USD/MXN Short-Term Rally Continues as US Treasury Yields Climb

USD/MXN, JPY/MXN – Prices, Charts, and Analysis

- USD/MXN bounces after posting a multi-year low.

- Will demand for EM currency yield continue to boost the Mexican Peso?

Recommended by Nick Cawley

Get Your Free USD Forecast

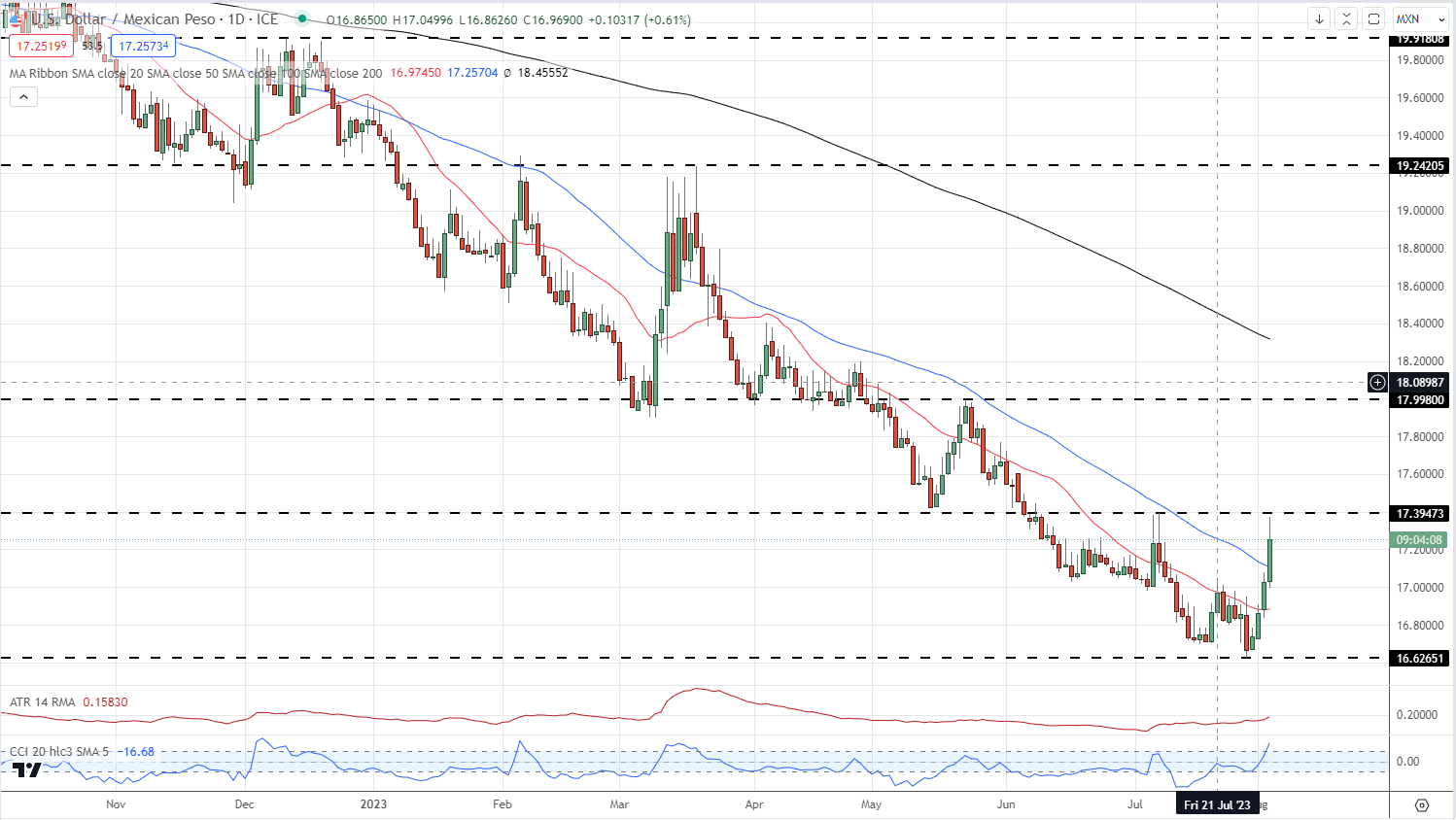

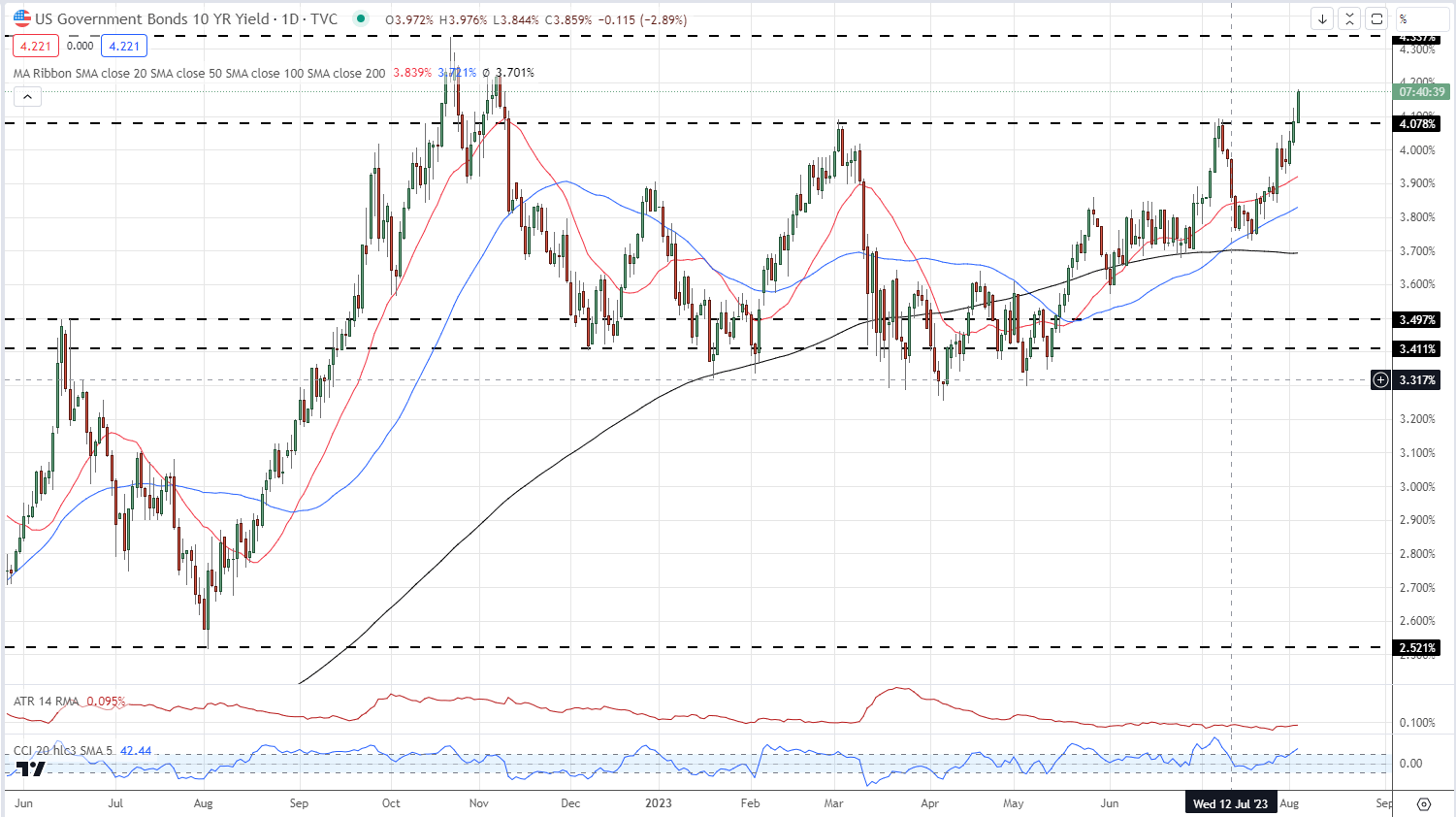

One of the star FX performers over the last three years, the Mexican Peso is currently giving back a small part of its recent gains to a resurgent US dollar. The USD/MXN rate hit its lowest level in over seven years last Friday (16.63) before this week’s pick up in US Treasury yields gave the greenback a boost across the board. US Treasury yields are moving higher as fears of a recession fade, while the heavy upcoming supply schedule is giving US Treasury investors the backdrop to demand more yield for their money.

US 10-Year Treasury Yield Daily Chart – August 3, 2023

Recommended by Nick Cawley

Building Confidence in Trading

The daily USD/MXN chart shows the pair has now broken above both the 20- and 50-day simple moving averages for the first time since mid-March. These two moving averages have been guiding the pair lower for around one year and a confirmed break above both may signal a slowdown, or an end, to the longer-dated move lower.

USD/MXN Daily Price Chart – August 3, 2023

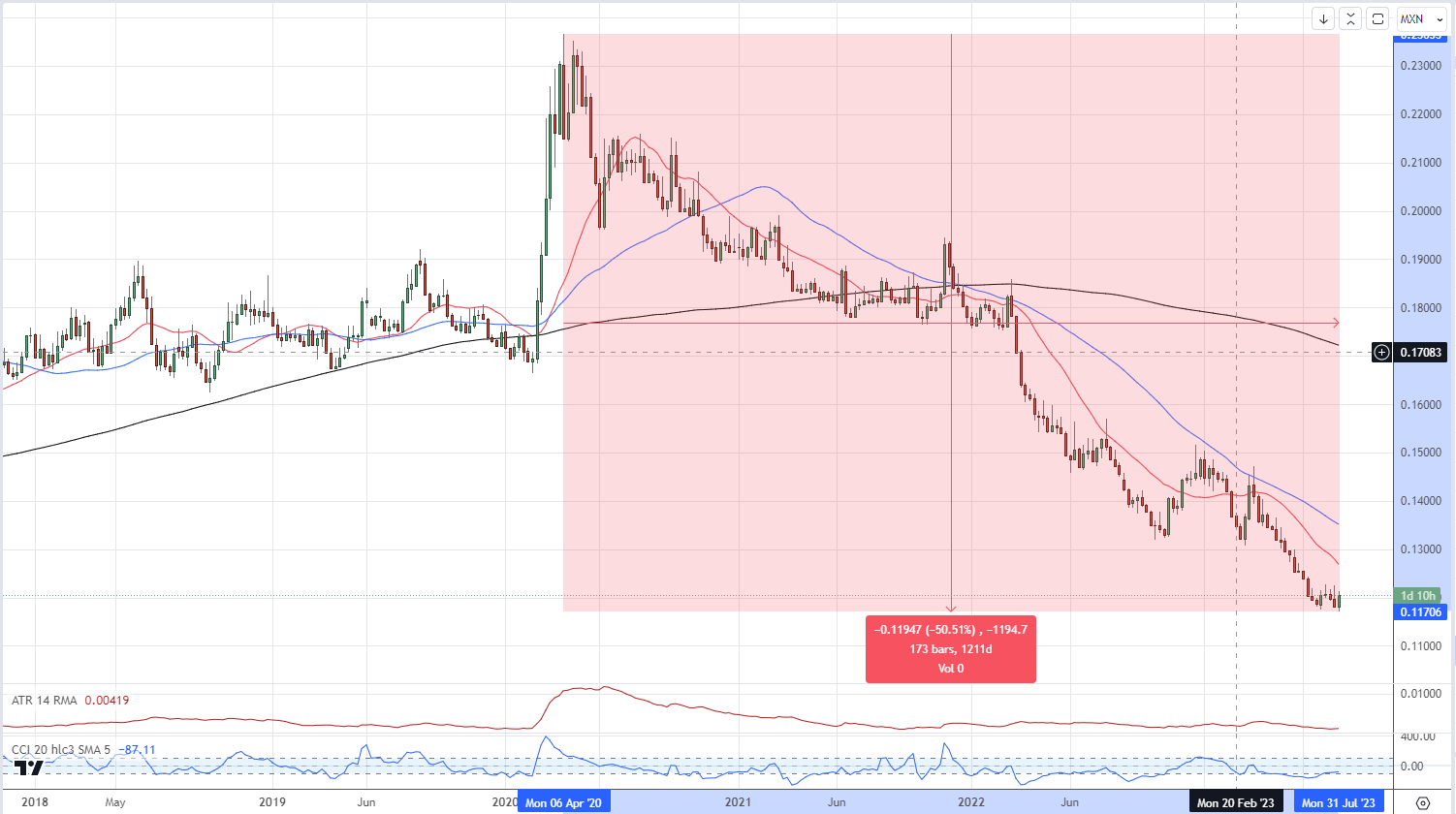

Another pair to show the strength of this rate-differential is JPY/MXN with the high-yielding Mexican Peso appreciating by over 50% (high to low) against the low-yielding Japanese Yen. While the Mexican central bank has been hiking rates ever higher, the Bank of Japan has left its borrowing rate at ultra-low levels in an effort to boost inflation. The widening interest rate differential between the two currencies has seen JPY/MXN on a one-way path over the last 3+ years. As long as the Bank of Japan stays put on monetary policy, JPY/MXN will struggle to break higher.

JPY/MXN Weekly Price Chart – August 3, 2023

Charts via TradingView

What is your view on the Mexican Peso – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.