USD/JPY Rebounds as Investors Pile into Japanese Government Bonds

USD/JPY News and Analysis

Recommended by Richard Snow

How to Trade USD/JPY

Japanese Government Bond Yields Tumble on Potential Banking Contagion

Japanese government bonds were bid on Tuesday (resulting in falling yields due to the inverse relationship between a bonds price and its yield) as investors sought safety. The Japanese banking index dropped 16% over three days as major losses in Silicon Valley Bank’s bond portfolio highlighted the extensive bond holdings present on the balance sheets of Japan’s largest banks. The banking industry has been plagued by years of ultra-easy monetary policy which has restricted the amount of interest banks can charge on loaned funds.

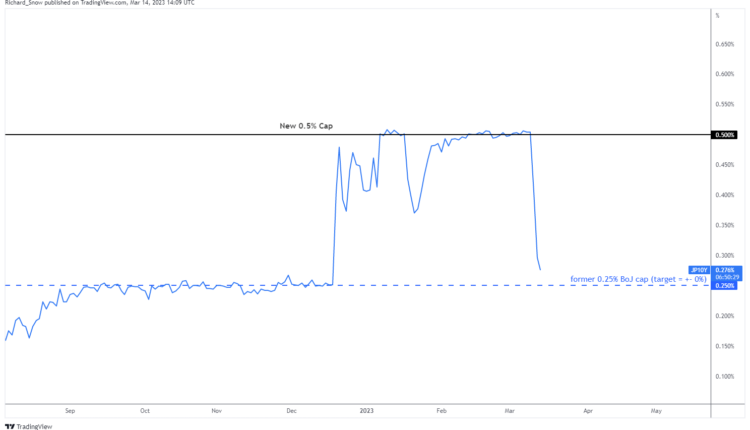

The 10 year Japanese government bond yield dropped from the new cap of 0.5% below the former cap of 0.25% earlier today, only to recover above 0.25%. The drop in the yields aligns with other major economies that have seen outflows in riskier assets like stocks as investors seek the safety of government backed securities like bonds.

10 Year Japanese Government Bond (JGB) Dropping from the Capped Level of 0.5% to the

Source: TradingView, prepared by Richard Snow

Trading Strategies and Risk Management

Volatility

Recommended by Richard Snow

USD/JPY Attempts to Pullback Losses as Rate Differential Rises

USD/JPY rose into the US session on Tuesday, as the dollar attempted to halt recent losses. In times of market distress, both the dollar and yen are seen as safe havens, although the dollar has come off in recent sessions – largely as a result of massively revised future fed funds rates and lower revisions in US yields, particularly the 2 year yield.

The chart below shows the interest sensitivity of the pair which broadly trades in line with changes in the countries’ interest rate differential. With the BoJ intervening in the bond market to maintain low borrowing costs for Tokyo, the rate differential largely follows changes in the US 10 year yield.

USD/JPY Daily Chart with Interest Rate Differential (US 10 year yield – JP 10 year yield)

Source: TradingView, prepared by Richard Snow

Price action has broken below the rising wedge/channel formation, as well as the zone of support around 134.50, but stopped short of 131.35. The level of 131.35 remains crucial to themes of a bearish continuation but the recent rise in USD/JPY necessitates consideration of the pullback and how long it can continue. To the upside, prices will need to rise and close above 134.50 and the underside of the wedge formation to provide a clearer indication of bullish intent and a rise above the recent high around 138.20 would suggest that bulls may be making a resurgence.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.