USD/JPY Drops as Evergrande Bankruptcy Application Spurs Safety Bid

USD/JPY News and Analysis

- Japanese inflation prints inline, but stickier prices remain elevated

- USD/JPY momentum stalls on developing safe-haven switch

- Japanese data is scarce but markets look ahead to Jackson Hole event

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free JPY Forecast

Japanese Inflation Prints Inline, But Stickier Prices Remain Elevated

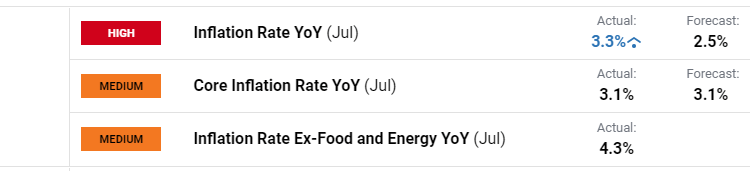

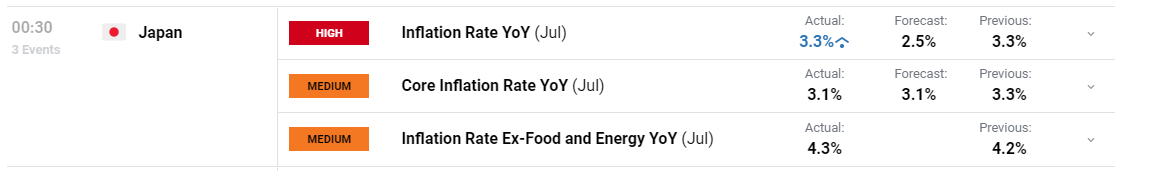

On Friday, Japanese inflation data helped to continue a two-day decline in USD/JPY as the ‘core-core’ measure rose while the headline measure of inflation saw no year-on-year change.

Elevated inflation data continues to assert pressure on the Bank of Japan (BoJ) to normalize monetary policy. BoJ officials have downplayed recent policy tweaks (yield curve control), clarifying that allowing Japanese 10-year yields to rise above 0.5% allows for a more sustainable implementation of existing supportive policy.

Customize and filter live economic data via our DailyFX economic calendar

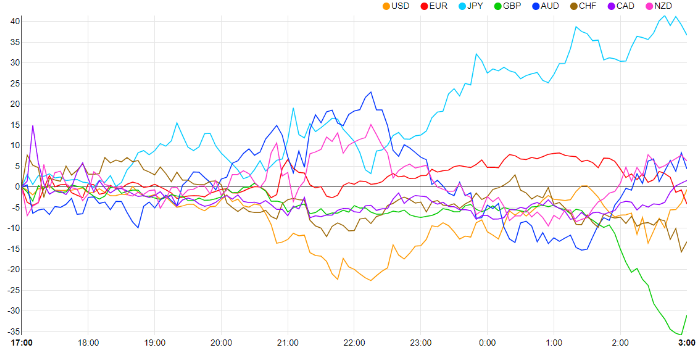

The chart below shows the intra-day move in the yen (light blue line), which appreciated more than its peers in the early hours of the morning. The data helped to support existing appreciation that had already been building ahead of the data release as the yen selloff received a reprieve.

Relative Currency Performance Since Last Night

Source: Financial Juice, prepared by Richard Snow

USD/JPY Momentum Stalls on Possible Safe-Haven Switch

News of the massive Chinese property developer Evergrande applying for bankruptcy protection in the US has markets seeking safety. High-flying US treasury bond yields dipped as market participants sought the safety of US bonds, lessening support for the US dollar.

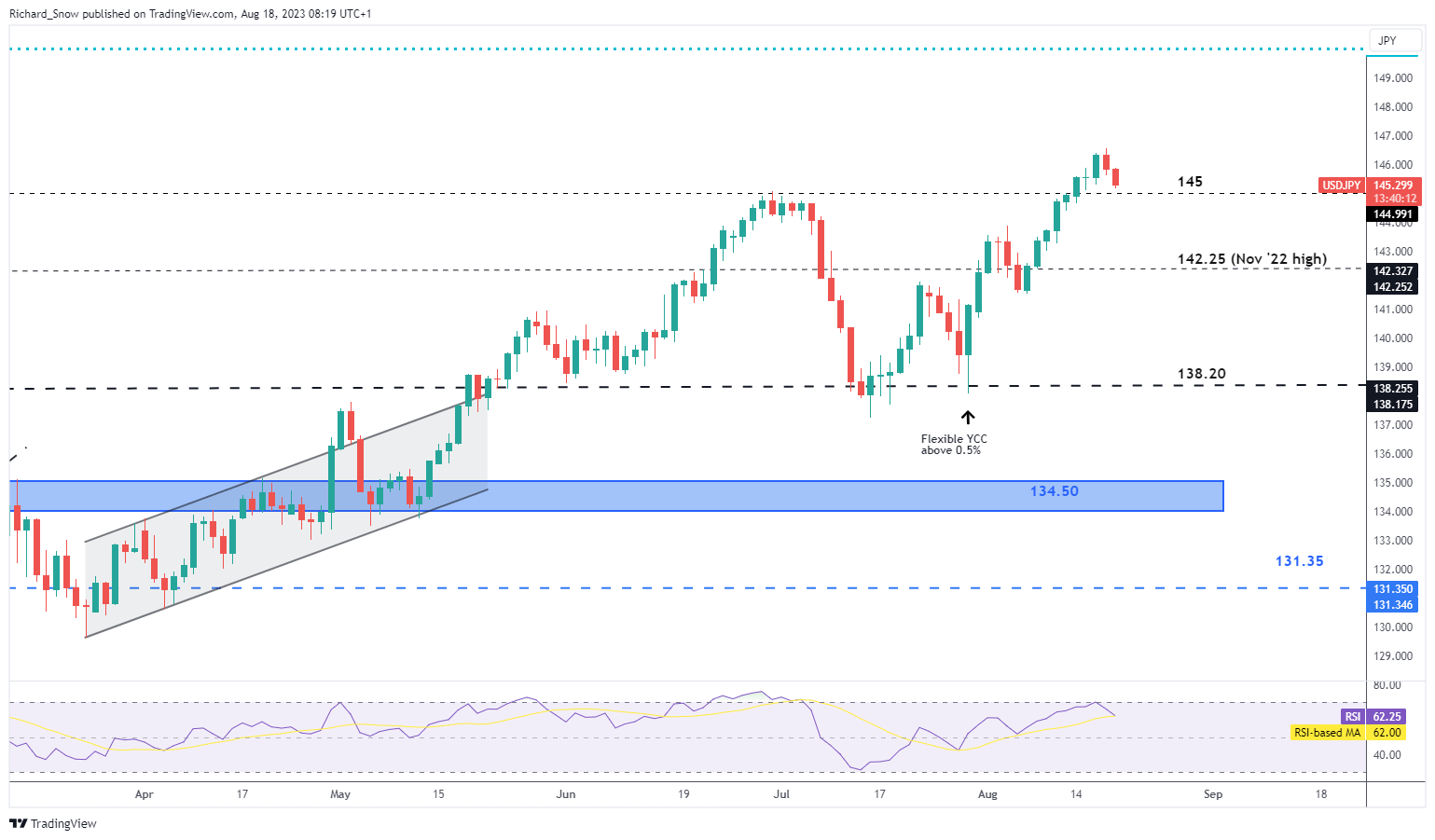

The yen also benefits from safe haven appeal and therefore stands to gain on market jitters. Yesterday we witnessed the first USD/JPY decline in the last 9 days as the pair turned lower just short of the overbought market on the RSI. The bullish move was allowed to move above the significant 145 level after Japanese officials clarified that the currency level is less of a concern than any potential wild swings which are unfavourable.

Immediate support comes in at the 145 level, followed by 142.55 if the pullback is to extend. A bullish continuation however, opens up a retest of the swing high at 146.56 followed by 147.57. The outlook for the pair depends to a great degree whether the US continues to benefit from improving economic conditions, keeping yields elevated as the case for ‘higher for longer’ gathers momentum. Yesterday the Fed’s real-time measure of US GDP soared to 5.8%. The indication of US growth is provided as a mere indication based on current data and has tended to flatter US growth recently.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

USD/JPY is a highly liquid, and frequently traded currency pair with many angles to trade it. Interest rate differentials and global risk sentiment are also reflected in its price. For more around this major pair read our dedicated guide below:

Recommended by Richard Snow

How to Trade USD/JPY

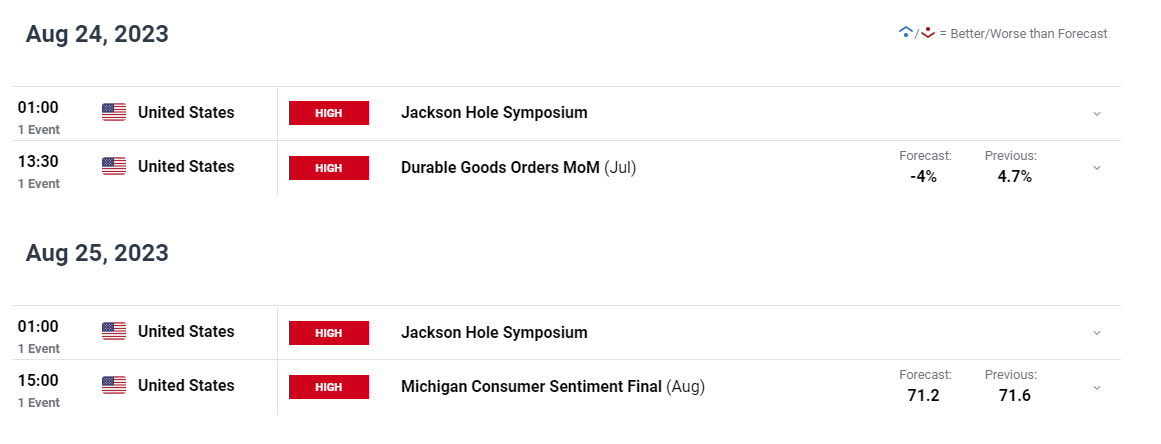

Light Japanese Data ahead of Jackson Hole Event

The economic calendar sees a notable drop off in Japanese data but we look ahead to the next big event for central bankers – the Jackson Hole Economic Symposium. Markets will be on the lookout for clues around terminal rates and current central bank thinking. Will the BoJ’s Ueda steal the limelight as he did at the ECB forum?

Source: DailyFX, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.