What’s Behind the Recent Yen Strength?

USD/JPY News and Analysis

- Broad Japanese Yen strength observes late on Friday as BoJ and currency officials address FX intervention and monetary policy, respectively

- USD/JPY heads back below 150 but major currencies still on track for another weekly gain vs JPY

- Japanese government bond yields ease in sympathy with the US, global trend

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Broad Japanese Yen Strength Observed on Friday

Comments from the Japanese Finance Ministry and from Bank of Japan Governor (BoJ) Kazuo Ueda inspired a late comeback in the yen across major FX pairs. The yen has otherwise experienced broad weakness despite the recent moves lower in the dollar on a worsening economic outlook for the world’s largest economy.

However, the Finance Ministry’s Akazawa confirmed that any FX intervention will be aimed at arresting market volatility and Tokyo won’t intervene just because the currency is weakening. Taking this statement at face value, one would be reasonable to assume this meant FX intervention may not be as imminent as many ay have believed, causing further weakness in the yen. Comments from BoJ Governor Ueda also lacked any sense of urgency, reaffirming that policy will only change if inflation is expected to be sustainably above target. Markets saw this as an opportunity to claw back recent losses heading into the end of the week.

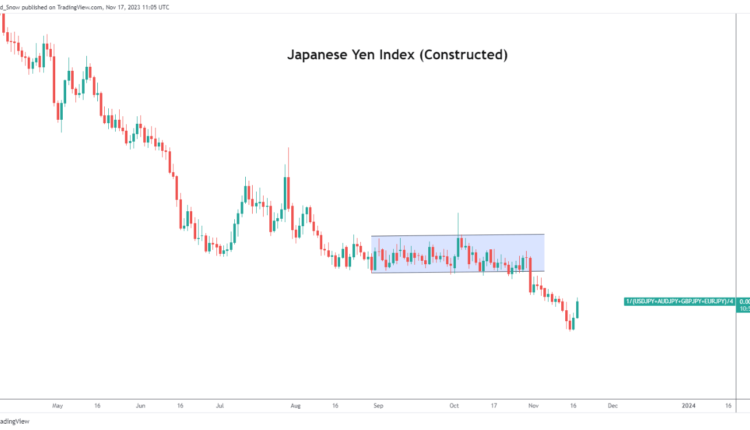

Japanese Index – Simple Weighted Average (USD/JPY, GBP/JPY, AUD/JPY, EUR/JPY)

Source: TradingView, prepared by Richard Snow

USD/JPY headed lower in Friday after comments from Tokyo and BoJ officials, trading well below the 150 mark once again. Markets have become more brazen, trading above the supposed tripwire for the next round of FX intervention (150) in the absence of push back from top officials.

Top currency officials may be more tolerant of yen weakness given oil prices have dropped notably in the past weeks. The net importer of oil will breathe a slight sigh of relief now that oil prices are under pressure – allowing the export industry to capitalize on its greater price competitiveness.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

Bond yields head lower in sympathy with the global trend. Japanese bond yields are notably lower than after the latest yield curve control tweaks but the yen has shown signs of strength regardless. The real question is how sustainable will it prove to be?

10-Year Japanese Government Bond Yields (JGBs)

Source: TradingView, prepared by Richard Snow

Major Event Risk Ahead

Next week the economic is fairly light across the board but we do get FOMC minutes to read over. With US rates now most likely at their peak, markets will be looking for further signs/ risks of overtightening now that the risk of not doing enough and doing too much has become more balanced. Softer US data has already led the Fed funds futures market to bring forward rate cuts in 2024 with nearly 100 bps worth of cuts expected.

Then, towards the end of the week, Japan releases inflation data. The BoJ is still collecting data before making a decision to withdrawn from its negative interest rate regime; seeking compelling evidence of demand driven inflation that will breach 2% in a stable and sustainable manner as well as witnessing sustainable wage growth. The majority if analysts polled by Reuters see the end of negative rates in 2024.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.