts | OI |

| Daily | -6% | 11% | 0% |

| Weekly | -2% | -11% | -6% |

GOLD PRICE TECHNICAL ANALYSIS

Gold Price Chart Created Using TradingView

Comments are closed.