USD/JPY Slips but AUD/USD Breaks Out After Fed, NFP Ahead

USD/JPY AND AUD/USD OUTLOOK:

- USD/JPY retreats for the second straight day as the broader U.S. dollar softens after the Fed fails to steer markets toward pricing another hike

- Meanwhile, AUD/USD breaks out to the topside after clearing trendline resistance

- Attention now turns to Friday's U.S. economic data, which includes the nonfarm payrolls report and the ISM services survey

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: EUR/USD, Gold Forecast – Powell Fails to Steer Markets Towards Another Hike. What Now?

The U.S. dollar depreciated broadly on Thursday after the Federal Reserve kept interest rates unchanged and did little to guide markets toward another potential hike. While the FOMC maintained a tightening bias in its statement, Chairman Powell fail to strongly endorse further policy firming, leading traders to conclude that the terminal rate has been reached and the hiking campaign is effectively over.

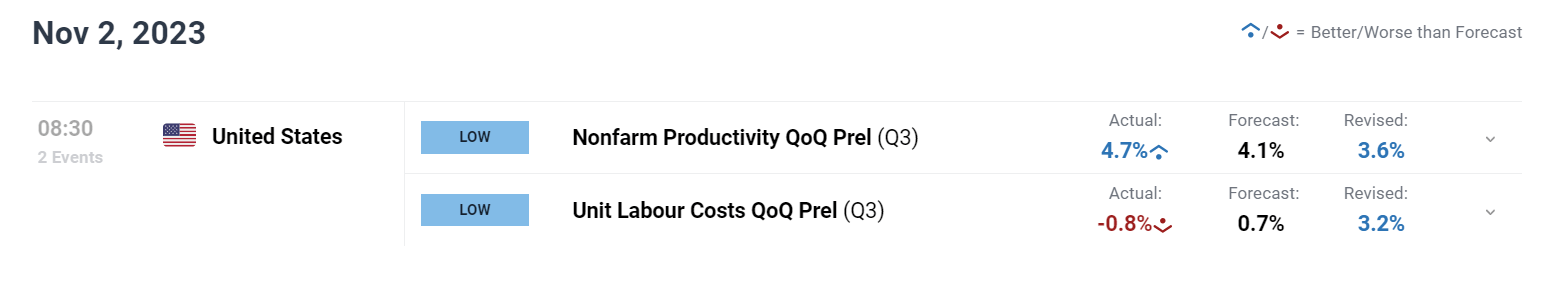

U.S. economic data released this morning accelerated the greenback’s descent after reinforcing the pullback in Treasury yields. For context, U.S. labor costs showed a surprising contraction in the third quarter, falling 0.8% versus expectations for a 0.7% increase, indicating that wage pressures are easing at a time of rising productivity, an encouraging development for the central bank.

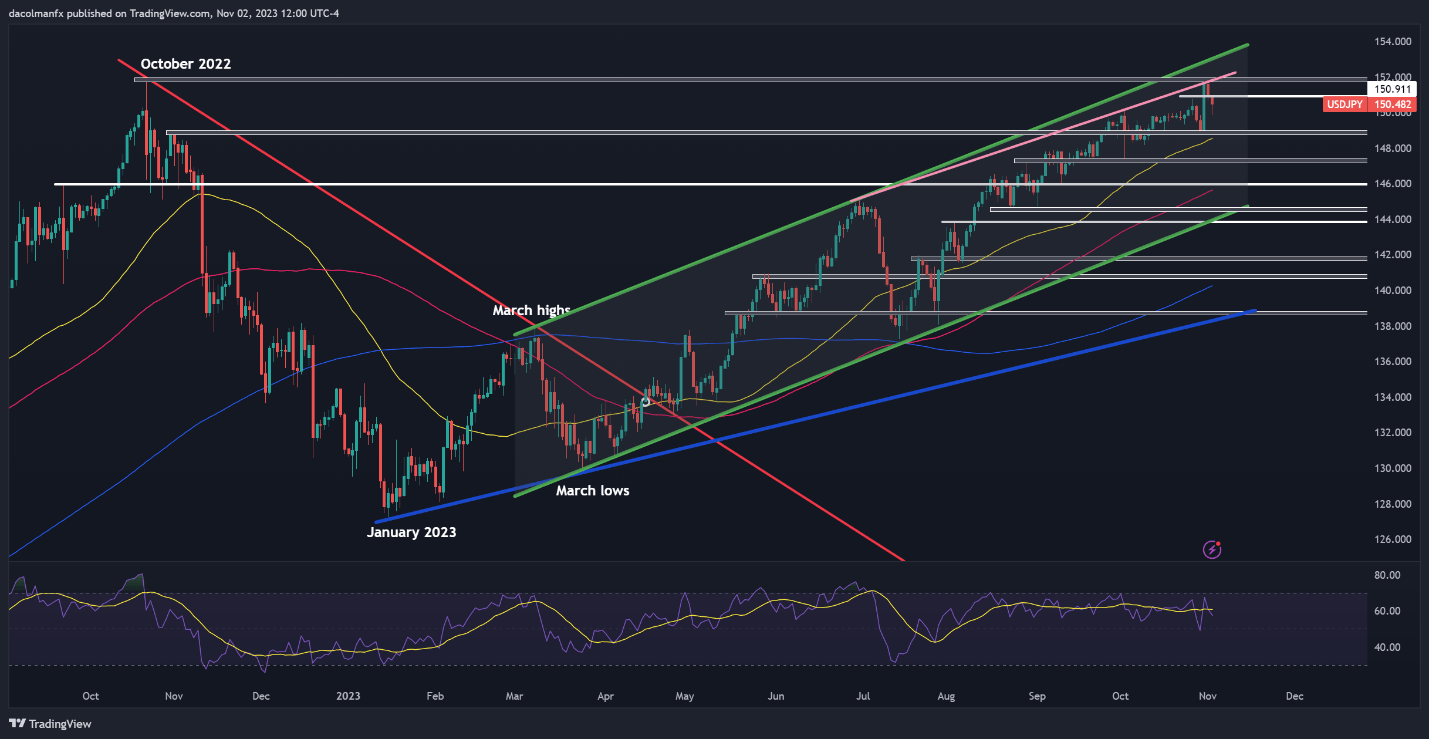

US TREASURY CURVE TODAY VERSUS MONDAY

Source: TradingView

Seeking actionable trading insights? Download our top trading opportunities guide packed with interesting technical and fundamental trading setups!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

US DATA AT A GLANCE

Source: DailyFX Economic Calendar

With the Fed pledging to proceed carefully, perhaps in recognition that the full impact of past actions has yet to be felt, the U.S. dollar may soon undergo a prolonged downward correction, especially if sentiment stabilizes. To trust this assessment, however, incoming data will have to confirm that the economic outlook is deteriorating under the weight of overly restrictive financial conditions.

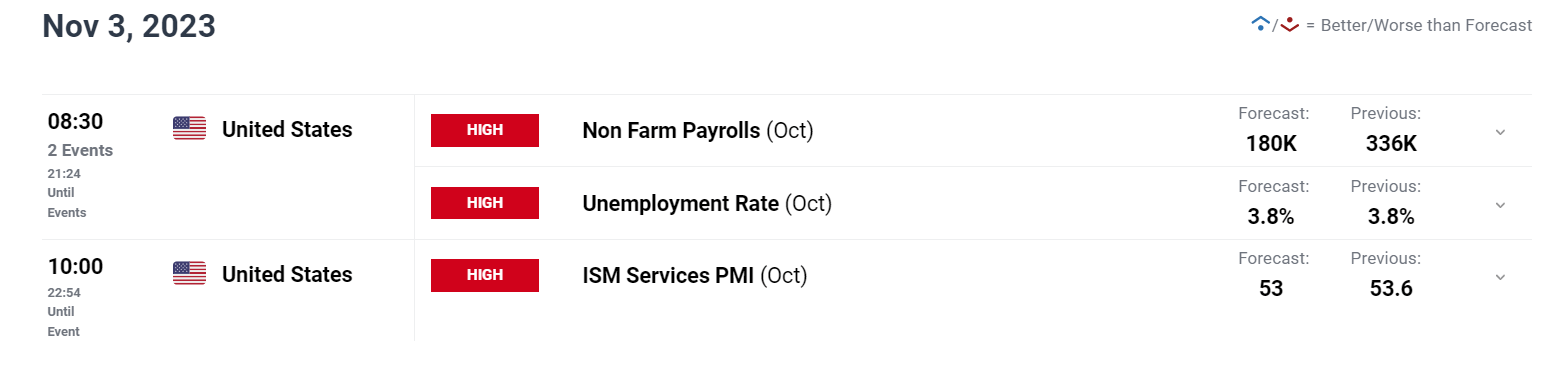

Traders will have a chance to gauge the health of the overall economy on Friday when the U.S. October nonfarm payrolls numbers and the ISM services PMI survey are unveiled. If both reports surprise to the downside, in a manner reminiscent of ISM manufacturing activity earlier this week, the U.S. dollar could take a big hit, resulting in a sharp pullback for USD/JPY and a meaningful rally for AUD/USD.

The figure below reflects investors' outlook for both releases

Source: DailyFX Economic Calendar

For a comprehensive view of the Japanese yen's fundamental and technical outlook, grab a copy of our Q4 trading forecast today. It’s totally free!

Recommended by Diego Colman

Get Your Free JPY Forecast

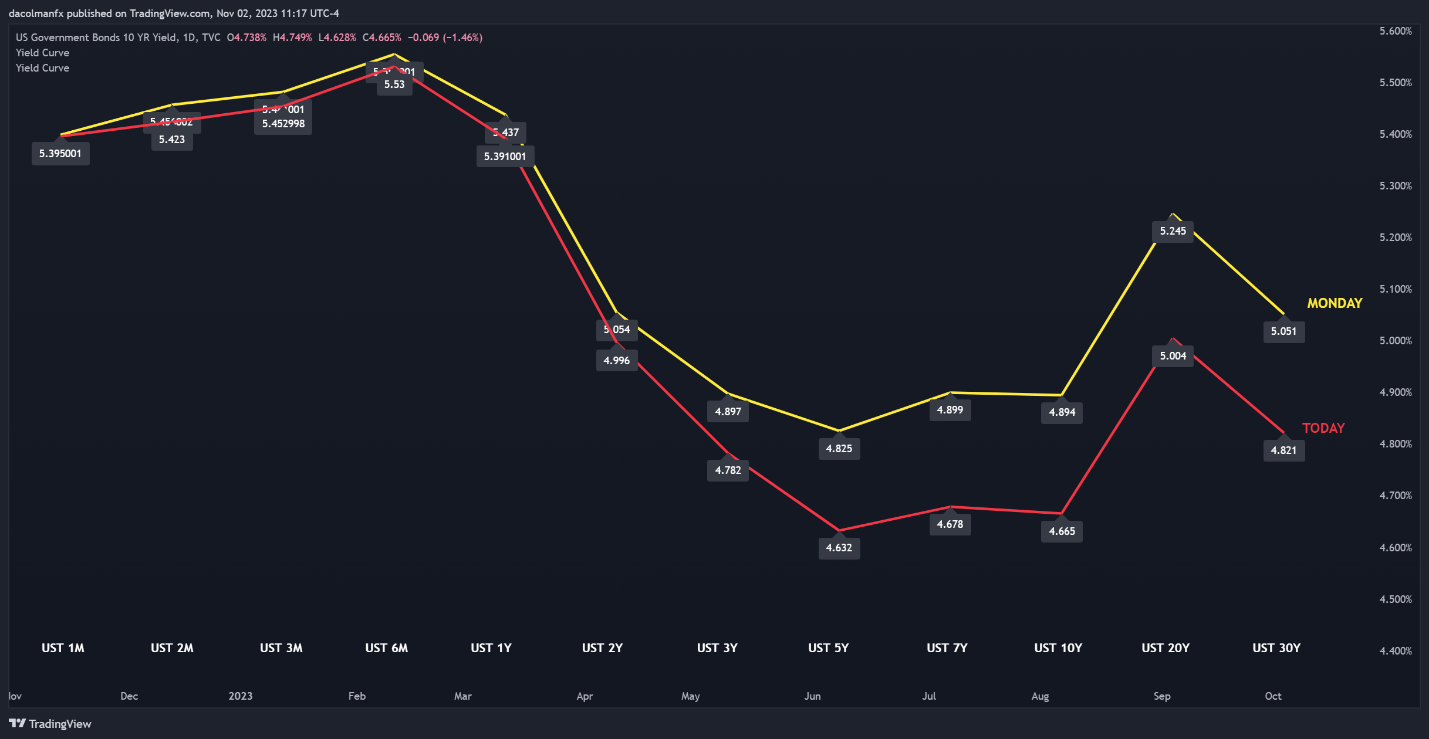

USD/JPY TECHNICAL ANALYSIS

USD/JPY fell on Thursday, extending losses for the second straight day after failing to clear resistance around the psychological 152.00 level earlier in the week. If the decline extends further in the coming sessions, support is seen at 148.75. While the pair may establish a base in this area on a pullback, a breakdown might entice new sellers into the market, potentially resulting in a drop toward 147.30.

On the other hand, if the bullish camp reasserts dominance and initiates an upward reversal, technical resistance stretches from 151.95 to 152.00, where this year's high aligns with the 2022 peak. If strength is maintained, we could see a potential rally towards 153.00, which corresponds to the upper boundary of a medium-term rising channel, as shown in the daily chart below.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Looking for informative insights into where the Australian Dollar is headed and the crucial market drivers to keep on your radar? Explore the answers in our Q4 trading guide. Download a free copy today!

Recommended by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL ANALYSIS

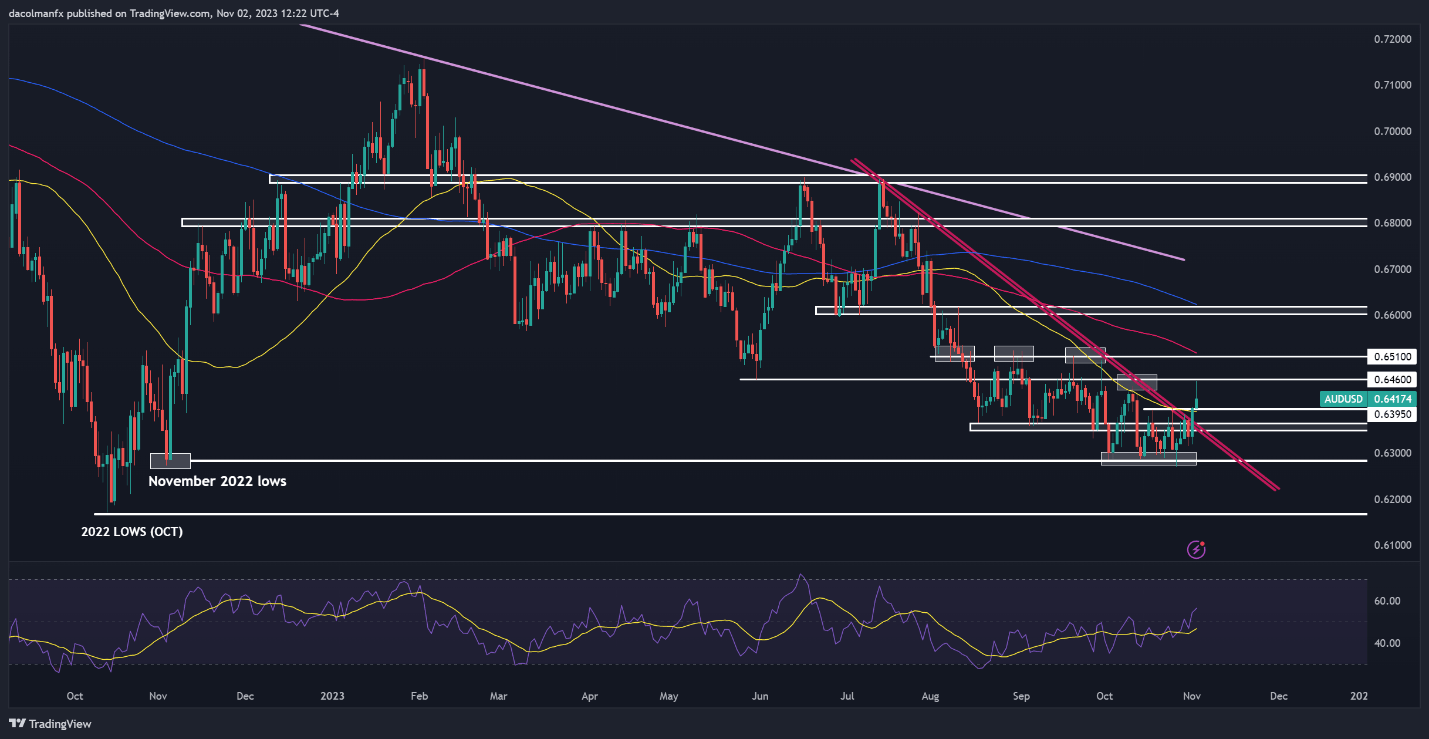

AUD/USD has been in a prolonged downtrend, with sharp declines since mid-July, as shown in the chart below. Late last week, however, prices managed to find support near the 0.6275 area before staging a moderate comeback in the days that followed. This rebound took the pair above trendline resistance and the 50-day simple moving average, creating a more constructive backdrop for the Australian dollar.

For AUD/USD's outlook to improve further, bulls need to take out overhead resistance at 0.6460. If this scenario plays out, we could see a rally towards 0.6510. On further strength, buyers could be emboldened to launch an attack on the 0.6600 handle. Conversely, if sellers return and regain the upper hand, initial support appears at 0.6395, followed by 0.6360. Below this area, attention turns to the 2023 lows.

AUD/USD TECHNICAL CHART

AUD/USD Chart Created Using TradingView

Comments are closed.