USDJPY Heads Lower as Market Digests a More Dovish Fed

USDJPY Analysis and Charts

- USD/JPY fell sharply after the Fed on Wednesday

- The prospect of fewer rate hikes ahead clearly weighed on the Greenback

- Major Japanese businesses remain gloomy, data showed

Recommended by David Cottle

How to Trade USD/JPY

The United States Dollar remained close to seven-week lows against the Japanese Yen as European trade got underway on Thursday. A bout of broad Dollar weakness has followed the Federal Reserve’s decision to raise interest rates again,

While this may seem a little counterintuitive, as higher interest rates might be generally expected to support a currency, the Fed weighed in with some more cautious commentary in the wake of clear stresses on the domestic US banking system.

The central bank dialed back its forward guidance, the view it takes on likely future policy action. Chair Jerome Powell said on Wednesday that some additional policy firming may now be appropriate, a clearly less emphatic phrase than his previous take, which was that an ongoing process of increases was likely necessary. Powell was at pains to reassure the world that the US financial sector remains ‘sound and resilient’ in the wake of the failure at Silicon Valley Bank and the extension of credit lifelines to another lender, First Republic.

Faced with the prospect of fewer rate rises ahead, it’s less surprising that the Dollar should slide, and, sure enough, it’s the ‘USD’ side of USD/JPY that’s done most of the heavy lifting through the European session. There was some bad news out of Japan, in the form of the closely watched Reuters ‘Tankan’ survey which found the mood at the country’s large manufacturers gloomy for a third straight month.

Persistent worries about global demand and the damage entrenched weakness there might do to Japan’s formidable export machine are understandably weighing on sentiment.

However, US interest rate prospects and their knock-on effects on Treasury bond yields are likely to remain the substantial driver for USD/JPY.

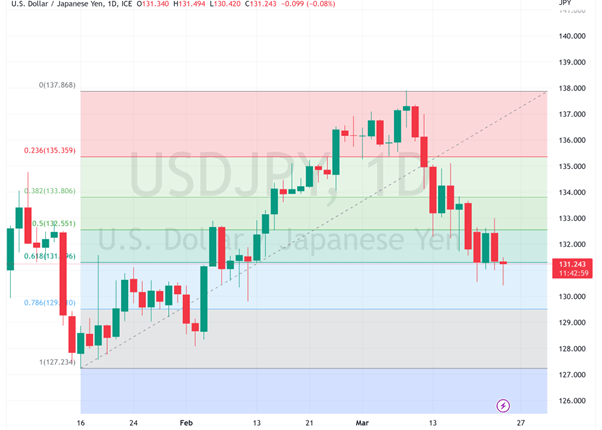

USD/JPY Technical Analysis

Chart Compiled Using TradingView

The pair is currently finding support at the fourth Fibonacci retracement of its rise up to the highs of March 8 from the lows of January 16. That comes in at 131.264 and it has so far held on a daily closing basis despite being probed by Dollar bears in the last four sessions. They have managed to nudge the pair below it in intraday trade, however, and the level remains very close to the current market and under clear threat.

Even if bulls manage to hold the line, there will be clear suspicions that a ‘head and shoulders’ pattern is forming on the daily chart, which could mean further falls ahead. The left ‘shoulder’ under this scenario would be seen on February 7 and 8, when price action around current levels was last seen.

USDJPY Sentiment is Bearish

| Change in | Longs | Shorts | OI |

| Daily | 10% | -8% | 0% |

| Weekly | 26% | -5% | 8% |

Sentiment toward USD/JPY is unremittingly bearish according to IG’s own indicator. It finds fully 80% of participants expect further falls, which is such a large share of the total as to suggest that the bearishness may now be a little overdone, faint hope though that will be to Dollar bulls.

–By David Cottle For DalyFX

Comments are closed.