Will US CPI Reignite FX Intervention Concerns?

Japanese Yen (USD/JPY, EUR/JPY) Analysis

Ueda’s Nod to Rate Normalisation Fades as Focus Shifts to US CPI

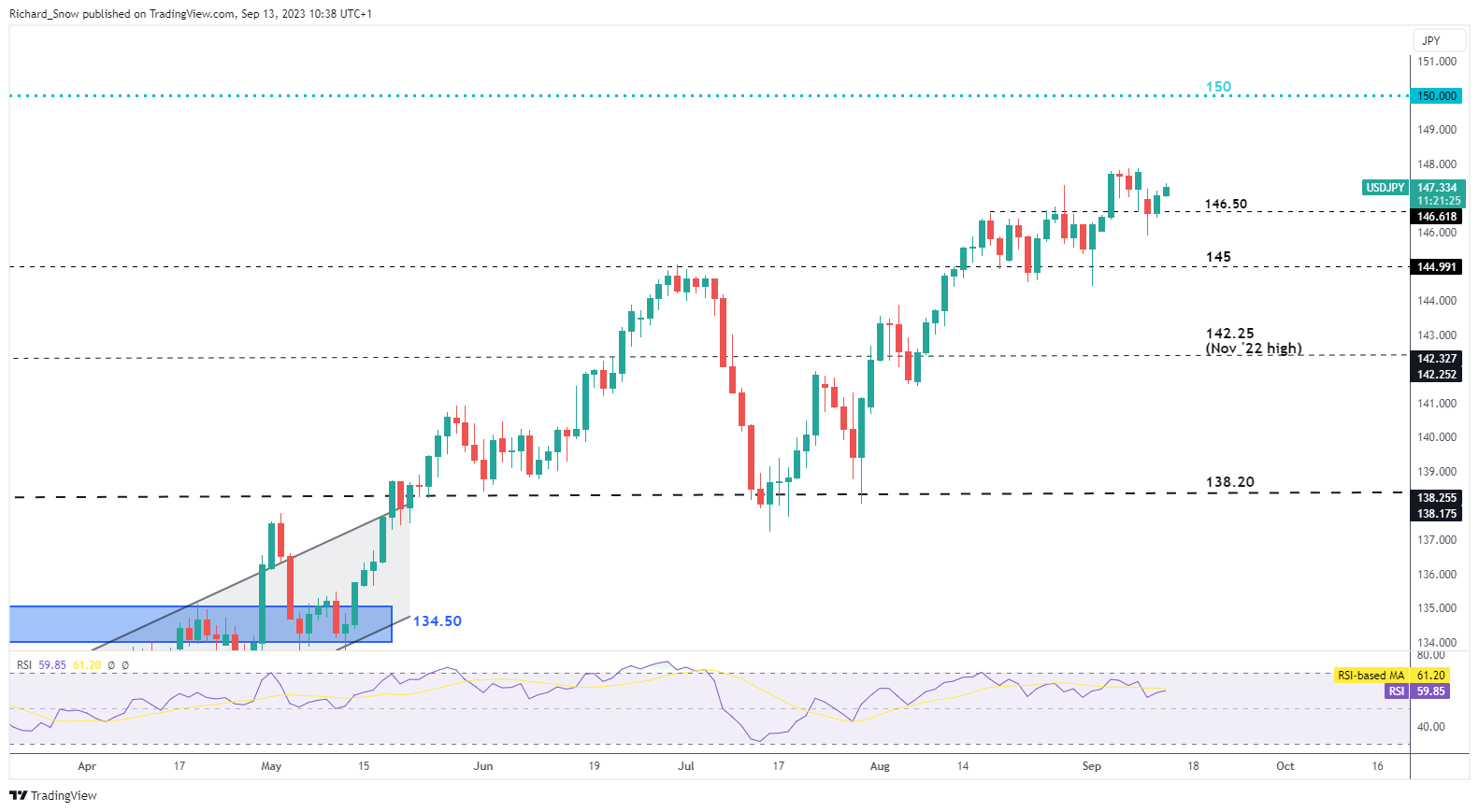

The yen made a partial recovery/pullback after the Bank of Japan (BoJ) Governor Kazuo Ueda expressed a view that the bank will have enough data at their disposal to make a decision on stepping away from negative interest rates. Markets initially perceived this as bullish news for the yen and presented an opportunity to regain some lost ground, especially against a resilient dollar.

However, 146.50 proved a level too far for USD/JPY, finding support and heading higher yesterday and today in the London session. The recent swing high of 147.87 is well within reach, particularly if US CPI data reignites inflation concerns that are likely to keep the dollar supported at the very least. OPEC’s continued supply cuts have sent oil prices sharply higher throughout July and August with another surge yesterday after the US Energy Information Agency reemphasized a tight oil market in its short-term energy outlook. This morning the Paris-based International Energy Agency warned of declining global observed inventories which plunged to a 13-month low in August.

USD/JPY has the swing high in sight, with a hot US CPI print providing a potential catalyst. However, moves upwards of 148 may be difficult to come by as the threat of FX intervention from the Japanese government picks up ahead of 150 – believed to be the line in the sand. A lower CPI print is more likely to see the pair consolidate around 146.50.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

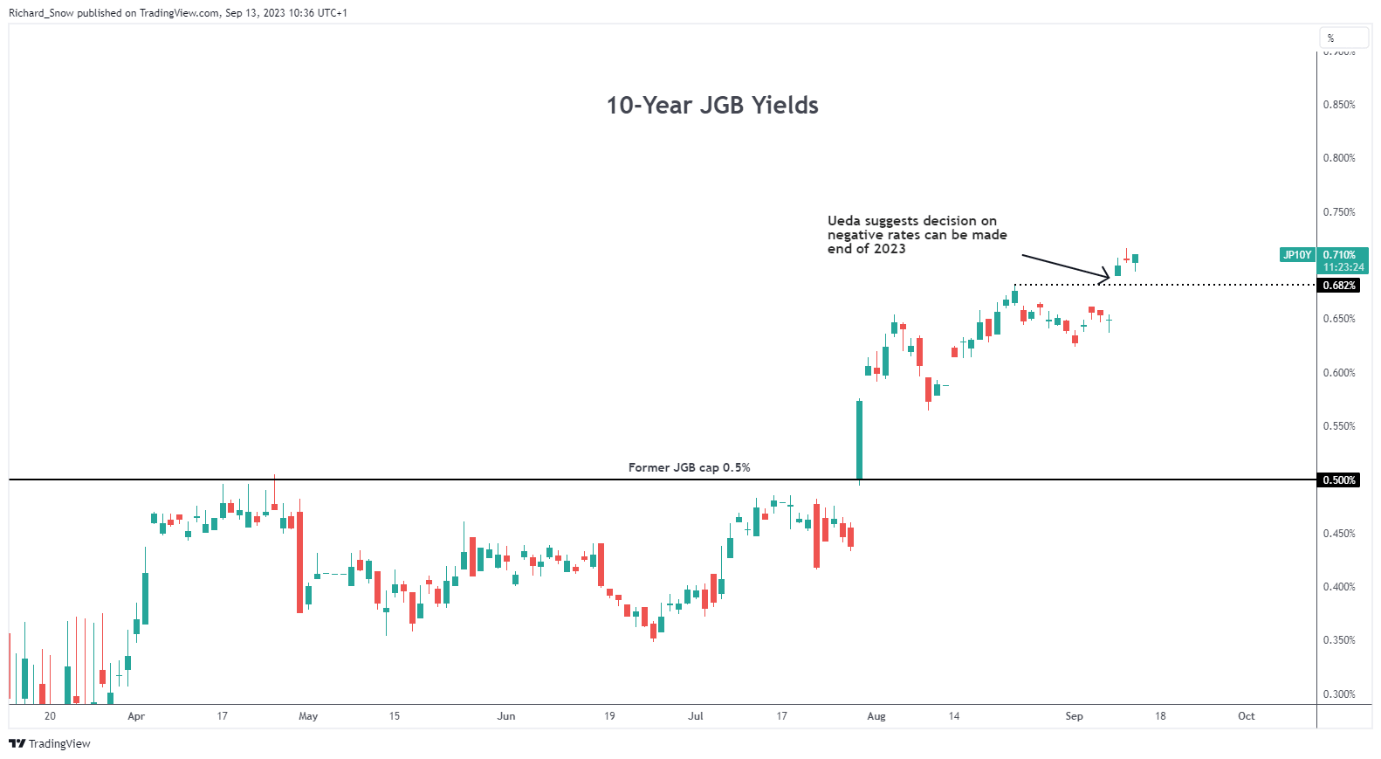

Interesting developments in the Japanese bond market reveal a move higher after Ueda’s comments on possibly ending negative interest rates. This could slow down USD/JPY bullish momentum if US yields weren’t still elevated.

Japanese 10-Year Government Bond Yields

Source: TradingView, prepared by Richard Snow

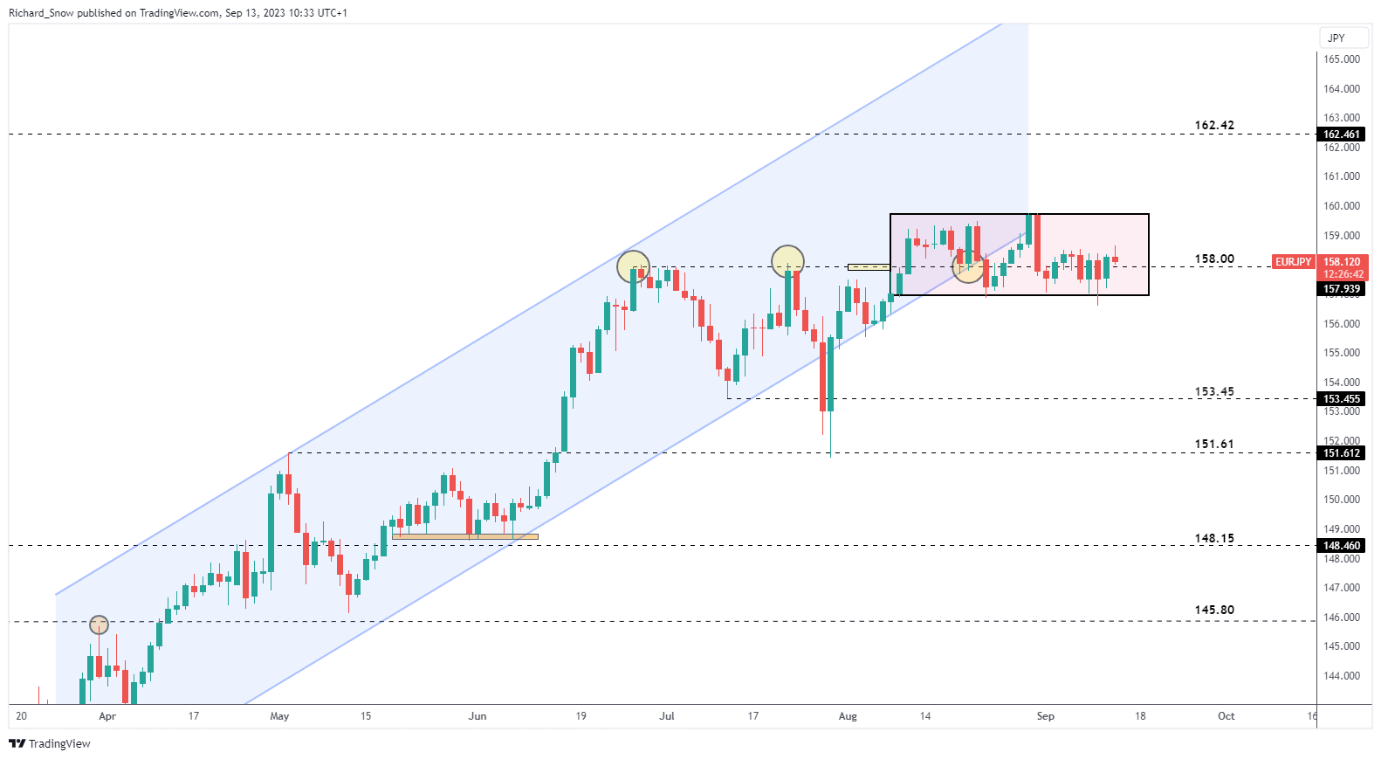

EUR/JPY Consolidates Ahead of US CPI and ECB Meeting

EUR/JPY has been unable to build on bearish momentum after breaking below the longer-term ascending channel (blue) and has instead settled within a horizontal channel of consolidation (red).

With markets reversing course and now suggesting the likelihood of an ECB hike tomorrow, The euro could benefit slightly from what is now a consensus hike but should the governing council decide to hike, it would be a very difficult sell to get further hikes across the line and so 4% could very well be the level the bank peaks at – in the absence of sharply accelerating inflation from here.

Recommended by Richard Snow

The Fundamentals of Range Trading

Therefore, the range remains constructive for now. ECB staff projections will also shed some light on the dire fundamental outlook for the EU economy, which is likely to weigh on future conversations regarding rate hikes.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.