WTI and Brent Start Week on the Back Foot as Chinese GDP Underwhelms

OIL PRICE FORECAST:

Recommended by Zain Vawda

Q3 Forecast on Oil Prices Available Now

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices finished last week on the back foot and that trend seems to have continued into the new week. A gap down in price over the weekend with further selling pressure following the Asian Open leaving WTI and Brent down 1.17% and 1.12% respectively.

CHINESE DATA AND US DOLLAR

Last week’s risk-on rally was halted on Friday as strong consumer confidence data from the US reignited some concern that it may be too early to declare victory for the US Federal Reserve in its fight against inflation. Asian session hints at a continuation of that trend to start the week.

China remains interesting as despite a stuttering recovery Oil data released last month revealed that demand for oil remains strong thanks to surging petrochemical use which is expected to see China account for 70% of global gains. This morning brought a mixed bag in terms of Chinese data with the GDP print likely to dominate as it came in below estimates. However, a closer look at the data and there were some positives as Fixed Asset Investment YoY, Industrial Production YoY and GDP QoQ numbers all beat estimates with YoY Retail Sales missing estimates by 0.1%. In the aftermath of the data release the PBoC opted against cutting its medium-term lending facility as calls and hopes of a stimulus package continue to grow.

For all market-moving economic releases and events, see the DailyFX Calendar

We have already heard mounting speculation that China’s top leaders may announce a massive stimulus package at a key meeting later this month. Following today decision however, this month’s meeting of top Chinese officials could garner even more interest as a stimulus package could provide a welcome boost not just for China but Global economies as well.

The US Dollar and Dollar Index (DXY) did finish the week with a bit of strength with a continuation toward immediate resistance at the 100.84 mark in the early part of the week a possibility. This could see Oil prices continue on the current downward trajectory before bouncing and looking higher toward last week's highs.

Discover what kind of forex trader you are

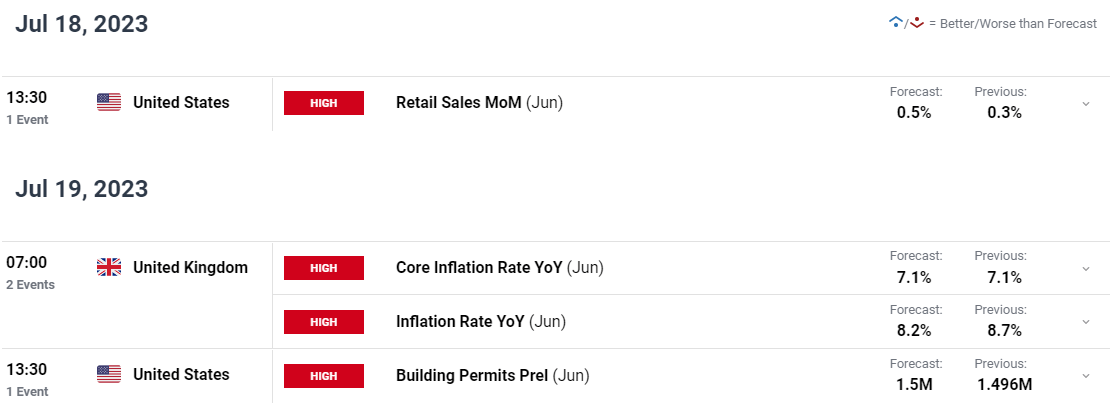

ECONOMIC CALENDAR AND EVENT RISK

There is not a lot on the calendar in terms of event risk with Retail Sales and Building Permit data from the US and of course UK inflation. Market sentiment this week is largely expected to be driven by US earnings season with continuation of positive earnings likely to see Oil prices remain supported. Market participants are likely to view positive earnings as a sign that a ‘soft landing’ may be possible and push recessionary concerns to the background for now at least.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

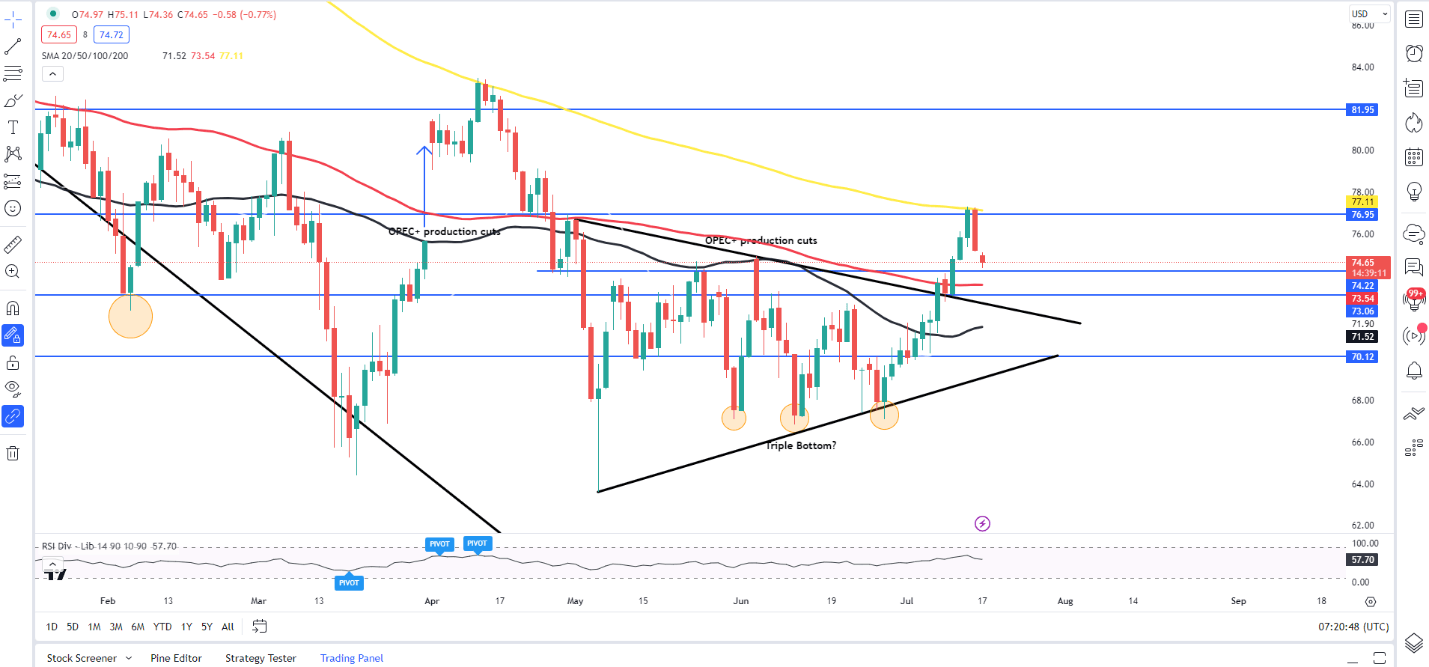

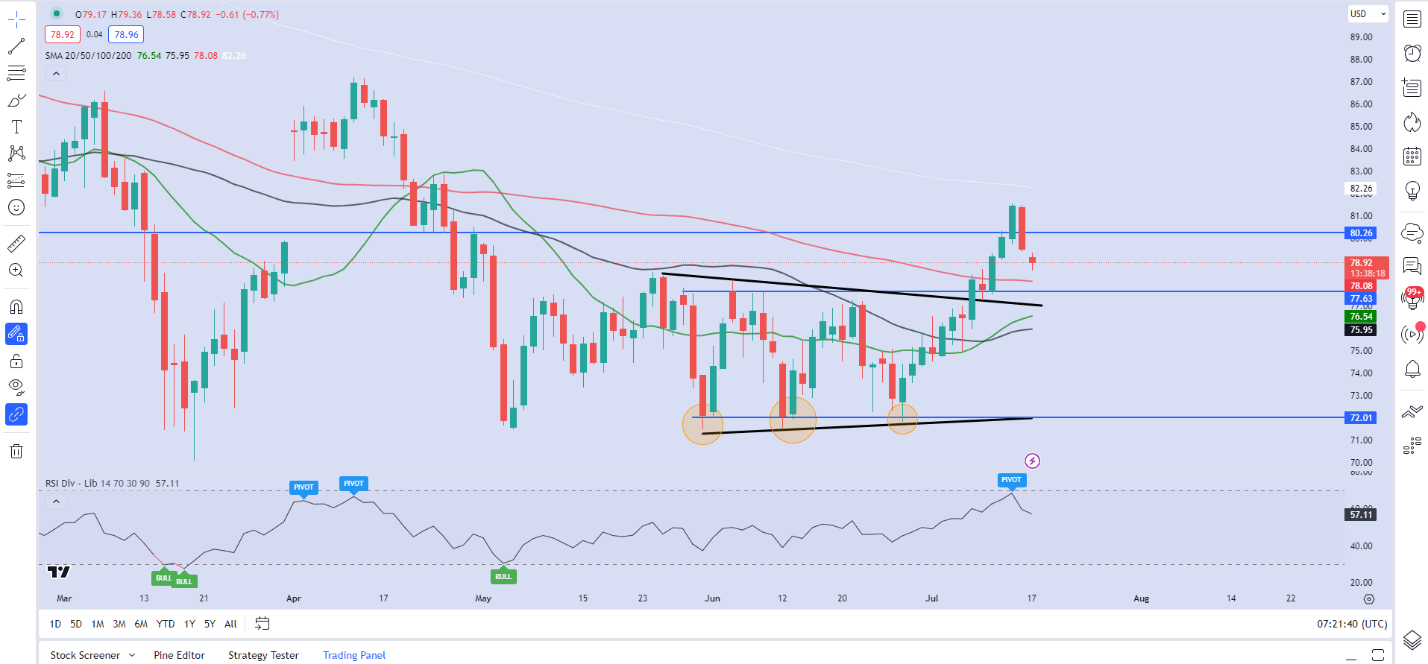

From a technical perspective both WTI and Brent finished last week with a bearish engulfing daily candle close with selling pressure continuing in the Asian session. We are seeing a slight bounce as the European session kicks off with a bit of weakness in the Dollar Index (DXY) helping as well.

WTI Crude Oil Daily Chart – July 17, 2023

Source: TradingView

Both Brent and WTI did open with a slight gap to the downside overnight and market participants may look to close the gap before selling pressure returns. A push toward the $79.45 mark for Brent and $75.17 for WTI will see the weekend gaps close before a continued push toward the 100-day MAs. A lack of event risk today could result in a lack of volatility today with US earnings season continuing tomorrow as well Retail Sales from the US.

Brent Oil Daily Chart – July 17, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA- OIL US CRUDE

IGCS shows retail traders are currently LONG on WTI Oil, with 60% of traders currently holding LONG positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that WTI may enjoy a short rally higher before continuing to fall.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.