USD/CAD Rises on Oil’s Slump, Nasdaq 100 Carves Double Top Pattern as Bears Lurk

CANADIAN DOLLAR, NASDAQ 100 OUTLOOK:

- Canadian dollar weakens, pressured by lower oil prices and the broader U.S. dollar rebound

- USD/CAD breaks above its 200-day simple moving average, a positive sign for bulls

- Nasdaq 100 slides, with prices rejected at resistance and forging a double top

Most Read: Gold (XAU/USD) Price Under Yield Pressure, Support Level Nears

| Change in | Longs | Shorts | OI |

| Daily | -20% | 22% | -3% |

| Weekly | -12% | 30% | 5% |

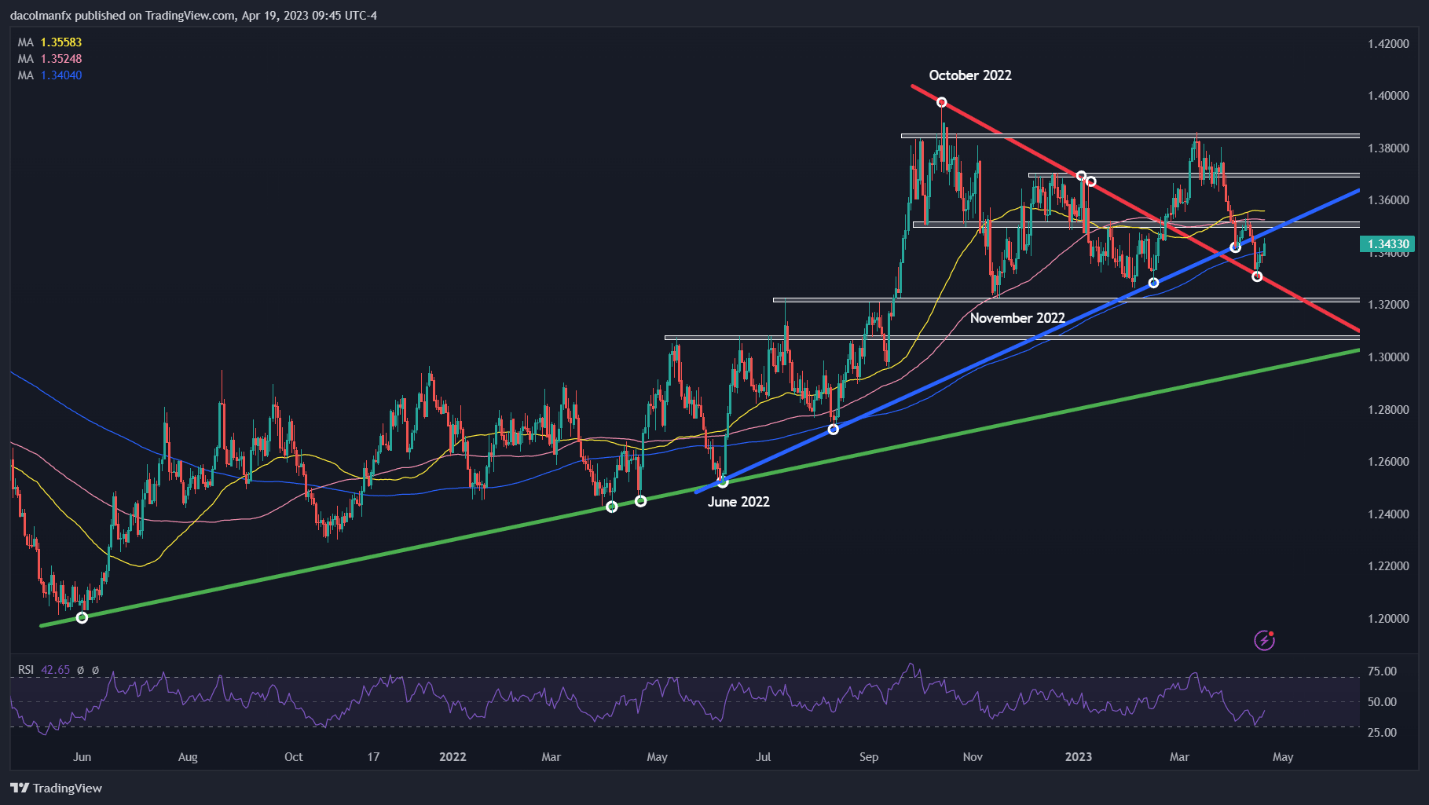

USD/CAD ANALYSIS

The U.S. dollar, as measured by the DXY index, regained lost ground on Wednesday after moderate losses in the previous session, boosted by rising U.S. Treasury rates, especially those at the front end of the curve, which pushed the 2-year yield briefly to 4.28%, its highest level since March 15.

The outperformance of the greenback weighed on some developed market currencies, such as the Canadian dollar, with USD/CAD up 0.32% at 1.3435, although there were other catalysts contributing to today's price action.

For instance, the loonie was also hurt by the sharp drop in oil prices. WTI for June delivery sank as much as 2% to 79.40 in late morning trade, undermined by the demand worries. Crude is one of Canada’s top exports, so the domestic currency tends to weaken when energy prices retreat.

Looking at USD/CAD’s technical profile, the pair has recovered moderately after bouncing off trendline support late last week near the psychological 1.3300 level; in fact, the price has recaptured its 200-day moving average, a welcomed sign for bulls.

If gains accelerate in the near term, initial resistance stretches from 1.3475 to 1.3515, followed by 1.3560, near the 50-day simple moving average. On the flip side, if sellers return and trigger a bearish reversal, support appears at 1.3400, and 1.3290 thereafter.

USD/CAD TECHNICAL CHART

USD/CAD Chart Prepared Using TradingView

Recommended by Diego Colman

Get Your Free Equities Forecast

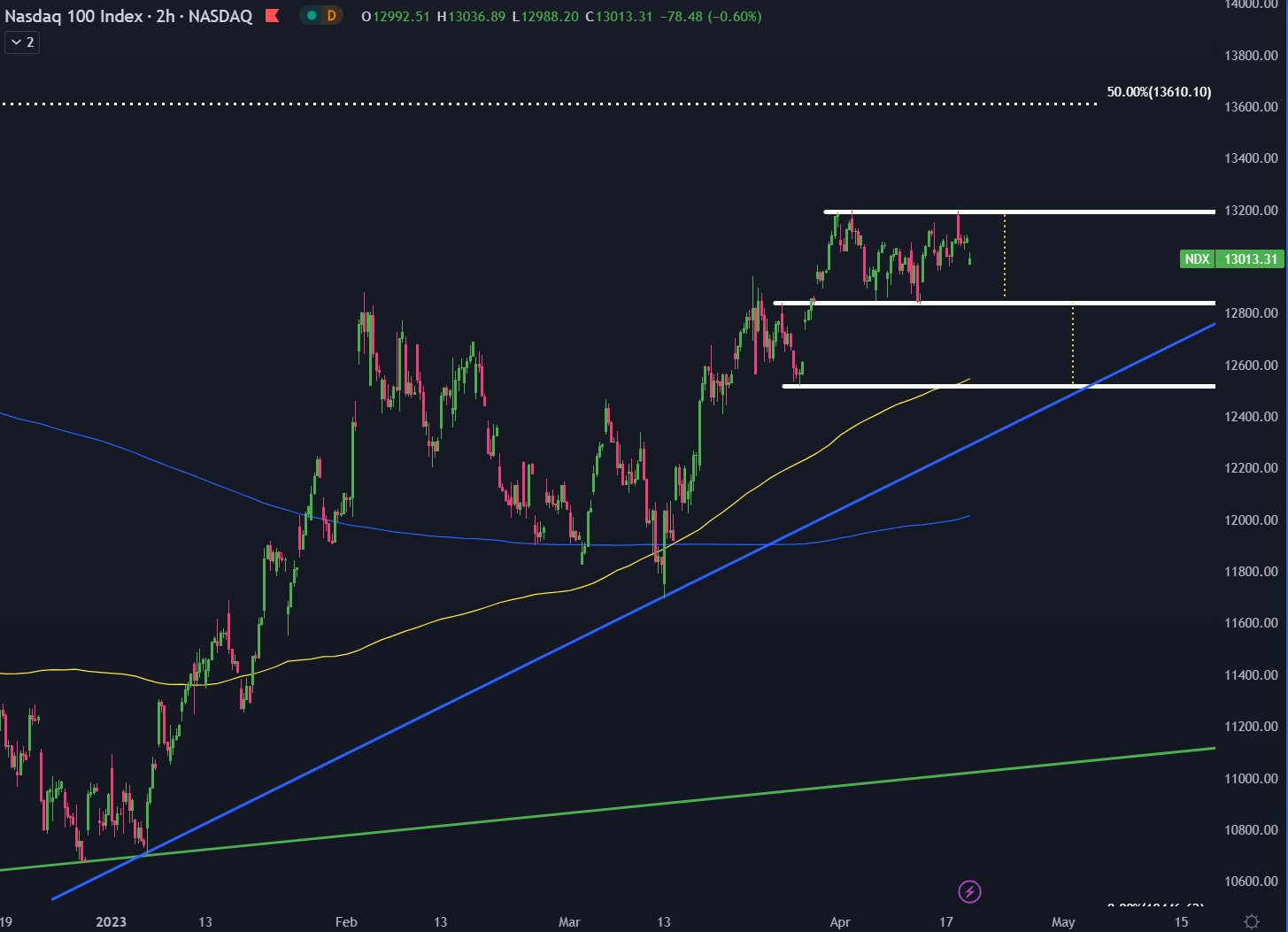

NASDAQ 100 ANALYSIS

The Nasdaq 100 fell on Wednesday, down about 0.6% to 13,010 at the time of writing, dragged lower by rising U.S. Treasury yields, which are widely seen as a headwind for the technology space. In addition, the sharp drop in Netflix shares following disappointing quarterly results also crimped the benchmark’s performance.

From a technical analysis standpoint, the index entered a bull market earlier this month after rallying more than 20% from its 2023 lows. While this development is in itself bullish, caution is warranted as prices have been forging a double-top pattern in recent weeks, a sign of exhaustion of upside momentum.

If the double top is validated, the Nasdaq 100 could head sharply lower in short order, with a retest of the late March low near 12,500 potentially coming into play. In terms of technical signals, the bearish configuration would be confirmed with a break below support at 12,835.

On the other hand, if prices resume their ascent, initial resistance appears at 13,200. A breakout to the upside would nullify the double top formation, setting the stage for a rally towards 13,610, which corresponds to 50% of the Fibonacci retracement of the November 2021/October 2022 sell-off.

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Chart Prepared Using TradingView

Comments are closed.