USD/JPY Grinds Lower as Fear Overshadows UBS/Credit Suisse Deal

US Dollar/ Japanese Yen (USD/JPY) Price Forecast:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/JPY slips as a deal between Credit Suisse and UBS fails to calm fears

The price of USD/JPY is currently trading 3.80% this month, losing an additional 0.60% today (at the time of writing). As the US financial system takes strain, the Japanese Yen has benefited from its safe-haven appeal.

While UBS has agreed to a takeover of embattled Credit Suisse for $3.25 billion with further assistance offered to the buyer from the Swiss National Bank. After the collapse of SVB, the integrity of the financial system came into question, sparking a sell-off of banking stocks. Since then, turmoil has spread to other key players like First Republic Bank who has received a $30BN rescue package from a consortium of 11 major banks (including JP Morgan & Citibank).

Related Articles: UBS Rescues Credit Suisse, Fed Increases Dollar Liquidity , Gold Hits a One-Year High

Major Risk Events for the Week Ahead

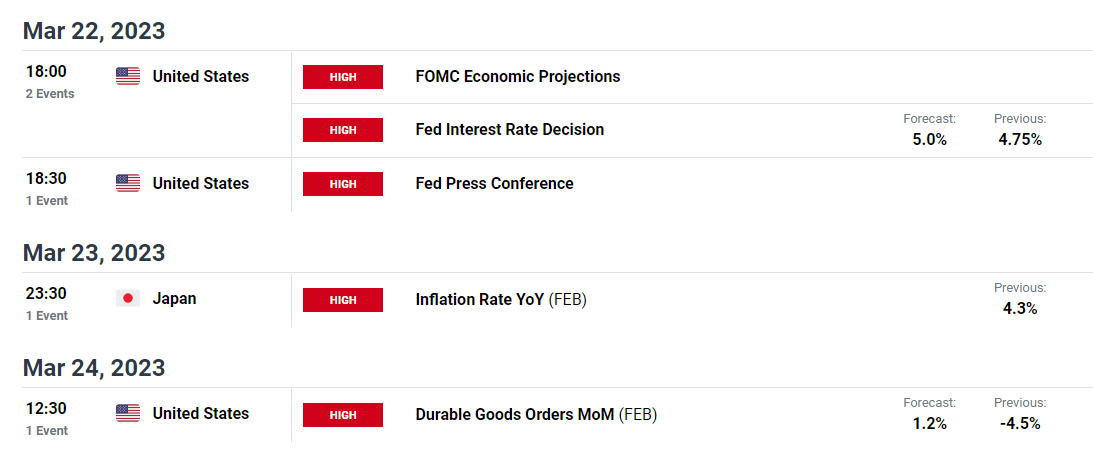

Although contagion from the recent banking crisis will likely remain in focus this week, the economic calendar highlights additional data releases and events that could influence the short-term move.

DailyFX Economic Calendar

On Wednesday, the FOMC economic projections and the Fed rate decision will be monitored closely, followed by the release of Japan’s inflation data on Thursday.

Recommended by Tammy Da Costa

How to Trade USD/JPY

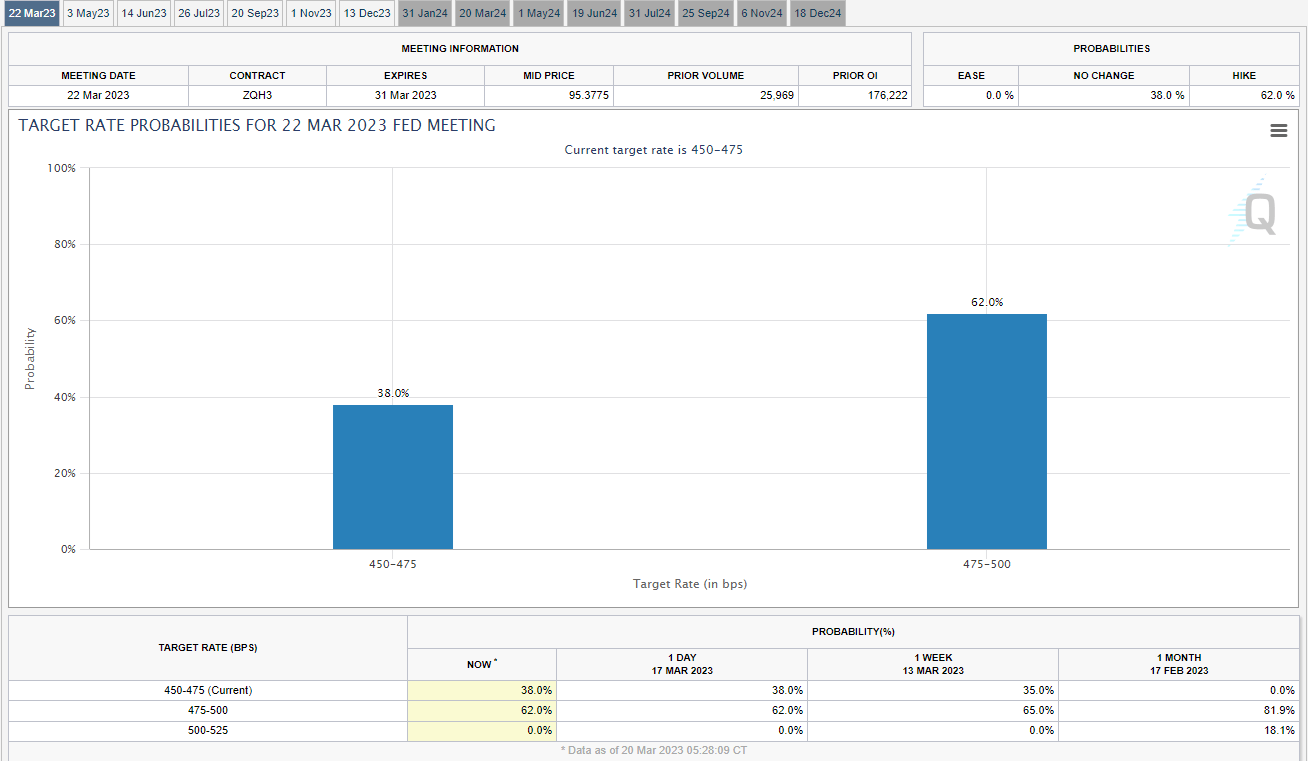

While the Federal Reserve hinted at another 50 basis-point rate hike earlier this month, concerns of financial instability have dramatically reduced the odds of an aggressive move. This has placed the central bank in a difficult position to balance the objectives of their dual mandate while simultaneously reducing recession fears. As inflation remains well-above the Fed’s target rate of 2% (currently at 6%), the figures over the past eight months have shown positive signs of easing. But, up until now, a robust labor market has allowed the Fed to implement restrictive monetary tightening without major implications.

Visit DailyFX Education to learn about the relationship between interest rates and FX

That was until Silicon Valley Bank, Credit Suisse and First Republic Bank fell into turmoil which was partially caused by rising borrowing costs.

However, with the ECB increasing rates by 0.5% last week, the probability of a 25bp (0.25%) now sits at 62%. With these expectations already priced in, the Dollar appears to be lacking creditability, boosting the safe-haven Yen.

Source: CME FedWatch Tool

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

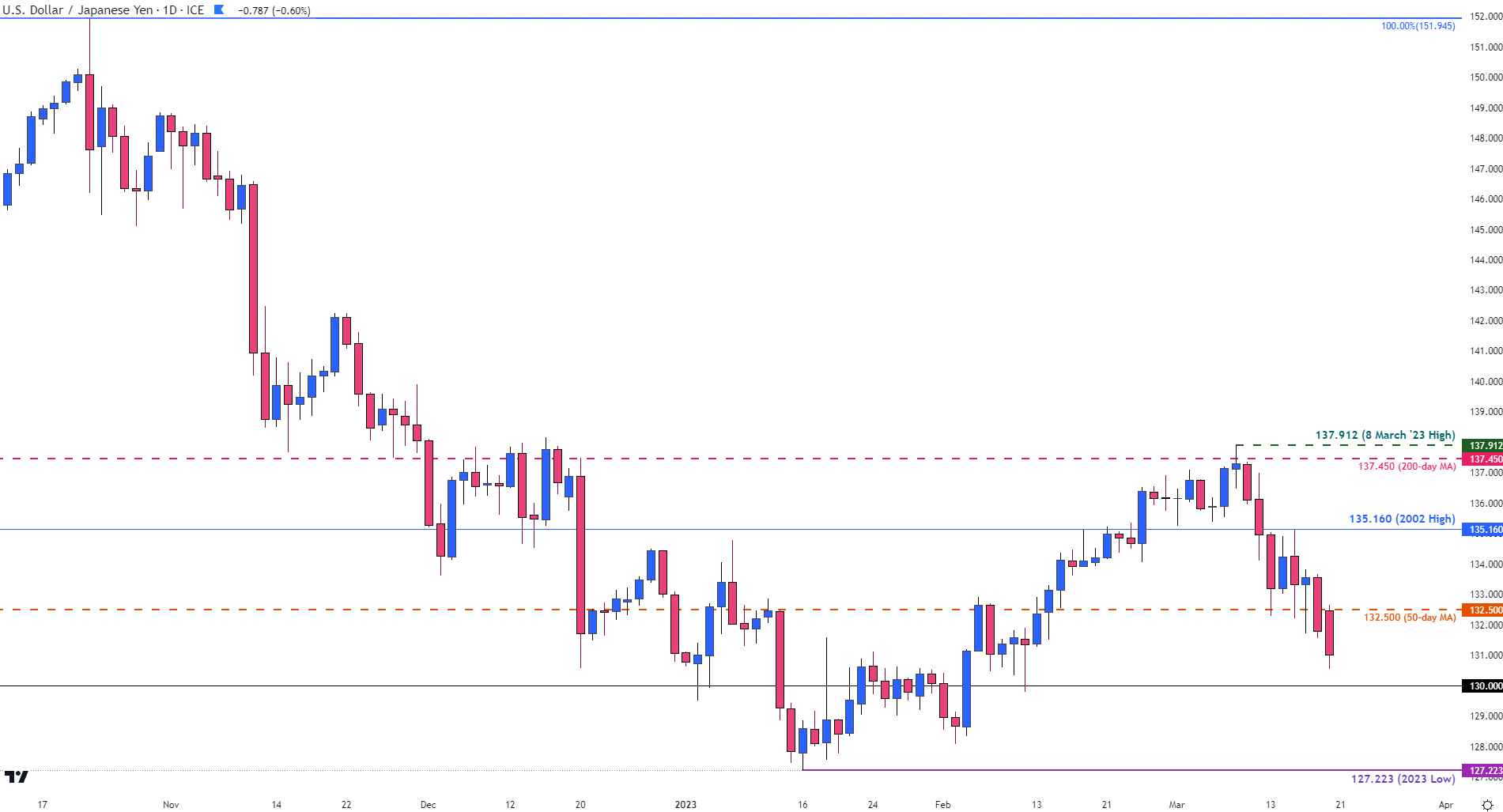

USD/JPY Technical Analysis

After breaking below the 50-day MA (moving average) earlier today, USD/JPY is now looking to retest the key psychological level of support at 130.00.

With the major currency pair could be susceptible to further declines, the events on the economic docket could serve as an additional catalyst for the Dollar Yen cross. If bearish momentum gains traction below 130.00, it is possible for prices to fall below the January low of 127.223.

USD/JPY Daily Chart

Chart prepared by Tammy Da Costa using TradingView

For bulls to regain confidence, a hold above the 50-day MA could bring the 2022 high back into play at 135.160.

USD/JPY Price Levels – Looking Ahead

| Support | Resistance |

|---|---|

| 130.545 (Daily low) | 132.500 (50-day MA) |

| 130.00 (Psychological level) | 135.160 (2022 High) |

| 127.223 (2023 Low) | 137.450 (200-day MA) |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Comments are closed.