WTI and Brent Face Challenges as Chinese Economy Remains in Focus

WTI PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Oil Price Forecast: WTI and Brent Rally Gains Steam Despite the IEA Increasing 2023 Supply Outlook

CHINESE ECONOMY, PBoC STIMULUS AND US RIG COUNT

Crude Oil finished last week with a flourish snapping back-to-back losses to finish the week with gains of around 1.9%. A late week push which coincided with overall weakness in the US Dollar as well as some optimism around a stimulus package from China helped WTI end the week at 71.60 a barrel. Overnight the Asian session saw some hesitancy as prices fell around 1% before rebounding following the European open to trade just shy of the 72.00 handle.

The People Bank of China (PBoC) is expected to cut loan rates this week in what was seen as a likely positive for Oil prices but has largely been overshadowed by ongoing uncertainty around a Chinese recovery. We have seen a number of major players in the investment banking arena already downgrade their growth forecasts for China for the rest of 2023 which could continue to weigh on oil prices.

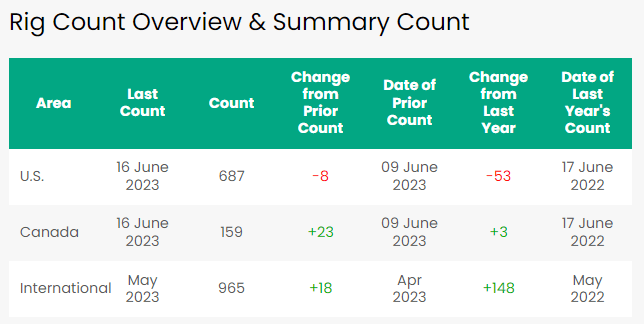

This comes despite IEA data last week which revealed Chinese demand for oil in April hit a new all-time high while the refinery throughput rate in Asia’s largest economy rose 15.4% in May, the second highest on record. US energy firms meanwhile continue to decrease the number of oil rigs with data from last week indicating a seventh successive week of declines.

Source: Baker Hughes

Another factor which could come into play as the week progresses is the ongoing negotiations between the US and Iran. There has been little in the way of concrete feedback regarding the talks with market participants weary of the potential for increased oil supply should a positive deal be reached. Whether or not this is even a part of the current discourse is unclear but remains a key area of interest and could pose risks to Oil prices.

Recommended by Zain Vawda

Understanding the Core Fundamentals of Oil Trading

ECONOMIC CALENDAR AND EVENT RISK

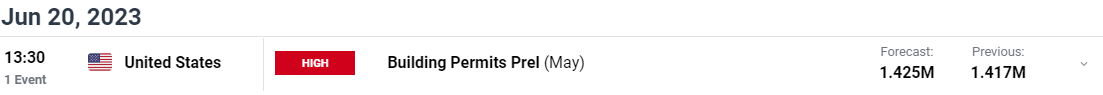

Following a busy couple of weeks, we start the new week with a bank holiday in the US which could see lower liquidity as we approach what would be the US open. The calendar this afternoon is empty with the first piece of high impact data for the week coming in the form of US preliminary building permits tomorrow. We do have some US Federal Reserve policymakers scheduled to speak this week which could also see an uptick in volatility as markets still decode the Feds thoughts behind last weeks pause in the hiking cycle.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

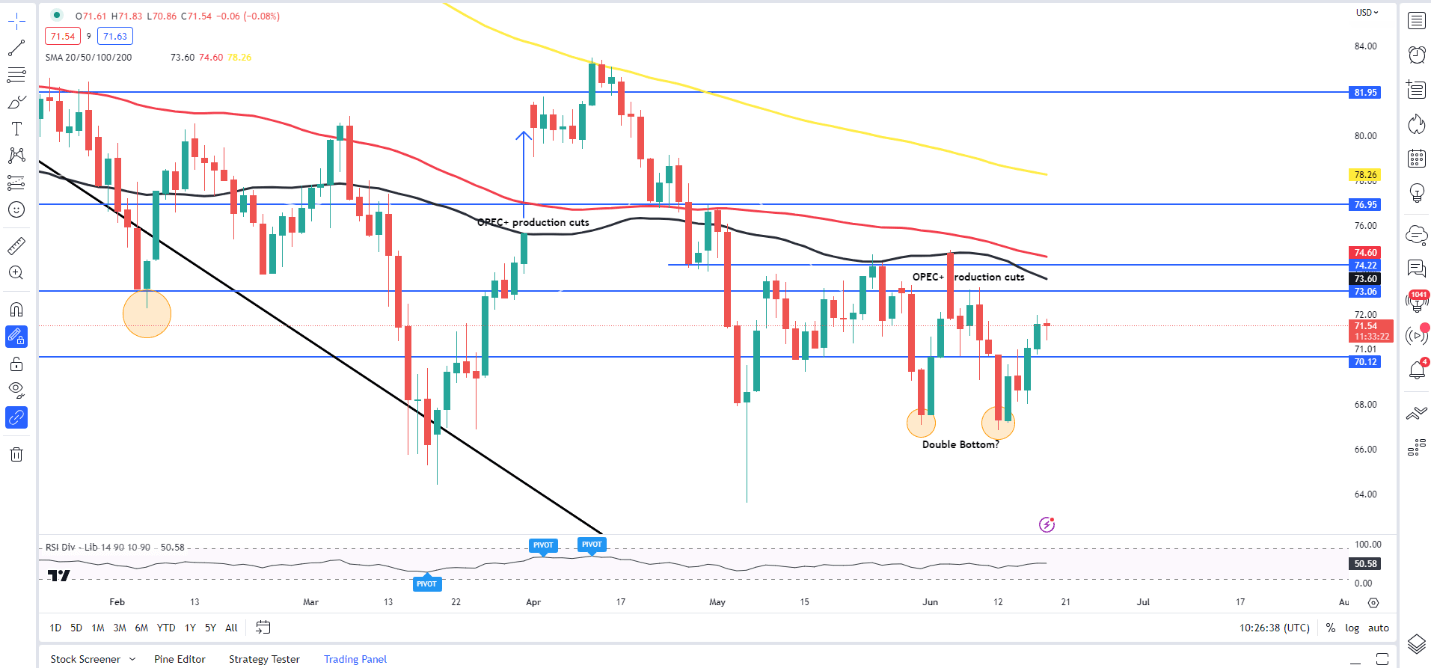

From a technical perspective both WTI and Brent snapped a two-week losing streak, finishing last week up around 1.9% while printing a hammer candlestick close. When one couples this with last weeks double bottom pattern on a daily timeframe, the conviction for a bullish continuation should be strong. However, as has been the case of late the technical outlook has at times been overshadowed by a change in sentiment or high impact USD data releases. This leaves me to question whether this bounce has the steam needed to continue toward the 75.00 psychological mark?

Oil is currently testing the 72.00 resistance area with the 50 and 100-day MA resting above around the 73.60 and 74.60 handles respectively. A break above 72.00 would need to clear these hurdles first if we are to look for any sustained move to the upside.

Alternatively, a break lower from here would face support at the daily low around 70.86 before the psychological 70.00 mark comes into focus. Further down we have support around 68.40 before the double bottom around 67.00 becomes an area of focus.

WTI Crude Oil Daily Chart – June 19, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently LONG onWTI Crude Oil, with 78% of traders currently holding LONG positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that WTI may enjoy a short recovery before continuing to fall.

Foundational Trading Knowledge

Commodities Trading

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.