Wall Street Up Overnight; Sentiment in Extreme-Greed Territory

Recommended by IG

Building Confidence in Trading

The softer US economic calendar overnight prompted market participants to source for clues on the Fed’s policy path from the US weekly jobless claims, which reflected a pull-ahead in initial claims reading to its highest since October 2021 (261,000 versus 235,000 forecast). With its tendency to provide an early lead for the US unemployment rate, its sharp rise uplifted hopes that the US labour market may continue to see some softening ahead, although we will have to look towards subsequent weeks’ data to provide conviction for a clear trend.

With rate expectations being highly sensitive to economic data on the Fed’s data-dependent stance, the claims figure translated to a dovish adjustment in rate expectations towards the end of the year. Two-year and 10-year Treasury yields were lower by 4.1 basis-points and 7.5 basis-points respectively, overall dragging the US dollar to its two-week low while supporting a 1% jump in gold prices.

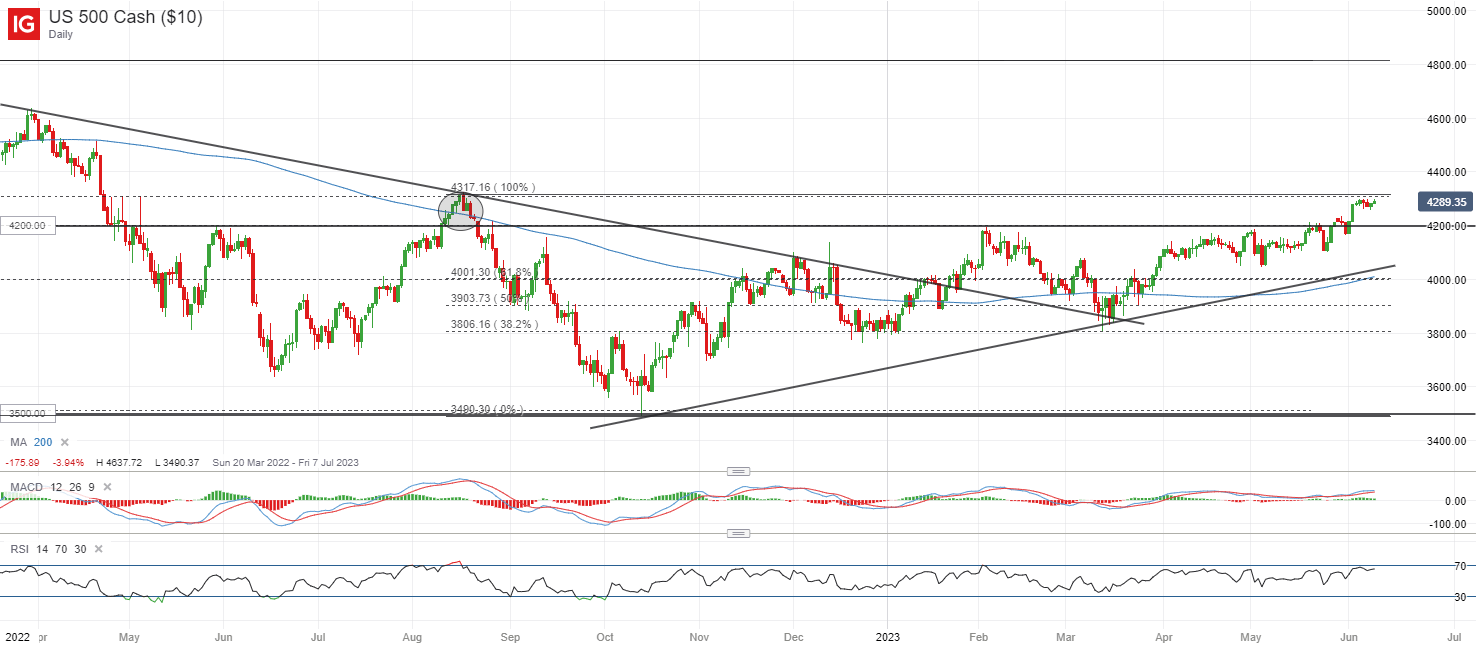

The quiet front on the economic schedule today may lead to a drift in Wall Street in the lead-up to the US Consumer Price Index (CPI) and the FOMC meeting outcome next week, which will be key catalysts to dictate whether the S&P 500 can deliver a break above its 4,320 level of resistance. For now, the CNN Fear and Greed Index has reflected market sentiments in “extreme greed” territory for the first time in four months. Previous two instances where the index touches this territory in December 2022 and February 2023, the S&P 500 forms a near-term top shortly thereafter. While it may not necessarily play out this time round, it suggests that risks may be considerably higher and a buy-on-retracement approach may be the preferred option.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +1.62%, ASX +0.26% and KOSPI +0.43% at the time of writing, tracking the renewed gains in Wall Street overnight. The economic calendar today will place market focus on China’s inflation figures, which are expected to reinforce a low-for-longer growth outlook but could be seen as an added justification for more support stimulus from Chinese authorities.

Current consensus is for a subdued 0.3% rise in its headline consumer prices (previous 0.1%) as a reflection of still-soft demand, while producer prices is expected to decline for the eighth consecutive month (consensus -4.3% versus previous -3.6%).

Any higher-than-expected read may provide a much-needed positive surprise by pointing to stronger consumer demand but with the China’s Citi economic surprise index trending in negative territory for the first time since its reopening efforts in January this year, a clear trend of economic resilience will be what investors may want to see to support greater conviction for Chinese equities.

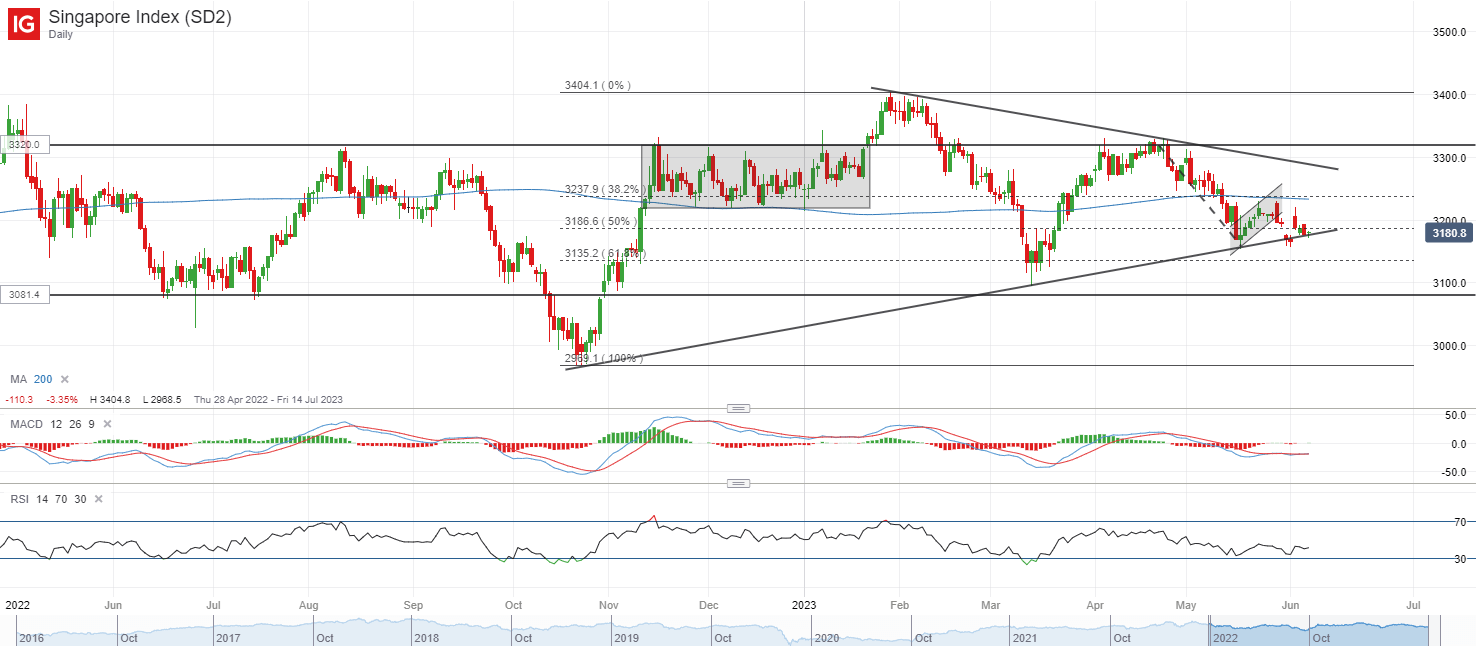

Closer to home, the Straits Times Index has been attempting to defend a key upward trendline support at the 3,180 level but intermittent bounces thus far have been short-lived as a reflection of strong selling pressures. A bearish flag formation since April this year remains in place and should the trendline support fail to hold ahead, a retest of its year-to-date bottom may be in sight. On any upside, the index will have to face a test of resistance confluence around the 3,220 level, where a previous support-turned-resistance stands alongside its 200-day moving average (MA).

Source: IG charts

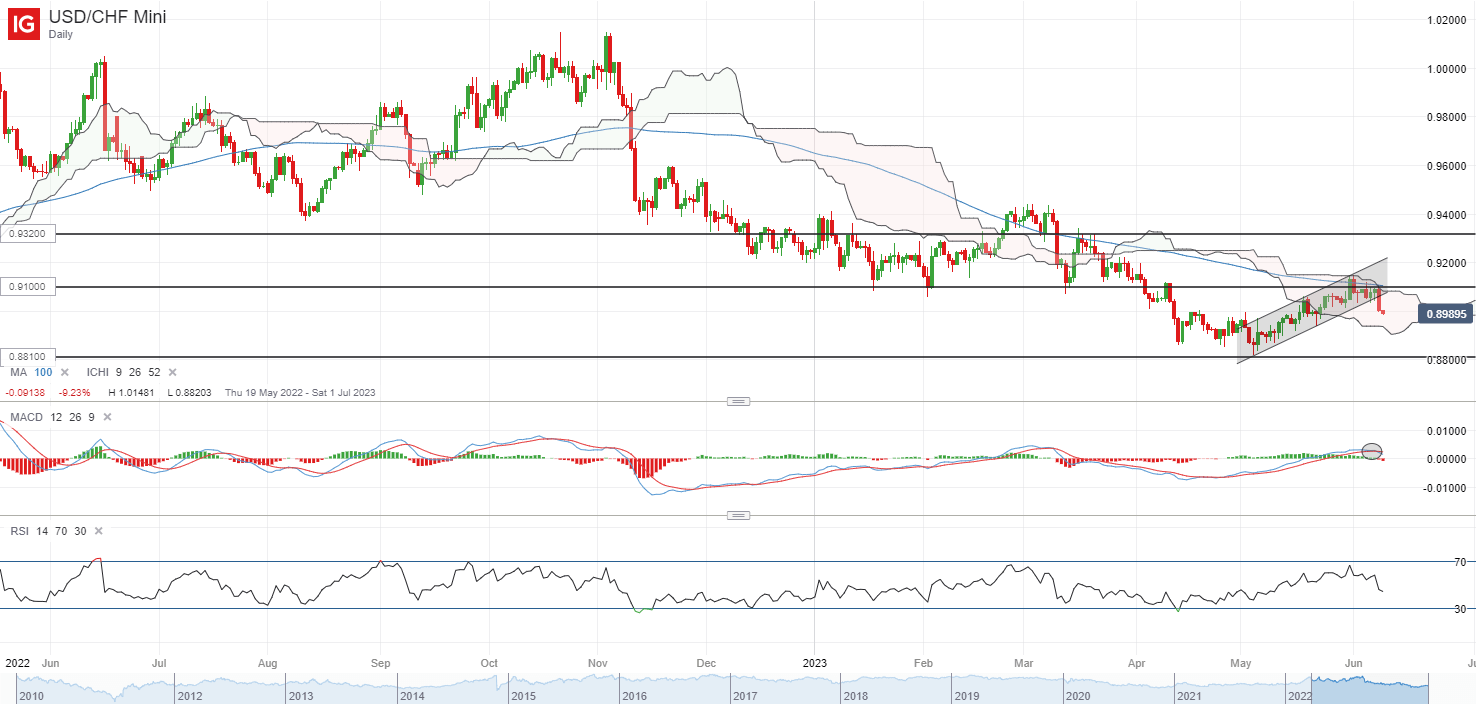

On the watchlist: USD/CHF dived 1.2% on retest of resistance confluence

The USD/CHF has given back all of its past two weeks’ gains with a 1.2% dive overnight, following another failed attempt in overcoming the upper edge of its Ichimoku cloud on the daily chart. A more-than-expected rise in US initial jobless claim figure puts an overnight drag on the US dollar (-0.7%) while on the other hand, a highlight on inflation persistence by Swiss National Bank (SNB) Chairman Thomas Jordan suggests that its central bank’s policy may diverge with additional hikes being priced over the two meetings.

The confluence of both events saw a downward break of a near-term rising channel pattern for the USD/CHF, with a bearish crossover displayed on moving average convergence divergence (MACD). Near-term, the 0.910 level will be a key resistance level to overcome, where a move above the Ichimoku cloud resistance may support a move to retest the 0.922 level next. For now, selling pressures remain dominant, with further downside potentially leaving its May 2023 bottom on watch.

Source: IG charts

Thursday: DJIA +0.50%; S&P 500 +0.62%; Nasdaq +1.02%, DAX +0.18%, FTSE -0.32%

Comments are closed.