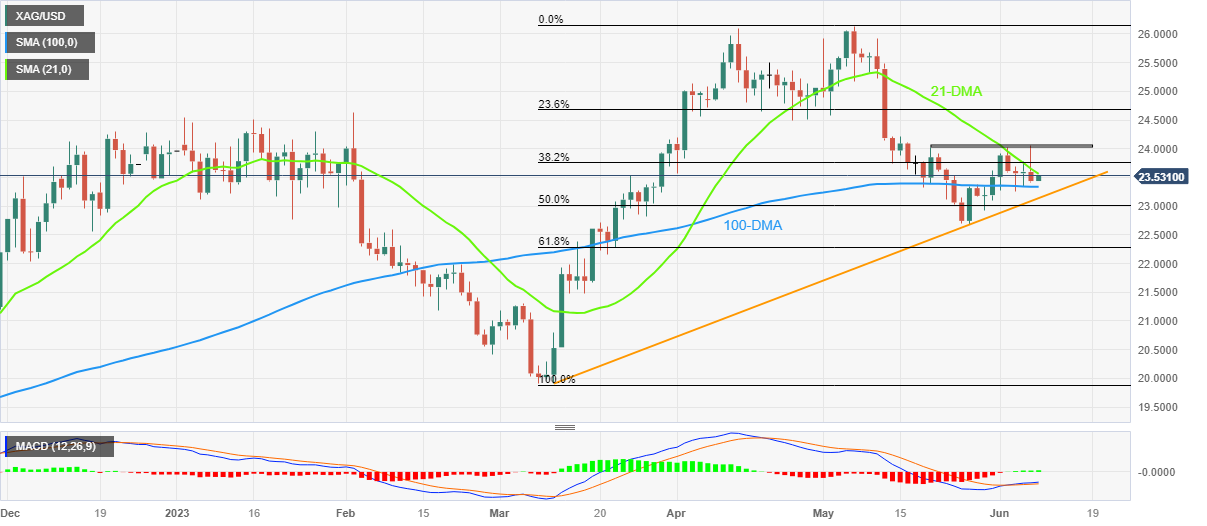

XAG/USD eyes another battle with 21-DMA hurdle around $23.50

- Silver Price picks up bids to reverse the previous day’s retreat from three-week high.

- Firmer MACD signals, repeated failures to break 100-DMA keep buyers hopeful.

- Daily closing beyond $24.10 becomes necessary for XAG/USD bears to keep the reins.

Silver Price (XAG/USD) regains upside momentum, following the previous day’s U-turn from a multi-day high, as buyers prod $23.50 amid early Thursday. In doing so, the XAG/USD eyes another attempt to break the 21-DMA hurdle after portraying three failures to cross the short-term moving average resistance in the last week.

That said, the bullish MACD signals and repeated failures to break the 100-DMA support, around $23.30 by the press time, underpin the hopes of the Silver Price run-up.

In a case where the XAG/USD crosses the 21-DMA hurdle of $23.55, it can rise towards a three-week-old horizontal resistance area surrounding $24.00-24.10.

However, April’s low of near $24.50 and February’s high surrounding $24.65 could challenge the Silver buyers afterward.

On the flip side, a daily closing below the 100-DMA support of $23.30 becomes necessary for the Silver bear’s conviction.

Even so, an upward-sloping support line from early March, close to $23.15 by the press time, quickly followed by the $23.00 round figure, can restrict the short-term downside of the Silver Price.

To sum up, the Silver Price is likely to recover but the upside room appears limited.

Silver Price: Daily chart

Trend: Limited recovery expected

Comments are closed.