Weekly FX Market Recap: Mar. 13 – 17, 2023

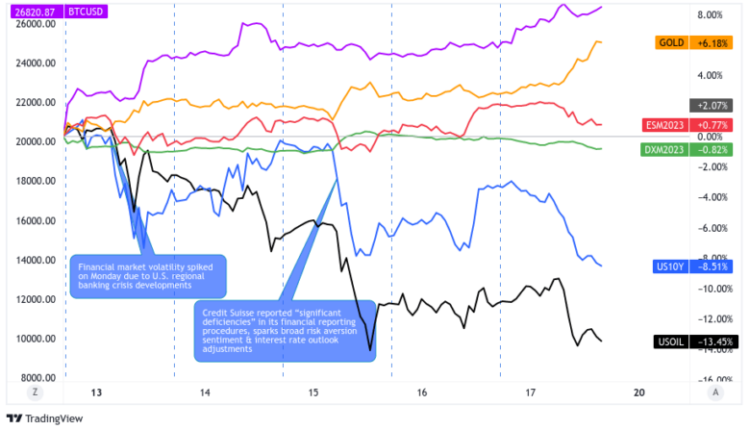

Price action was mixed and it was a push-and-pull kind of week as traders and investors weighed fresh banking sector crisis concerns against a potential shift in monetary and interest rate policies.

Hard assets like bitcoin and gold dominated this week on fears of banking system issues and depositor safety, while in FX, the Japanese yen took the top spot among the forex majors.

Notable News & Economic Updates:

Global banking liquidity headlines:

- On Sunday night, the U.S. Treasury Department, Federal Reserve, and the Federal Deposit Insurance Corp. (FDIC) insured ALL of SVB and Signature Bank’s deposits

- The Fed launched a loan program that would help U.S. banks cover their deposits

- Credit Suisse dropped sharply on Wednesday on news that Saudi National Bank – its largest investor – won’t extend further financial help

- SNB stepped in and provided a 50B CHF package to boost Credit Suisse liquidity

- U.S. Treasury Secretary Janet Yellen assured that the U.S. banking system is “sound” but stressed that not all deposits will be protected

- The European Central Bank shared it’s “ready to respond as necessary” to preserve financial stability in the euro area

- On Thursday, a group of large U.S. banks that includes Bank of America, JP Morgan, and Citi put together a $30B package to help regional First Republic Bank stabilize depositor base

Saudi Aramco CEO Amin Nasser expects oil markets to “remain tightly balanced” thanks to China’s reopening and pickup in jet fuel demand

North Korea reportedly launched two short-range ballistic missiles according to South Korean military

Sticky February CPI supports idea that Fed still needs to hike interest rates despite possibly banking system issues

New U.K. budget plan showed modest growth and no technical recession estimates for 2023

New Zealand economy contracted 0.6% q/q in Q4 2022 vs. estimated 0.2% growth slowdown, previous reading downgraded from 2.0% to 1.7% growth

ECB raised interest rates by 50bps as expected and is going “data-dependent” going forward

Intermarket Weekly Recap

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay 1-Hour by TradingView

At the start of the week, just when Asian session traders were getting ready to price in their Silicon Valley Bank (SVB) contagion concerns from Friday, the U.S. Treasury Department, Federal Reserve, and the Federal Deposit Insurance Corp. (FDIC) stepped in and announced that they would cover ALL of SVB and Signature Bank’s uninsured deposits.

More importantly, the Fed also launched a special loan program that would let U.S. banks borrow cheap money to cover depositor withdrawals, using the U.S. Treasury bonds on the bank’s balance sheets as collateral, valued at par.

The intervention not only helped stem depositor fears, but it also got traders wondering if the event would make the Fed think twice about a forecasted hawkish tightening schedule that included a previously expected 50 bps rate hike next week.

The prospect of a less hawkish Fed sent the 10-year Treasury yields and U.S. dollar lower on Monday, while gold and Bitcoin both gained from the anti-dollar sentiment, as well as the rising narrative that hard assets may attract more capital if the banking system worsens.

Price action was a bit calmer on Tuesday as traders awaited the always anticipated U.S. CPI release. The report itself supported a sticky inflation scenario ahead where the Fed would need further rate hikes this year, but it wasn’t strong enough to weaken the narrative that the Fed may have tightened too much.

The Fed pivot narrative seems to have actually gained ground with some traders and financial institutions pricing a lower rates ahead. Based on the CME Fed Watch Tool, the most likely Fed Funds range at the end of 2023 is now 3.75% – 4.0% at a 31.9% probability vs. just last week where the 4.75% – 5.00% range was leading at a 32.8% probability.

Gold, U.S. equities, and Bitcoin made new intraweek highs before the CPI report tempered expectations of a less hawkish Fed. Bitcoin, in particular, dipped back to the $25,000 major area of interest after hitting the $26,500 levels.

The re-re-pricing of Fed expectations turned to full blown risk aversion on Wednesday thanks to news from Credit Suisse may be in trouble (the Swiss firm disclosed that its 2021 and 2022 financial reporting procedures contained “significant deficiencies”). Market fears really kicked off, though, when Saudi National Bank – Credit Suisse’s largest investor – said that it is not able to provide further financial help to banking giant.

Not surprisingly, markets turned to safe-havens at the news. USD, JPY, gold, and government bonds gained ground for most of the European and U.S. sessions while CHF lost pips across the board.

The panicking eventually eased after Swiss National Bank (SNB) announced its 50B CHF package to help boost Credit Suisse’s liquidity.

Focus then turned to the European Central Bank (ECB) on Thursday when the central bank raised its interest rates by 50 basis points as expected. ECB President Lagarde expressed confidence in the European banking sector but also stressed that future ECB decisions will be data-dependent.

The ECB wasn’t the only bank under the spotlight! First Republic Bank – a regional U.S. bank – had bank run concerns before a group of large U.S. banks including Bank of America, JP Morgan, and Citi chipped in to provide a $30B rescue package to help stabilize its depositor base.

This was enough to stem banking crisis fears, characterized by a bounce in positive risk sentiment going into the Friday session, which seems to have been only momentary relief as banking sector assets took another dive, taking risk sentiment lower into the weekend.

Most Notable FX Moves

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

U.S. CPI for February: 0.4% m/m and 6% y/y (both inline with expectations); core CPI was slightly above 0.4% m/m forecast at 0.5% m/m

U.S. headline retail sales slipped 0.4% m/m in February versus expectations of a 0.3% dip, previous reading upgraded from 3.0% to 3.2%

U.S. producer price index for February: -0.1% m/m vs. +0.3% m/m increase; retail sales fell -0.4% m/m as expected

NY Fed Manufacturing survey for March: -24.6 vs. -5.8 previous; employment and new order indicators weaken; prices increased at a slower pace

U.S. initial jobless claims fell to 20K in the week ending 3/11/2023 vs. 192K in the previous week

Philly Fed manufacturing index for March: -23.2 vs. -24.3 in February; new orders index fell to -28.2 vs. -13.6 previous

U.S. housing starts was up by +1.1%, building permits rebounded by +13.8% in February signaling that the housing market is probably stabilizing amidst higher mortgage rates

The Preliminary read of University of Michigan Consumer Sentiment Survey for March came in at 63.4 vs. 67.0

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Eurozone Industrial Production for January: +0.7% m/m vs. -1.3% m/m in December; strength seen in Germany and Ireland making up for weakness elsewhere

Germany Wholesale Prices for February: +0.1% m/m vs. +0.3% m/m forecast/+0.2% m/m previous

On Thursday, the European Central Bank raised the refi rate to 3.5% from 3.0% and the deposit rate to 3.0% from 2.5%; raised the growth forecast from 0.5% to 1.0% and sees the average inflation rate at 2.1% in 2025; they are monitoring market tensions and ready to respond if needed

European Central Bank President Christine Lagarde speech notes:

- Underlying price pressures remain strong and wage pressures have strengthened

- The banking sector is in a stronger position than 2008

- They do not see a liquidity crisis but is ready to respond if necessary

- Commitment to fighting inflation is as strong as ever

- There were no other options on interest rates

Euro Area inflation in February 2023: +8.5% y/y vs. +8.6% y/y previous; +9.9% y/y in the European Union vs. 10.0% y/y

In Q4 2022, labor costs in the Euro area was +5.7% q/q and +5.8% q/q in the European Union

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

U.K. claimant count change reflected 11.2K drop in unemployment versus projected 12.5K increase in joblessness for February, previous reading upgraded to show larger 30.3K reduction in claimants from initially reported 12.9K drop

U.K. average earnings index slipped from 6.0% to 5.7% in three-month period ending in January as expected

U.K. Spring Budget 2023: “The OBR forecast the UK economy will avoid a recession and, supported by action taken at the Spring Budget, GDP is higher in the medium term.”

U.K. jobless rate held steady at 3.7% instead of rising to the estimated 3.8% figure for January

The Conference Board Leading Economic Index for the U.K. fell by -0.6% in January to 78.8 (following at -0.8% fall in December)

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

A business survey of Japan’s large manufacturers fell from -3.6 to -10.5 in Q1, while non-manufacturers also slipped from 2.7 to 0.6 in the same period

Bank of Japan meeting minutes showed members debating making further tweaks to its YCC program but deciding to wait and see for now

Japanese core machinery orders jumped by 9.5% m/m in January vs. estimated dip from 1.6% to 1.5%

Japan’s Feb trade deficit narrowed from 1.82T JPY to 1.19T JPY vs. estimated 1.46T JPY shortfall, as exports increased by 4.4% m/m while imports fell 3.0% m/m

Japan Tertiary Industry Activity Index in January: +0.9% m/m to 100.5 (-0.4% m/m in December)

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

Swiss producer prices tumbled by 0.2% month-over-month in February versus estimated 0.5% uptick and previous 0.7% gain

SECO Economic Forecasts :Swiss economic growth to be significantly below average in 2023

Credit Suisse to borrow up to 50B CHF from SNB and announces public tender offers for debt securities, as bank takes action to preemptively bolster liquidity

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australia’s Westpac consumer sentiment unchanged at 78.5 in March, holding near 30-year lows as confidence in labor market started to wane

Australia Business Confidence Survey for February: Business conditions index ticked down 1 point to +17; Employment index held steady at +12 and profitability fell -4 points ot +14; overall business confidence index fell 10 points to -4

Australia’s February employment report: 64,600 vs. -10,900 in January. Unemployment rate was 3.5% (the lowest in almost 50 years), down from 3.7% and below the estimate of 3.6%

Australia’s MI inflation expectations dipped from 5.1% to 5.0% in February

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

Tourism, post-holiday spending helped boost New Zealand’s BusinessNZ services index from 54.7 to 55.8 in February

New Zealand’s food prices accelerated from 10.3% to 12% y/y in February, the fastest increase since 1989.

China’s data dump showed improvements in investment and consumer demand in February

New Zealand’s current account deficit widened from 21.1B NZD in 2021 (6% of GDP) to 33.8B NZD for the year ended 2022 (8.9% of GDP), the highest since the series began in 1988.

S&P: New Zealand’s AA+ and AAA credit grades could come under pressure if the nation’s account deficit remains “extremely high” over the next 12 to 18 months

New Zealand economy contracted 0.6% q/q in Q4 2022 vs. estimated 0.2% growth slowdown, previous reading downgraded from 2.0% to 1.7% growth

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

Canadian manufacturing sales in January: +4.1% m/m to C$73.9B vs. a -2.1% m/m fall in December

Foreign investments in Canadian securities in January: C$4.2B vs. C$21.2B in December

Canadian Industrial Product Price Index in February: -0.8% m/m vs. +0.3% m/m in January; Raw Materials Price Index was -0.4% m/m vs. -0.2% m/m in January

Comments are closed.