USD/JPY Breaks Major Trendline Resistance as USD/CAD Defies Key Moving Average

USD/JPY AND USD/CAD TECHNICAL OUTLOOK:

- The U.S. dollar begins the week on a positive note, supported by rising U.S. Treasury yields

- USD/JPY rises to its best level in more than a month following a bullish breakout

- USD/CAD extends its rebound for the second day in a row after bouncing off trendline support at 1.3300

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: S&P 500 Week Ahead Forecast – Bullish Momentum Fades as Bears Flirt with Comeback

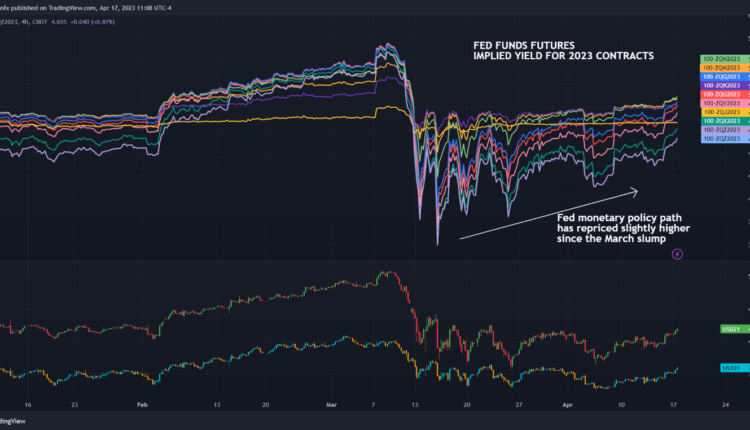

The U.S. dollar, as measured by the DXY index, started the week on the front foot, supported by market skittishness and rising U.S. Treasury yields, as Fed monetary policy expectations for the second half of the year continued to turn less dovish relative to what was priced in a few weeks ago, in a context of resilient economic data.

FED FUNDS FUTURES & US TREASURY YIELDS

Source: TradingView

Against this backdrop, USD/JPY (U.S. dollar – Japanese yen) rallied more than 0.5% and rose above 134.50, reaching its best level since March 15. Meanwhile, USD/CAD advanced for the second day in a row, climbing about 0.3% and coming within striking distance from overtaking its 200-day simple moving average located near 1.3400.

Following Monday's moves in the foreign exchange space, both pairs have reached key levels that are worth keeping an eye on in the short term. Traders interested in recent price action and chart formations can refer to the technical analysis of USD/JPY and USD/CAD below.

Recommended by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL ANALYSIS

USD/JPY bounced off cluster support near 130.50 earlier this month, picking up momentum and accelerating higher in recent days, with prices breaching the 50-day simple moving average and trendline resistance decisively at the start of the week.

After the latest breakout, USD/JPY is steadily approaching a key technical ceiling located around 134.75, which roughly aligns with January’s high. If this barrier is taken out, buying interest could gain strength, setting the stage for a rally towards 136.60, the 38.2% Fib retracement of the Oct 2022/Jan 2023 decline.

Conversely, if sellers return and push prices lower from current levels, initial support lies at 133.75/133.65. If the pair manages to break below this area, bears could become emboldened to launch an attack on 131.50, a key floor defined by a rising trendline in play since February 2022.

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 0% | 16% | 5% |

| Weekly | 31% | -32% | -1% |

USD/CAD TECHNICAL CHART

USD/CAD has fallen aggressively over the past five weeks, but has begun to recover modestly in the last couple of trading sessions, after ricocheting off trendline support around the psychological 1.3300 level. If the rebound consolidates in the near term, the 200-day simple moving average at 1.3400 should act as resistance to cap future gains. However, if that ceiling is breached on the topside, a runup towards 1.3465 could become the baseline case.

On the other hand, if sellers resurface and regain control of price action, the first support to monitor appears at 1.3300. Below that floor, the next area of interest for sellers is located at 1.3225/1.3210, near the November 2022 swing lows. While USD/CAD retains a bearish tilt over the near term, market bias could shift should sentiment worsen and volatility pick up, given the safe-haven qualities of the U.S. dollar in times of heightened uncertainty and turbulence.

USD/CAD TECHNICAL CHART

USD/CAD Chart Prepared Using TradingView

Comments are closed.