WTI Prints Double Bottom Pattern. Recovery Incoming?

OIL PRICE FORECAST:

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices struggled for the majority of the day before finding some joy in the US session. The question is whether there is enough optimism among market participants to inspire a recovery in price?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US OIL OUTPUT AND SPR RESERVES

The OPEC+ meeting last week failed to convince markets with the 2.2 million bpd seemingly falling short of market expectations. This is really interesting as it comes at a time when US Crude Oil production set a record for second successive month adding a challenge to OPEC+ as they look to keep prices under control. OPEC+ are looking to add more member states which in turn will allow them greater control over the price of Oil moving forward and limit the impact of what is known as ‘Free Riders’. Interesting times ahead just as the possibility of uncertainty in the Middle East rages on.

The US Energy Department Deputy Secretary said the United States is taking advantage of low oil prices and refilling the Strategic Petroleum Reserve (SPR) as much as it can. The Deputy Secretary David Turk was quoted as saying that the amount is limited by physical constraints in the caverns. Will this aid a potential recovery in WTI prices?

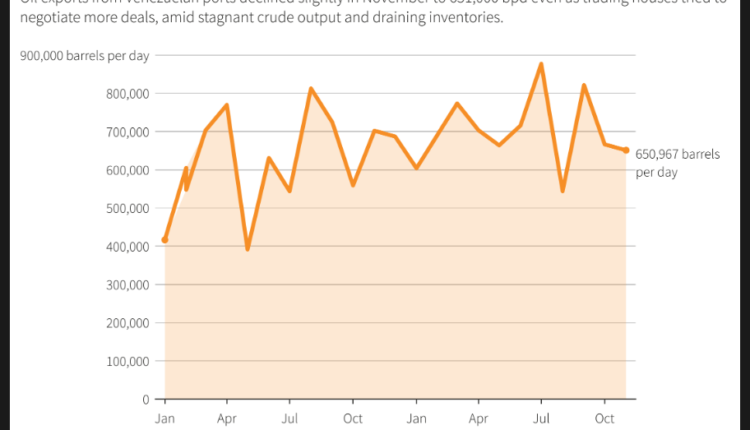

VENEZUELAN OIL EXPORTS

Despite the optimism around the lifting of sanctions on Venezuelan oil, exports remain almost unchanged as discussed following the announcement. The lack of maintenance and infrastructure at oil fields coupled with long-standing loading delays as well as some shippers remaining reluctant to send vessels to the South American nation are all factors.

At present authorities are in negotiations with various middlemen in a bid to increase its exports with sales through intermediaries currently languishing around 57% of the total. OPEC+ did comment following the lifting at sanctions warning that any material impact will take a while to be felt.

Source: REFINITIV

Recommended by Zain Vawda

How to Trade Oil

LOOKING AHEAD

Looking to the rest of the week and there is a raft of data releases due out particularly from the US which could pose some risks to Oil prices. We also have some Chinese mid-tier data out tomorrow which could give another sign as to the health of the Chinese economy together with US ISM Services PMI release. Both of which could potentially have an indirect impact on oil prices. I would also advise keeping an eye on developments in the Middle East and potential shipping routes facing challenges as the conflict continues to heat up.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical perspective, WTI is hovering close to the 473.00 a barrel support area which was the most recent lows in the middle of November. As things stand it does appear we are going to print a double bottom print today barring a late selloff. If that does occur it may bode well for WTI and a potential recovery if recent history is anything to go by.

As you can see on the chart below, we had a triple bottom print across June and July which was the start of the rally which led us to the $95 a barrel high printed late in September. It is important to note that we do have very strong resistance areas above current price with the $76 and $78 levels in particular likely to prove challenging.

WTI Crude Oil Daily Chart – December 4, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 85% of Traders are currently holding LONG positions. Given the contrarian view to client sentiment adopted here at DailyFX, does this mean we are destined to revisit recent lows and the $70 a barrel mark?

For a more in-depth look at WTI/Oil Price sentiment and the tips and tricks to utilize it, download the guide below.

| Change in | Longs | Shorts | OI |

| Daily | 5% | 22% | 8% |

| Weekly | 2% | -8% | 1% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.