USD/JPY, GBP/JPY, and CAD/JPY Latest

Japanese Yen USD/JPY, GBP/JPY, CAD/JPY Prices, Charts, and Analysis

- Japanese Yen-pairs continue to weaken.

- Officials warn of intervention to stem ‘rapid and one-sided’ Yen moves.

- CAD/JPY prints a fresh 8-month high, GBP/JPY a new 7.5-year high.

Recommended by Nick Cawley

How to Trade USD/JPY

One of Japan’s top currency officials, Masato Kanda, has been on the wires warning about the current bout of Japanese Yen weakness. Kanda noted that the Yen moves are ‘rapid and one-sided’ and that Japanese officials will monitor the situation and ‘take appropriate responses to excessive moves’. The thinly-veiled warning to the foreign exchange market is seen as a renewed attempt to rein in Yen speculators without having to alter the countries’ ongoing ultra-loose monetary policy. Japanese authorities last intervened in the FX market in late October 2022 when USD/JPY traded a fraction under 152.00. The market subsequently fell back to 127.15 over the next three months before turning higher. USD/JPY currently trades just under 144.00.

Bank of Japan (BoJ) – Foreign Exchange Market Intervention

While all three charts – see below – look positive and likely to see further Yen weakness, traders should be cognizant of the risks of further warnings or market intervention. All three charts show have left little in the way of support as they have rallied and this leaves them vulnerable to sharp falls if Japanese officials back up their words.

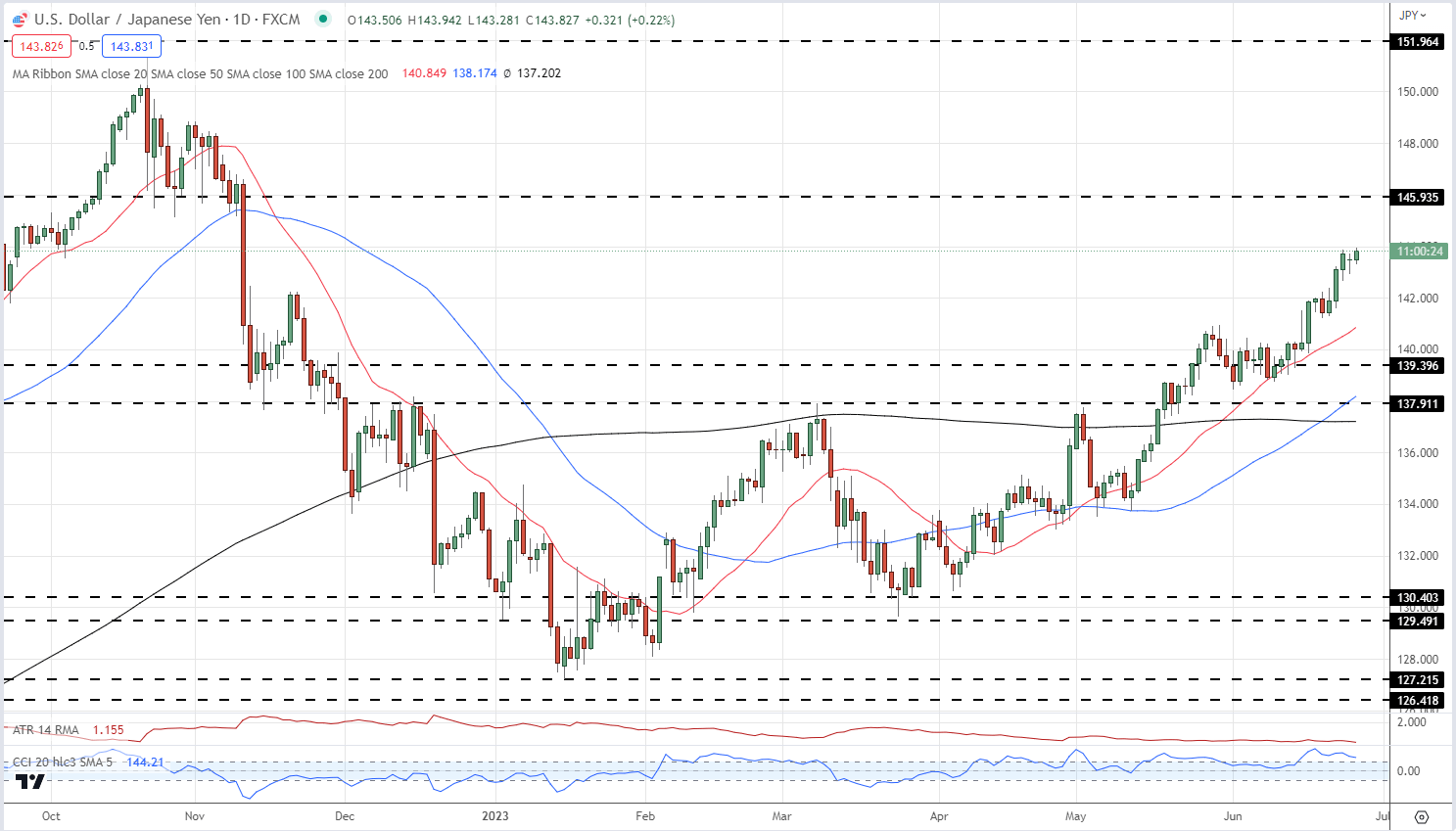

USD/JPY continues to print fresh multi-month higher highs and higher lows, a sign of a strong bull market, while the 50-dma/200-dma golden cross made early last week is seen as another bullish driver. The next target is 145.9.

USD/JPY Daily Price Chart – June 27, 2023

| Change in | Longs | Shorts | OI |

| Daily | 0% | 3% | 2% |

| Weekly | -3% | 7% | 4% |

Retail Sentiment are Net-Short

Retail trader data shows 28.61% of traders are net-long with the ratio of traders short to long at 2.49 to 1.The number of traders net-long is 10.77% higher than yesterday and 1.80% higher than last week, while the number of traders net-short is 2.36% higher than yesterday and 5.74% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

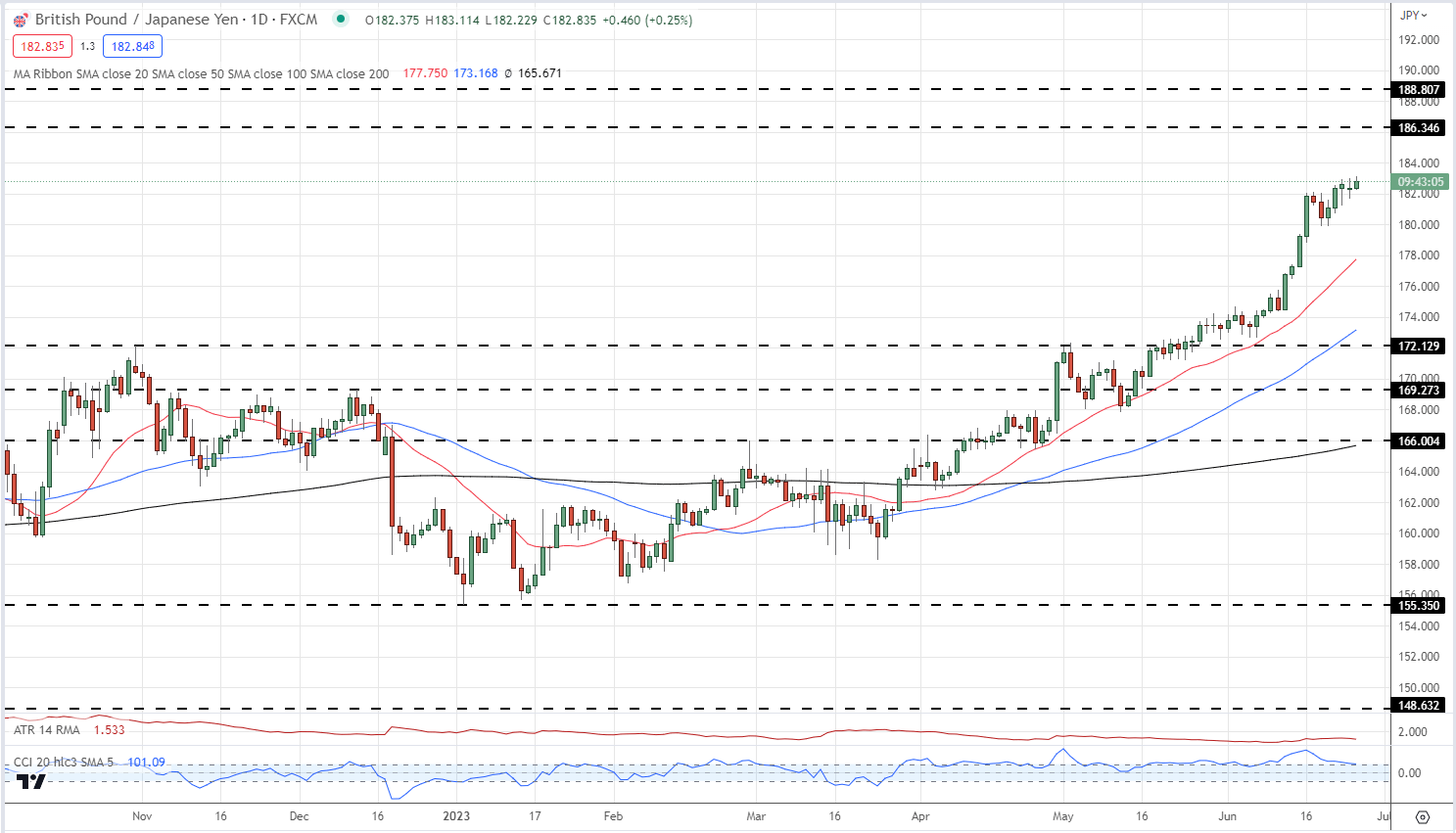

GBP/JPY has been a one-way trade since the start of the year with the British Pound appreciating by nearly 18% against the beleaguered Yen. All three moving averages have been positive for months, while the 50-dma/200-dma golden cross formed in late April gave the pair a further boost. GBP/JPY now trades at levels last seen nearly seven-and-a-half years ago.

GBP/JPY Daily Price Chart – June 27, 2023

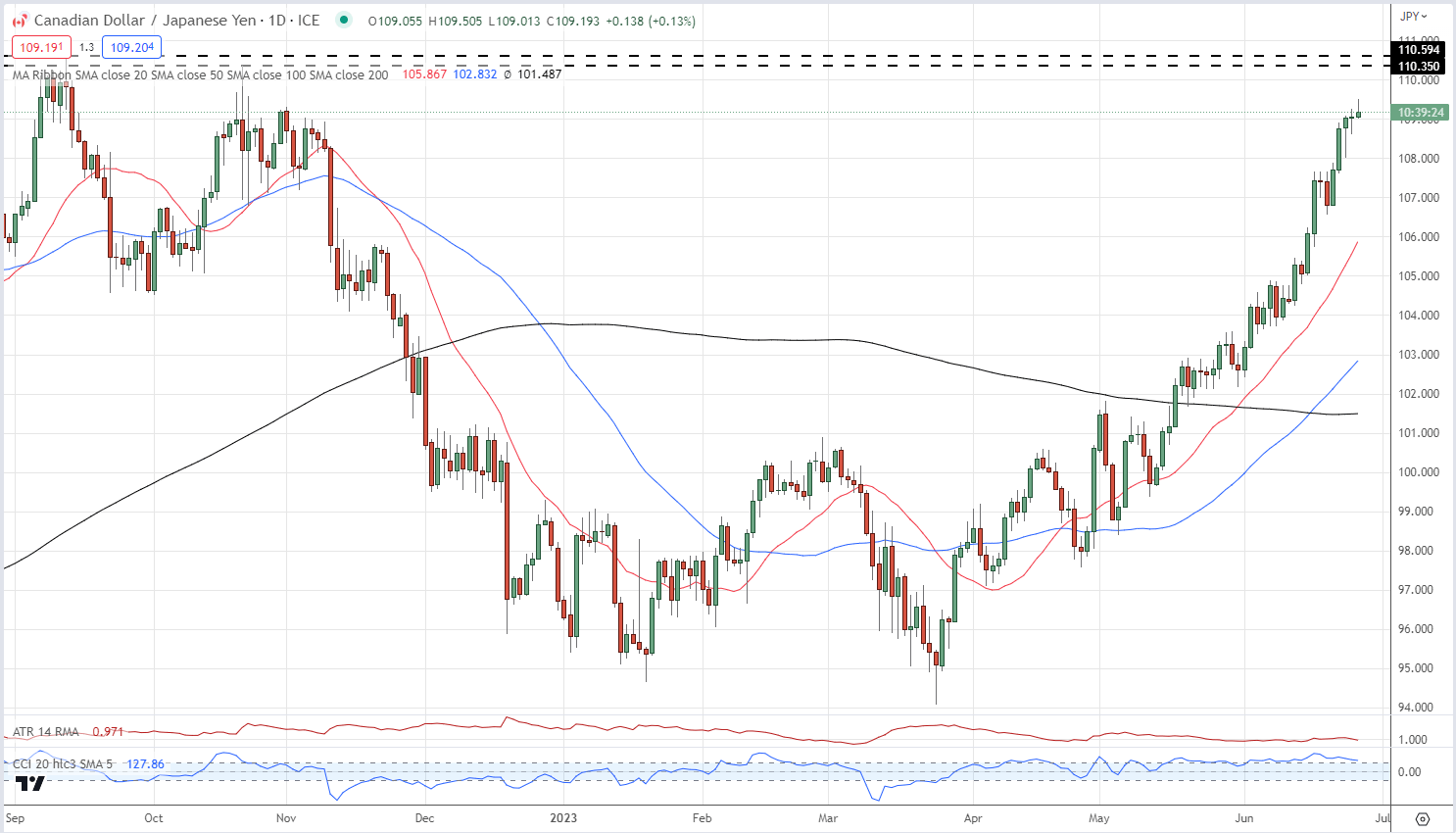

CAD/JPY is another example of a strong vs weak currency pair with the Canadian dollar currently running hot across the fx market. CAD/JPY has appreciated over 16% since the end of March and currently eyes prior highs at 110.35 and 110.59.

CAD/JPY Monthly Price Chart – June 27, 2023

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

All charts via TradingView

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.